Mchenry County Property Taxes

When it comes to property taxes, McHenry County in Illinois has its own unique characteristics and considerations. Property taxes are a significant aspect of homeownership, and understanding the process and rates in McHenry County is essential for both current and prospective homeowners. This comprehensive guide aims to provide an in-depth analysis of McHenry County's property taxes, covering various aspects that affect residents.

Understanding McHenry County’s Property Tax System

McHenry County, located in the northern part of Illinois, boasts a diverse landscape ranging from rural areas to suburban communities. This diversity is reflected in the county’s property tax system, which is influenced by various factors such as property values, assessment methods, and tax rates.

The property tax system in McHenry County operates under the supervision of the McHenry County Assessor's Office. This office is responsible for assessing the value of all taxable properties within the county, including residential, commercial, and industrial properties. The assessed value forms the basis for calculating property taxes.

The assessment process in McHenry County is carried out every three years, with the next reassessment scheduled for 2024. During this process, the Assessor's Office analyzes various factors to determine the fair market value of properties. These factors include recent sales data, construction costs, and property improvements. The assessed value is then multiplied by the applicable tax rate to calculate the property tax liability.

Tax Rates and Assessments

McHenry County’s tax rates are set by various taxing bodies, including the county government, school districts, and local municipalities. These tax rates are expressed as a percentage of the property’s assessed value. For instance, in 2023, the average tax rate in McHenry County was approximately 2.68%, which is lower than the state average of 2.81%.

| Taxing Body | Tax Rate |

|---|---|

| McHenry County | 0.75% |

| Local School Districts | Varies (0.60% - 2.00%) |

| Municipalities | Varies (0.25% - 1.50%) |

It's important to note that tax rates can vary significantly within the county, depending on the specific taxing district in which a property is located. This means that two similar properties in different districts can have different tax liabilities.

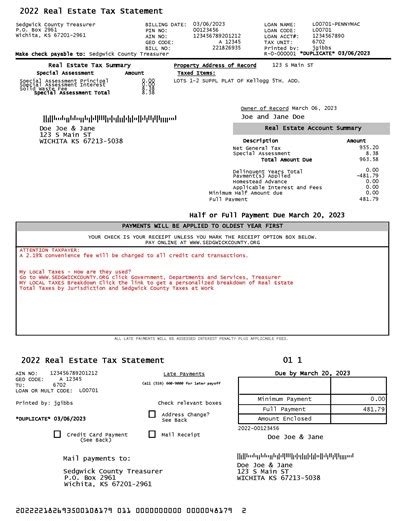

Property Tax Bills and Payment Options

Property tax bills in McHenry County are typically mailed to homeowners in February or March of each year. These bills detail the assessed value of the property, the applicable tax rates, and the total tax amount due. Homeowners have the option to pay their taxes in full or choose an installment plan, with payments typically due in March and September.

The McHenry County Treasurer's Office offers several payment methods, including online payment through their website, by phone, or by mailing a check. Homeowners can also set up automatic payments to ensure timely payment and avoid late fees.

Factors Influencing Property Taxes in McHenry County

Several factors contribute to the variability of property taxes in McHenry County. Understanding these factors can help homeowners anticipate potential changes in their tax liabilities.

Property Value Appreciation

One of the primary factors influencing property taxes is the appreciation of property values. McHenry County has experienced steady growth in property values over the years, driven by factors such as economic development, population growth, and an increasing demand for housing. As property values rise, so do the assessed values, leading to higher property tax bills.

For instance, a recent analysis by Real Estate Data Insights revealed that the median home value in McHenry County increased by 6.2% from 2021 to 2022. This appreciation translates to higher assessed values and, consequently, higher property taxes for homeowners.

Assessment Accuracy and Appeals

The accuracy of property assessments is crucial in ensuring fair and equitable property taxes. McHenry County Assessor’s Office strives to maintain accuracy by employing trained assessors and utilizing modern assessment methods. However, assessment errors or discrepancies can occur, leading to overassessment or underassessment of properties.

Homeowners who believe their property has been overassessed have the right to appeal the assessment. The appeal process in McHenry County involves submitting an appeal to the Board of Review within a specified timeframe, usually within 30 days of receiving the assessment notice. The Board of Review conducts hearings to review and adjust assessments as necessary.

