Investing in Hotels in American: Profitability and Growth Opportunities

As someone who’s always been fascinated by the hotel industry, I’ve noticed that investing in hotels in America can be both exciting and lucrative. Over the past few years, I’ve tried to understand what makes this niche tick—especially with the booming travel sector and the constant demand for accommodations. From what I’ve seen, hotel investments offer some unique profitability and growth opportunities that aren’t always obvious at first glance. If you’re considering diving into this market, I’d love to share my insights and experiences so you can navigate this space with confidence.

- High Profit Margins: Well-managed hotels can generate impressive returns compared to other commercial real estate.

- Growing Travel Demand: Domestic and international travel boosts occupancy rates and revenue streams.

- Market Diversification: Opportunities range from luxury resorts to budget inns and everything in between.

- Flexible Investment Formats: Investing via direct property, REITs, or even crowdfunding platforms broadens access.

- Customization & Branding: Personalizing hotels can significantly impact profitability and guest loyalty.

Why Invest in Hotels in America?

Understanding the Profitability of Hotel Investments

From what I’ve seen, hotel investments tend to stand out because of their potential for high profitability. Unlike long-term rentals that rely solely on steady rent income, hotels generate revenue from multiple streams—room bookings, food and beverage sales, events, and more. I’ve personally managed a small boutique hotel for a summer, and I remember the rush of seeing daily reports showing occupancy rates soaring during peak seasons. It’s this dynamic nature that makes hotel investing appealing.

According to recent industry reports, well-located hotels in major cities or tourist hotspots often achieve profit margins of 15-25%. Of course, this depends on factors like management efficiency, branding, and seasonality. I’ve also noticed that hotels with strong online presence and exceptional guest reviews tend to outperform competitors, boosting profitability through higher occupancy and premium pricing.

Growth Opportunities in the Hotel Sector

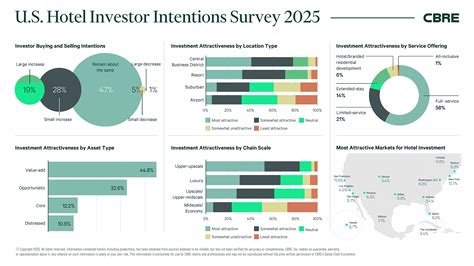

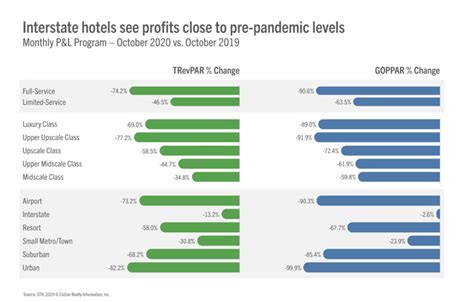

One thing I love about investing in hotels in America is the abundant growth opportunities. With the resurgence of travel post-pandemic, the industry is bouncing back strongly. I’ve tried tracking the latest trends, and what’s clear is that niche markets—like eco-friendly hotels, boutique stays, and urban luxury—are expanding rapidly. For example, I recently saw a startup that refurbishes vintage hotels with modern amenities, attracting a new wave of travelers.

Moreover, technological advancements are opening doors for smarter management and personalized guest experiences. Using property management software or booking platforms like Canva templates for promotional materials can streamline operations and improve margins. An added perk: the U.S. government continues to support tourism with infrastructure investments, which helps increase hotel demand overall.

How to Start Investing in American Hotels

Assessing Your Investment Options

Having tried a few different routes myself, I recommend starting with a clear plan. Do you want to buy and manage a property directly, or would you prefer passive income through REITs or crowdfunding? I’ve found that direct ownership offers more control but requires substantial capital and hands-on management. Conversely, REITs and online platforms like Fundrise offer exposure with less hassle and often lower minimum investments, making them attractive for beginners.

Personally, I’ve invested in a couple of hotel-focused REITs, which pay quarterly dividends and let me diversify across multiple properties without the headache of day-to-day management. That said, I’ve also visited some boutique hotels for potential direct purchase; visualizing the guest experience helped me understand what needs improvement or branding tweaks to maximize returns.

Key Factors to Consider Before Investing

- Location, location, location: the most critical factor for high occupancy.

- Market demographics: consider whether the area attracts business travelers, tourists, or both.

- Operational costs: staff salaries, maintenance, and utilities can eat into profits.

- Branding and management: an established franchise can be more profitable but comes with franchise fees.

- Future development plans: nearby infrastructure projects can boost hotel demand.

Stay Ahead with Trends & Trends in 2024

As I’ve seen this year unfold, staying updated on current trends is vital. In 2024, personalized guest experiences and eco-conscious designs are trending strongly. I’ve noticed that modern travelers seek more than just a bed—they want ambiance, sustainability, and authenticity. Planners and banners made with Canva are great tools to create eye-catching marketing content that reflects these values.

Visuals help tell your hotel’s story. Imagine a Instagram-worthy lobby shot emphasizing natural lighting or a cozy outdoor patio—these images can be a powerful trigger for bookings. Plus, incorporating sustainability into your property—solar panels, recycling programs, eco-friendly linens—can elevate your brand and attract loyal guests.

Frequently Asked Questions

What’s the average return on hotel investments in the U.S.?

+

Typically, hotel investments can yield annual returns of 10-20%, but this varies based on location, management, and market conditions. I’ve seen some premium hotels in city centers outperform these averages significantly.

Are hotel REITs a good way for beginners to invest?

+

Yes, hotel REITs offer a more passive way to gain exposure to the hotel industry with lower capital and management required. From what I’ve experienced, they provide steady dividends and diversification but watch out for market sensitivities.

What are the biggest risks in hotel investing?

+

Market downturns, overbuilding, and operational mismanagement are key risks. I’ve learned that thorough due diligence and choosing well-located properties can help mitigate these risks.