Property Tax Wichita Ks

Understanding property taxes is an essential aspect of homeownership, and in Wichita, Kansas, this becomes a crucial topic for both current and prospective homeowners. The property tax system in Wichita, like in many other places, can seem complex, but it's a necessary component of maintaining local services and infrastructure. This guide aims to demystify property taxes in Wichita, offering an in-depth analysis of how they work, what they're used for, and how they impact residents.

Unraveling Property Taxes in Wichita, KS

Property taxes are a vital source of revenue for local governments, and in Wichita, they play a significant role in funding various public services and maintaining the city's infrastructure. These taxes are typically assessed on real estate properties, including homes, businesses, and other land improvements. The revenue generated from property taxes goes towards funding essential services such as schools, fire protection, police services, road maintenance, and more.

The Assessment Process

In Wichita, the property tax assessment process begins with an evaluation of each property's value. This valuation is typically conducted by a professional appraiser or assessor employed by the Sedgwick County Appraiser's Office. The appraiser considers several factors when determining a property's value, including its size, location, improvements, and recent sales of similar properties in the area. This process ensures that each property is assessed fairly and accurately.

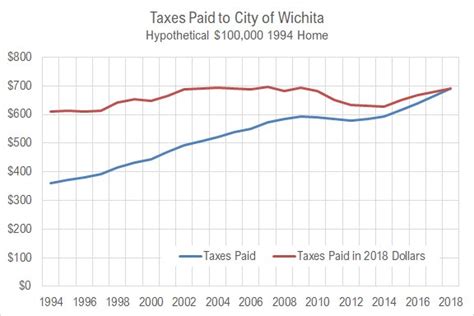

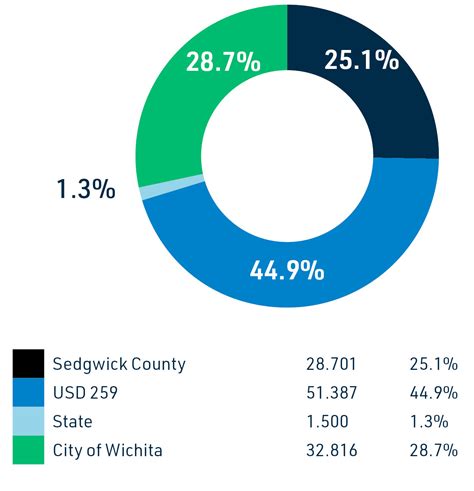

Once the appraiser has determined the property's value, the county applies a tax rate to calculate the property tax liability. This tax rate is a percentage of the property's assessed value and is set annually by the local government. The tax rate can vary from one year to the next, depending on the budgetary needs of the city and county. It's important to note that property taxes in Wichita are not solely determined by the city; they are a collaborative effort between the city, county, and other taxing authorities, such as school districts and special assessment districts.

| Assessment Type | Description |

|---|---|

| Market Value Assessment | Assessing property value based on recent sales data and market trends. |

| Income Approach Assessment | Valuation based on the property's potential rental income. |

| Cost Approach Assessment | Determining value by estimating the cost to replace the property, considering depreciation. |

Understanding the Tax Rate

The tax rate in Wichita, as mentioned earlier, is a percentage applied to the assessed value of a property to calculate the property tax liability. This rate is often referred to as the mill levy, where one mill represents one-tenth of a cent ($0.001). The mill levy is calculated by adding up the mill rates of all the taxing authorities that have jurisdiction over the property. For instance, if a property is located within the city limits of Wichita, the mill levy would include rates from the city, the county, the school district, and any other applicable special assessment districts.

| Taxing Authority | Mill Rate |

|---|---|

| City of Wichita | 12.5 mills |

| Sedgwick County | 10.2 mills |

| School District | 28.7 mills |

| Special Assessment District | 2.3 mills |

| Total Mill Levy | 53.7 mills |

In the example above, the total mill levy for this property is 53.7 mills. To calculate the property tax liability, you would multiply the assessed value of the property by the total mill levy and then divide by 1000. For instance, if the assessed value of the property is $200,000, the property tax liability would be calculated as follows:

$200,000 x 53.7 mills = $10,740

$10,740 / 1000 = $10.74 per $100 of assessed value

So, in this case, the property tax liability would be $10.74 for every $100 of assessed value, resulting in a total property tax of $2,000 for the year.

Property Tax Relief Programs

Recognizing the potential financial burden of property taxes, Wichita and Sedgwick County offer several relief programs to assist homeowners. These programs aim to make property ownership more affordable, especially for those on fixed incomes or with limited financial means.

