Irvine Tax Rate

Welcome to this comprehensive guide on the tax landscape in Irvine, a vibrant city nestled in Orange County, California. This article aims to shed light on the intricate details of the Irvine tax rate, offering a deep dive into its structure, implications, and how it compares to other areas. By delving into specific examples and real-world scenarios, we will navigate the intricacies of local taxation, providing valuable insights for both residents and businesses alike.

Understanding the Irvine Tax Structure

The tax system in Irvine, like many other municipalities, is a complex interplay of various levies and assessments. It is important to grasp the different components that make up the overall Irvine tax rate to truly understand the financial obligations of individuals and businesses in the city.

Property Taxes: A Key Component

Property taxes form a significant part of the revenue stream for Irvine. The city assesses these taxes based on the value of real estate properties, which can include residential homes, commercial buildings, and land. The ad valorem tax rate is applied to the assessed value, with the rate varying depending on the property’s classification and usage.

| Property Type | Tax Rate |

|---|---|

| Residential Property | 1.04% |

| Commercial Property | 1.28% |

| Industrial Property | 1.36% |

For instance, consider a residential property in Irvine with an assessed value of $700,000. The property tax for this home would amount to $7,280 (1.04% of $700,000). This rate is relatively competitive when compared to other cities in Orange County, offering a potential advantage for homeowners in Irvine.

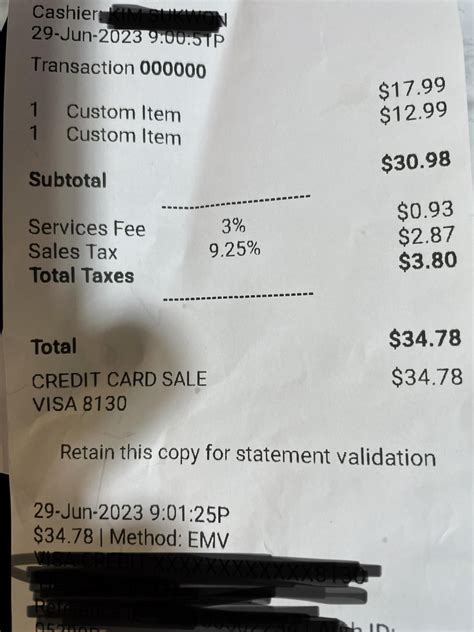

Sales and Use Taxes

Sales and use taxes are another critical aspect of the Irvine tax structure. These taxes are levied on the sale of goods and services within the city, with the revenue collected going towards funding essential public services and infrastructure projects.

Currently, the combined sales and use tax rate in Irvine stands at 7.25%, which includes both the state and local components. This rate is applied to the purchase price of tangible goods and certain services, such as restaurant meals and entertainment. It is important to note that certain items, like groceries, are exempt from this tax.

To illustrate, if you purchase a new laptop in Irvine for $1,000, the sales tax component would amount to $72.50 (7.25% of $1,000). This tax is often included in the displayed price of goods, but it's essential to understand the breakdown for financial planning and budgeting purposes.

Income Taxes: A Local Perspective

Irvine, like most cities in California, does not impose a local income tax. Instead, income tax obligations fall under the purview of the state and federal governments. However, understanding the state income tax rate is crucial for residents and businesses alike, as it directly impacts their financial strategies and decisions.

California's income tax system is progressive, with tax rates ranging from 1% to 12.3%, depending on an individual's or business's taxable income. For instance, a single taxpayer with a taxable income of $60,000 would fall into the 6% tax bracket, meaning they would owe 6% of their taxable income to the state.

Comparative Analysis: Irvine’s Tax Position

Understanding how Irvine’s tax rates compare to other areas is crucial for evaluating the city’s financial competitiveness and appeal. Let’s explore how Irvine stacks up against other notable cities in Orange County and California as a whole.

Property Tax Comparison

When it comes to property taxes, Irvine offers a competitive rate when compared to other cities in Orange County. For instance, neighboring cities like Santa Ana and Anaheim have property tax rates of 1.15% and 1.14%, respectively, which are slightly higher than Irvine’s 1.04% for residential properties.

On a larger scale, California's average property tax rate stands at around 0.76%, which is significantly lower than Irvine's. However, it's important to note that California's property tax rate is capped at 1% through Proposition 13, making Irvine's rate comparatively high for the state. This can be a factor for individuals considering a move within California, especially for those with high-value properties.