Taxing Body Budgets and Expenditures

The tax rates set by various taxing bodies in McHenry County are influenced by their budget needs and expenditures. School districts, for example, may require higher tax rates to fund educational programs and maintain school facilities. Similarly, local municipalities may need to increase tax rates to cover infrastructure improvements or public service costs.

Homeowners should stay informed about the budget and expenditure plans of their respective taxing districts. This information can be obtained through public meetings, budget documents, or by reaching out to local government representatives.

Strategies for Managing Property Taxes

Managing property taxes effectively is essential for homeowners to maintain financial stability and plan their budgets. Here are some strategies to consider:

Regularly Review Tax Bills and Assessments

Homeowners should carefully review their tax bills and compare them with previous years’ bills. Any significant increases or discrepancies should be investigated further. Additionally, reviewing the assessment details can help identify potential errors or changes in property characteristics that may impact the assessed value.

Consider Tax Exemptions and Credits

McHenry County offers various tax exemptions and credits to eligible homeowners. These can include homestead exemptions, senior citizen exemptions, and disability exemptions. Taking advantage of these exemptions can reduce the taxable value of a property, resulting in lower property taxes. Homeowners should consult with the Assessor’s Office or a tax professional to determine their eligibility.

Explore Assessment Appeal Options

If a homeowner believes their property has been overassessed, they can explore the assessment appeal process. This process involves gathering evidence, such as recent sales data or appraisals, to support their case. It’s important to note that assessment appeals are time-sensitive, so homeowners should act promptly to ensure their appeal is considered.

Monitor Tax Rate Changes

Staying informed about tax rate changes in McHenry County is crucial. Tax rates can fluctuate annually, and understanding these changes can help homeowners anticipate potential increases or decreases in their tax liabilities. Local news outlets, government websites, and tax consultant services can provide valuable updates on tax rate changes.

Future Outlook and Potential Changes

The property tax landscape in McHenry County is subject to ongoing changes and developments. Here’s an analysis of potential future implications:

Economic Factors and Property Value Trends

The economic climate and real estate market trends significantly impact property values and, consequently, property taxes. If McHenry County experiences sustained economic growth and an increasing demand for housing, property values are likely to continue rising. This trend could lead to higher property tax bills for homeowners.

However, economic downturns or market fluctuations could also affect property values and tax liabilities. Homeowners should stay informed about economic indicators and market trends to anticipate potential changes in their tax obligations.

Government Initiatives and Policy Changes

Government initiatives and policy changes at the state and local levels can impact property taxes. For instance, changes in tax laws, assessment methodologies, or budget allocations can influence tax rates and assessment processes. Homeowners should monitor legislative updates and engage with local government representatives to understand the potential impact on their property taxes.

Community Development and Infrastructure Improvements

McHenry County’s ongoing community development projects and infrastructure improvements can affect property values and, subsequently, property taxes. Investments in transportation, education, and recreational facilities may enhance the desirability of certain areas, leading to increased property values. As a result, homeowners in these areas may experience higher property tax bills.

What is the average property tax rate in McHenry County, Illinois?

+

As of 2023, the average property tax rate in McHenry County is approximately 2.68%, which is lower than the state average of 2.81%.

How often are properties reassessed for tax purposes in McHenry County?

+

Properties in McHenry County are reassessed every three years. The next reassessment is scheduled for 2024.

Can homeowners appeal their property assessments in McHenry County?

+

Yes, homeowners who believe their property has been overassessed can appeal to the Board of Review within 30 days of receiving their assessment notice. The Board of Review conducts hearings to review and adjust assessments as necessary.

Are there any tax exemptions or credits available for McHenry County homeowners?

+

Yes, McHenry County offers various tax exemptions and credits, including homestead exemptions, senior citizen exemptions, and disability exemptions. Homeowners should consult with the Assessor’s Office or a tax professional to determine their eligibility.

How can homeowners stay informed about tax rate changes in McHenry County?

+

Homeowners can stay informed about tax rate changes by monitoring local news outlets, government websites, and engaging with local government representatives. Tax consultant services can also provide valuable updates and insights.