- Homestead Tax Refund: This program provides a refund of a portion of the property taxes paid by homeowners who use their property as their primary residence. The refund amount is determined based on income and property value.

- Senior Property Tax Exemption: Seniors aged 65 or older may be eligible for a partial or full exemption from property taxes. The exemption amount depends on the individual's income and property value.

- Disabled Veteran Property Tax Exemption: Veterans with service-connected disabilities may qualify for a property tax exemption. The amount of the exemption varies based on the veteran's disability rating.

- Low-Income Tax Abatement: This program offers a reduction in property taxes for low-income homeowners. The abatement amount is determined by income and property value, and it can provide significant savings for eligible homeowners.

The Impact of Property Taxes on the Community

Property taxes in Wichita play a crucial role in funding essential public services and maintaining the city's infrastructure. These taxes contribute to the funding of schools, ensuring that local students have access to quality education. They also support public safety services, such as the Wichita Police Department and the Sedgwick County Fire Department, which help keep the community safe and secure.

Additionally, property taxes are vital for maintaining and improving the city's infrastructure. They fund road repairs and maintenance, ensuring safe and efficient transportation for residents and businesses. The taxes also contribute to the development and upkeep of public parks, recreational facilities, and other community amenities, enhancing the quality of life for all residents.

| Public Service | Percentage of Property Tax Revenue |

|---|---|

| Education | 35% |

| Public Safety | 25% |

| Infrastructure Maintenance | 20% |

| Community Services | 10% |

| Other | 10% |

Frequently Asked Questions (FAQs)

When are property taxes due in Wichita, KS?

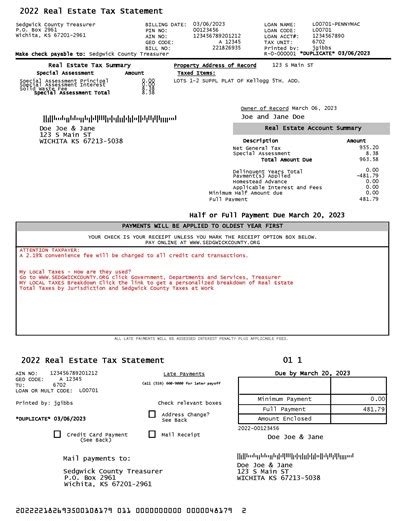

+Property taxes in Wichita are due in two installments. The first installment is typically due on December 20th of each year, and the second installment is due on May 20th of the following year. However, these dates may vary slightly depending on the day of the week they fall on. It's always best to check the official tax calendar from Sedgwick County for the exact due dates.

<div class="faq-item">

<div class="faq-question">

<h3>How can I pay my property taxes in Wichita?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>There are several convenient ways to pay your property taxes in Wichita. You can pay online through the Sedgwick County Treasurer's Office website using a credit card or electronic check. You can also pay by mail by sending a check or money order to the Treasurer's Office. Additionally, you can pay in person at the Treasurer's Office or at one of the authorized payment locations, which include several banks and credit unions in the area.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What happens if I don't pay my property taxes on time in Wichita?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Late payment of property taxes in Wichita can result in penalties and interest. If you miss the first installment deadline, you'll be charged a 6% penalty, and an additional 1% penalty is added for each month the payment remains delinquent. It's important to note that if your property taxes are not paid in full by the second installment deadline, the county may place a tax lien on your property, which could eventually lead to foreclosure if the taxes remain unpaid.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I appeal my property tax assessment in Wichita?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, if you believe your property has been unfairly assessed, you have the right to appeal the assessment. The appeal process begins with filing a written protest with the Sedgwick County Appraiser's Office. You'll need to provide evidence supporting your claim, such as recent sales data of similar properties in the area. The Appraiser's Office will then review your protest and schedule a hearing if necessary. It's advisable to consult a tax professional or attorney to guide you through the appeal process.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How often are property values reassessed in Wichita?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Property values in Wichita are reassessed every year. The Sedgwick County Appraiser's Office conducts annual assessments to ensure that property values remain accurate and fair. This process takes into account factors such as market trends, sales data, and improvements made to the property. If you believe your property's value has changed significantly since the last assessment, you can request a reassessment, but it's important to note that this is typically done at the discretion of the Appraiser's Office.</p>

</div>

</div>

</div>

Understanding property taxes in Wichita is an important part of being a responsible homeowner. By knowing how property taxes are assessed, what they fund, and the available relief programs, homeowners can make informed decisions and actively participate in their community. Remember, property taxes are a vital component of maintaining the city’s infrastructure and providing essential public services, and by paying these taxes, residents contribute to the continued growth and prosperity of Wichita.