Automobile Sales Tax Arkansas

Welcome to a comprehensive guide on understanding and navigating the automobile sales tax landscape in the state of Arkansas. This article aims to provide an in-depth analysis, complete with real-world examples and industry insights, to demystify the process of calculating and paying sales tax on vehicle purchases in the Natural State.

Unraveling the Arkansas Automobile Sales Tax

Arkansas, like many other states, imposes a sales tax on the purchase of vehicles, which is an essential revenue source for the state government. This tax applies to both new and used cars, trucks, motorcycles, and other motor vehicles. Understanding the intricacies of this tax is crucial for car buyers, as it can significantly impact the overall cost of their vehicle acquisition.

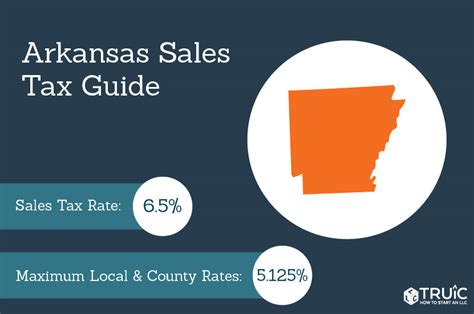

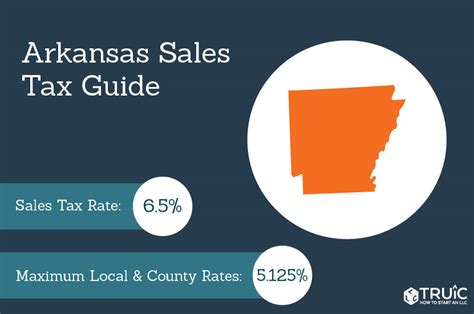

The Sales Tax Rate in Arkansas

The state of Arkansas has a uniform sales tax rate of 6.5% that applies to all tangible personal property, including vehicles. This rate is a combination of the state sales tax and any additional local taxes that may be levied by counties or municipalities. The local tax rate can vary, with some areas having a higher rate due to specific district or county taxes.

For instance, consider the city of Little Rock, which has a local sales tax rate of 1.5%. When purchasing a vehicle in Little Rock, a buyer would pay a total sales tax of 8% (6.5% state tax + 1.5% local tax). This additional local tax is important to note, as it can increase the overall sales tax liability for car buyers depending on their location.

Calculating Sales Tax on Vehicle Purchases

To calculate the sales tax owed on a vehicle purchase in Arkansas, one must first determine the total purchase price of the vehicle. This includes not just the vehicle’s sticker price but also any additional fees, such as dealer preparation fees, destination charges, and optional equipment.

Let's take an example: You're purchasing a new car in Arkansas with a base price of $30,000. The dealer has added a $1,000 preparation fee and a $1,500 destination charge. Your total purchase price would be $32,500.

Now, applying the 6.5% state sales tax, the tax amount would be $2,112.50 (6.5% of $32,500). If we were purchasing this vehicle in Little Rock, with its additional 1.5% local tax, the total sales tax would be $2,270.00 (8% of $32,500). This amount is then added to the purchase price, resulting in a total cost of $34,770 for the vehicle.

| Vehicle Purchase Cost Breakdown | Amount |

|---|---|

| Base Price | $30,000 |

| Dealer Fees | $2,500 |

| State Sales Tax (6.5%) | $2,112.50 |

| Local Sales Tax (1.5%) | $487.50 |

| Total Cost | $34,770 |

Exemptions and Special Cases

While most vehicle purchases in Arkansas are subject to sales tax, there are certain exemptions and special cases to be aware of:

- Trade-Ins: When trading in a vehicle as part of a purchase, the trade-in value is deducted from the purchase price of the new vehicle, potentially reducing the sales tax owed.

- Military Personnel: Active-duty military personnel are exempt from paying sales tax on vehicles purchased in Arkansas if they meet certain residency requirements.

- Disabilities: Certain individuals with disabilities may be eligible for sales tax exemptions on vehicle purchases, depending on the type of disability and the vehicle's modifications.

- Commercial Vehicles: Commercial vehicles, such as trucks used primarily for business purposes, may have different tax implications. It's advisable to consult with a tax professional for guidance in these cases.

Sales Tax Payment and Remittance

The sales tax on a vehicle purchase in Arkansas is typically due at the time of purchase. The dealer will calculate the tax and include it in the total amount owed. Buyers can pay this tax using various methods, including cash, check, or credit card, depending on the dealer’s policies.

After the purchase, the dealer is responsible for remitting the sales tax to the Arkansas Department of Finance and Administration (DFA). The DFA oversees the collection and distribution of sales tax revenue, ensuring it is used for various state and local government initiatives.

The Future of Automobile Sales Tax in Arkansas

While the current sales tax structure in Arkansas provides a stable revenue stream for the state, there have been discussions and proposals to reform the tax system. Some advocates suggest implementing a flat tax rate or exploring alternative revenue sources to reduce the reliance on sales tax. However, any changes to the tax structure would likely impact vehicle purchases and require careful consideration of the economic implications.

Conclusion: Navigating Arkansas’ Automobile Sales Tax

Understanding the automobile sales tax in Arkansas is a crucial step in the vehicle purchasing process. By familiarizing yourself with the tax rates, calculation methods, and potential exemptions, you can make more informed decisions and ensure you’re not caught off guard by unexpected tax liabilities. As with any significant financial transaction, it’s always advisable to consult with tax professionals or legal experts to ensure compliance and take advantage of any available exemptions or incentives.

How often are sales tax rates updated in Arkansas?

+

Sales tax rates in Arkansas are generally reviewed and updated annually to account for changes in the state’s budget and economic conditions. However, local tax rates may be adjusted more frequently, so it’s advisable to check for any recent changes before making a vehicle purchase.

Are there any online resources to help calculate sales tax on vehicle purchases in Arkansas?

+

Yes, the Arkansas Department of Finance and Administration (DFA) provides an online Sales Tax Calculator that allows you to estimate the sales tax on a vehicle purchase. This tool can be a helpful guide but always confirm the final tax amount with your dealer or a tax professional.

Can I deduct sales tax on vehicle purchases from my Arkansas state income tax return?

+

No, sales tax on vehicle purchases in Arkansas is not deductible from your state income tax return. However, you may be able to deduct certain vehicle-related expenses if you use your vehicle for business purposes.