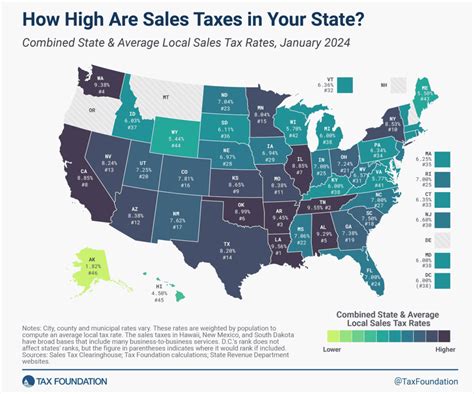

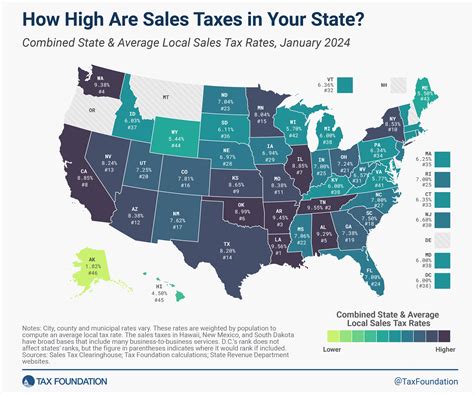

Sales Tax: A Statewide Comparison

The sales tax rate in Irvine, at 7.25%, is in line with the statewide average. However, it is important to consider that some cities in California, particularly those in the Bay Area, have higher sales tax rates due to additional local taxes. For example, San Francisco’s sales tax rate is 8.5%, which is notably higher than Irvine’s.

On the other hand, some cities in Southern California, like San Diego, have a slightly lower sales tax rate at 7.75%. This can make Irvine's sales tax rate appear less competitive, especially for businesses considering a move within the region.

Income Tax: A California Perspective

As mentioned earlier, Irvine, like the rest of California, does not impose a local income tax. This sets California apart from many other states, which often have both state and local income tax obligations. For individuals and businesses, this means that their income tax obligations are solely determined by the state’s progressive tax system.

When comparing California's income tax rates to other states, it is evident that California's rates are generally higher. For instance, Texas, a state with no income tax, can be a more attractive option for high-income earners and businesses looking to minimize their tax obligations. However, it's important to consider the overall business environment and other factors when making such comparisons.

The Impact of Irvine’s Tax Structure

The tax structure in Irvine has a significant impact on both residents and businesses. It influences everything from the cost of living to the financial obligations of businesses operating within the city. Let’s explore some of these implications in more detail.

Cost of Living Considerations

The tax rates in Irvine play a crucial role in shaping the city’s cost of living. While property taxes are relatively competitive within Orange County, the combined sales tax rate of 7.25% can contribute to a higher cost of living, especially for those who make frequent purchases of taxable goods and services.

For instance, consider a household that spends $5,000 per month on taxable items. Over the course of a year, they would pay approximately $4,350 in sales taxes alone (7.25% of $5,000 per month). This can significantly impact their overall financial situation and budgeting strategies.

Business Implications

From a business perspective, Irvine’s tax structure can be both an advantage and a challenge. The lack of a local income tax can be attractive for businesses, especially those with high-income operations. However, the higher property tax rates can be a deterrent for businesses considering a move to Irvine, especially if they own or plan to purchase commercial real estate.

Additionally, the sales tax rate can impact a business's pricing strategies and profitability. For businesses that sell tangible goods, especially those with a large customer base, the sales tax component can significantly impact their bottom line. It is crucial for businesses to carefully consider these tax obligations when planning their financial strategies and projections.

Future Implications and Trends

As with any tax system, the landscape in Irvine is subject to change and evolution. Understanding the potential future implications and trends can help individuals and businesses prepare for any upcoming adjustments.

Potential Tax Reform

Tax reform is always a possibility, especially in response to changing economic conditions or political landscapes. In recent years, there have been discussions and proposals at both the state and local levels to modify tax structures, which could impact Irvine’s current rates and obligations.

For instance, there have been proposals to adjust California's income tax brackets or introduce additional local taxes. While these proposals have not yet materialized, they highlight the potential for future changes. Staying informed about these discussions and their potential outcomes is crucial for long-term financial planning.

Economic Impact and Growth

The tax structure in Irvine also has a significant impact on the city’s economic growth and development. A competitive tax rate can attract businesses and residents, fostering economic growth and a vibrant community. Conversely, less competitive rates can hinder growth and development.

As Irvine continues to evolve and adapt to changing economic conditions, its tax structure will play a pivotal role in shaping its future. Understanding these dynamics and staying abreast of potential changes is essential for both individuals and businesses looking to thrive in this dynamic city.

How does Irvine’s tax rate compare to other cities in California?

+Irvine’s tax rate can vary depending on the specific type of tax. For property taxes, Irvine’s rate of 1.04% for residential properties is relatively competitive within Orange County but higher than the statewide average of 0.76%. In terms of sales tax, Irvine’s rate of 7.25% is in line with the statewide average, but some cities have higher rates due to additional local taxes. Irvine does not impose a local income tax, which sets it apart from many other states that have both state and local income tax obligations.

What are the main components of Irvine’s tax structure?

+Irvine’s tax structure primarily consists of property taxes, sales and use taxes, and state income taxes. Property taxes are assessed based on the value of real estate properties, with rates varying depending on the property’s classification and usage. Sales and use taxes are levied on the sale of goods and services within the city, with the combined rate currently at 7.25%. State income taxes are progressive, ranging from 1% to 12.3%, and are determined by an individual’s or business’s taxable income.

How does Irvine’s lack of a local income tax impact businesses and residents?

+Irvine’s lack of a local income tax can be an attractive feature for businesses and high-income earners, as it simplifies their tax obligations and offers a competitive advantage over cities with additional income tax obligations. For residents, it means that their income tax obligations are solely determined by the state’s progressive tax system, which can impact their financial strategies and decisions.