Tax Identity Theft Description

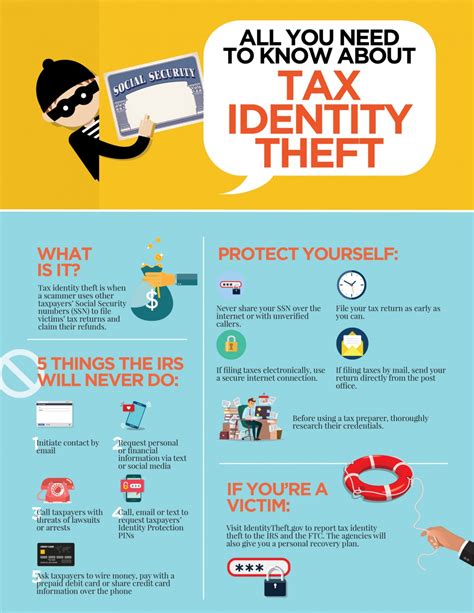

Tax identity theft is a serious and growing concern for individuals and tax authorities worldwide. It occurs when a criminal obtains someone's personal information, such as their Social Security number or tax identification details, and uses it to file a fraudulent tax return in the victim's name. This malicious activity aims to claim tax refunds or credits that rightfully belong to the victim, causing significant financial and legal repercussions. In this comprehensive guide, we will delve into the intricacies of tax identity theft, exploring its impact, prevention strategies, and the steps individuals can take to protect themselves and their financial well-being.

Understanding Tax Identity Theft

Tax identity theft involves the misuse of personal information for tax-related fraud. Criminals often obtain this information through various means, including data breaches, phishing attacks, or even simple scams. Once they have the necessary details, they can file tax returns in the victim’s name, often claiming large refunds or credits, leaving the actual taxpayer in a difficult situation.

The impact of tax identity theft is far-reaching. Not only does it result in financial losses for the victim, but it can also lead to lengthy and complex legal battles to clear one's name and rectify their tax records. Additionally, the emotional toll of such an incident can be significant, causing stress, anxiety, and a sense of violation.

Real-World Scenarios

Imagine a scenario where an individual, let’s call them Emily, receives a notification from the Internal Revenue Service (IRS) stating that more than one tax return has been filed using her Social Security number. Upon investigation, Emily discovers that someone has not only filed a fraudulent return but also claimed a substantial refund, leaving her with a tax liability and a complex web of paperwork to untangle.

In another case, a business owner, John, finds himself in a similar situation. His company's tax identification number has been compromised, and criminals have used it to claim tax credits on behalf of his business. This not only affects his business's financial health but also raises concerns about the security of his client's data.

Prevention Strategies

Preventing tax identity theft requires a multi-faceted approach, encompassing personal vigilance and awareness, as well as robust security measures implemented by tax authorities and financial institutions.

Personal Security Measures

Individuals play a crucial role in safeguarding their personal information. Here are some key steps to minimize the risk of tax identity theft:

- Protect Personal Information: Be cautious about sharing sensitive details like Social Security numbers, dates of birth, and financial account information. Only provide such information to trusted sources and ensure it is transmitted securely.

- Secure Digital Devices: Use strong passwords, enable two-factor authentication, and regularly update software and security patches on all devices to prevent unauthorized access.

- Be Wary of Phishing Attempts: Criminals often use phishing emails or text messages to trick individuals into revealing their personal information. Always verify the legitimacy of such requests before responding.

- Monitor Financial Accounts: Regularly check your bank and credit card statements for any unauthorized transactions. Set up alerts to notify you of unusual activities.

- Secure Tax Records: Store your tax returns and related documents in a secure location. Consider using encrypted cloud storage or a safe deposit box.

Institutional Responsibilities

Tax authorities and financial institutions also have a critical role in preventing tax identity theft. They can implement the following measures:

- Enhanced Security Protocols: Implement robust security systems to detect and prevent fraudulent tax return filings. This includes advanced identity verification processes and real-time fraud detection mechanisms.

- Public Awareness Campaigns: Educate taxpayers about the risks of tax identity theft and provide guidance on how to protect themselves. Offer resources and support to victims of such crimes.

- Collaborative Efforts: Work together with law enforcement agencies and financial institutions to share intelligence and track down criminal networks involved in tax identity theft.

- Data Security: Ensure the secure storage and transmission of taxpayer data. Implement encryption protocols and regularly audit systems for vulnerabilities.

Reporting and Resolution

If you suspect or become a victim of tax identity theft, it is crucial to take immediate action. Here are the steps you should follow:

Reporting the Incident

Contact the relevant tax authority, such as the IRS in the United States, and report the suspected fraud. They will guide you through the necessary steps and provide resources to help you protect your rights.

Additionally, file a report with the local police or law enforcement agency. This creates an official record of the incident and may assist in investigating and prosecuting the perpetrators.

Protecting Your Rights

Take the following steps to safeguard your rights and financial well-being:

- Freeze Your Credit: Contact the major credit bureaus and place a security freeze on your credit reports. This prevents new accounts from being opened in your name without your explicit consent.

- Monitor Your Tax Records: Regularly check your tax transcripts and ensure no unauthorized activities have taken place. Report any discrepancies immediately.

- Identity Theft Protection Services: Consider enrolling in identity theft protection services that can monitor your personal information and provide assistance in case of a breach.

- Keep Records: Maintain a record of all communications and documents related to the incident. This will be invaluable during the resolution process.

The Future of Tax Identity Theft Prevention

As technology advances, so do the methods employed by criminals to commit tax identity theft. To stay ahead of these threats, continuous innovation and collaboration are necessary.

Emerging Technologies

The use of artificial intelligence and machine learning can significantly enhance tax identity theft prevention. These technologies can analyze vast amounts of data to identify patterns and anomalies, flagging potential fraudulent activities in real time.

Biometric authentication, such as facial recognition or fingerprint scanning, can also add an extra layer of security to tax return filing processes, ensuring that only authorized individuals can access and submit tax information.

International Cooperation

Tax identity theft is not limited by borders. Criminals often operate across multiple jurisdictions, making international cooperation crucial. Tax authorities and law enforcement agencies must collaborate to share information, track down criminal networks, and establish standardized protocols for investigating and prosecuting such crimes.

Conclusion

Tax identity theft is a complex and evolving threat that requires a comprehensive and collaborative approach. By combining personal vigilance, institutional responsibility, and technological advancements, we can work towards a future where tax identity theft is minimized, and individuals can feel secure in their financial dealings.

Stay informed, stay vigilant, and together, we can protect our tax identities and ensure a fair and transparent tax system.

How can I protect my tax information online?

+To protect your tax information online, ensure you are using a secure connection, preferably a VPN. Avoid public Wi-Fi for sensitive transactions. Use strong, unique passwords for your tax accounts, and enable two-factor authentication where possible. Regularly update your security software and be cautious of phishing attempts.

What should I do if I suspect tax identity theft?

+If you suspect tax identity theft, immediately contact the relevant tax authority and file a report. They will guide you through the necessary steps. Additionally, file a police report to create an official record. Take steps to secure your credit and monitor your tax records for any unauthorized activities.

Are there any warning signs of tax identity theft?

+Warning signs of tax identity theft include receiving a notification from the tax authority about multiple tax returns filed in your name, unexpected rejections of your legitimate tax return, or notices of unpaid taxes that you have already settled. Regularly checking your credit reports for any unusual activities can also help detect potential tax identity theft.