Henry County Property Tax

Understanding property taxes is an essential aspect of homeownership, and Henry County, located in the vibrant state of Georgia, offers a unique perspective on this topic. With its rich history, diverse communities, and a thriving real estate market, Henry County provides an intriguing backdrop to explore the intricacies of property taxation. In this comprehensive guide, we will delve into the specifics of Henry County property tax, offering a detailed analysis that will empower homeowners and prospective buyers with the knowledge they need to navigate this critical aspect of their financial responsibilities.

The Complexities of Henry County Property Tax

Henry County’s property tax system is a fascinating blend of local regulations and state guidelines, creating a unique taxation landscape. The county’s property tax rate is determined by a combination of factors, including the assessed value of the property, the millage rate set by the county government, and various exemptions and abatements that may apply.

The assessed value of a property is a critical component in calculating property taxes. It represents the fair market value of the property, which is determined through a meticulous process by the Henry County Tax Assessor's Office. This value can fluctuate based on market conditions, property improvements, and other factors, which means property owners must stay vigilant to ensure their assessments remain accurate.

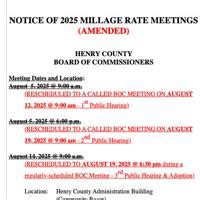

The millage rate, on the other hand, is a tax rate expressed in mills, where one mill represents a tax liability of one dollar per $1,000 of assessed value. This rate is set annually by the Henry County Board of Commissioners, taking into account the county's budgetary needs and the desire to maintain a balanced approach to taxation. The millage rate, when multiplied by the assessed value, determines the preliminary property tax amount.

However, the story doesn't end there. Henry County offers various exemptions and abatements that can reduce the taxable value of a property. For instance, homeowners may be eligible for a homestead exemption, which reduces the assessed value of their primary residence, thus lowering their property taxes. Additionally, the county provides exemptions for senior citizens, veterans, and individuals with disabilities, ensuring that these groups are not unduly burdened by property taxes.

Henry County’s Property Tax Cycle

The property tax cycle in Henry County is a well-organized process that ensures transparency and fairness. It begins with the assessment phase, where the Tax Assessor’s Office evaluates all properties within the county. This evaluation considers factors such as recent sales data, construction costs, and property improvements to determine an accurate assessed value.

Once the assessments are complete, property owners receive a notice of assessment, detailing the new assessed value of their property. This notice provides an opportunity for homeowners to review and, if necessary, appeal the assessment. The appeal process is designed to ensure that property values are fair and accurate, maintaining the integrity of the taxation system.

Following the assessment and potential appeal phase, the Henry County Board of Commissioners sets the millage rate for the upcoming fiscal year. This decision is based on a comprehensive review of the county's budget, taking into account the needs of various departments and services. The millage rate, once approved, is applied to the assessed value of each property to calculate the preliminary tax amount.

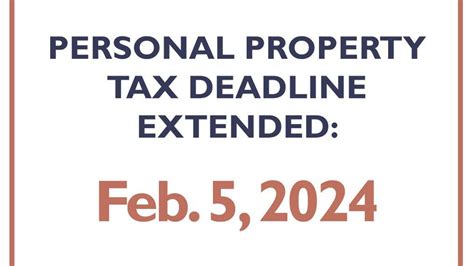

To ensure that property owners have ample time to prepare, Henry County sends out tax bills well in advance of the due date. These bills provide a clear breakdown of the calculated tax amount, including any applicable exemptions or abatements. Property owners are encouraged to review these bills carefully and reach out to the Tax Commissioner's Office with any questions or concerns.

Paying Henry County Property Taxes

Henry County offers a range of options for property owners to pay their taxes. The most common method is through online payment portals, which provide a convenient and secure way to settle tax liabilities. Property owners can also choose to pay by mail, using the remittance slip provided with their tax bill. For those who prefer in-person interactions, the Tax Commissioner’s Office accepts payments at their designated locations.

It's important to note that Henry County offers a discount for early payment. Property owners who pay their taxes in full by a specified early payment deadline can receive a discount on their total tax amount. This incentive not only encourages timely payments but also helps the county with its cash flow management.

For property owners who may face financial challenges, Henry County provides a payment plan option. This plan allows taxpayers to spread their tax payments over several months, making it more manageable to meet their financial obligations. However, it's crucial to understand that interest and penalties may apply to unpaid balances, so staying informed about payment deadlines is essential.

Henry County’s Commitment to Transparency

Henry County takes pride in its commitment to transparency and accessibility when it comes to property taxes. The county’s website provides a wealth of information, including tax rates, assessment data, and resources for taxpayers. This digital platform ensures that property owners have easy access to the information they need, whenever and wherever they require it.

Additionally, the Henry County Tax Commissioner's Office maintains a dedicated team of professionals who are readily available to assist taxpayers. Whether it's answering questions about assessments, providing guidance on exemptions, or offering support during the payment process, the office is committed to ensuring that property owners have a positive experience when dealing with their property taxes.

The office also conducts regular outreach programs and educational initiatives to keep taxpayers informed about changes in tax laws, new exemptions, and other relevant updates. By staying connected with the community, Henry County fosters a culture of informed taxpayers who are actively engaged in the local governance process.

Comparative Analysis: Henry County vs. Other Counties

To gain a broader perspective, let’s compare Henry County’s property tax system with that of other counties in Georgia. While each county has its unique characteristics, certain trends emerge when analyzing property tax rates and assessment practices.

For instance, some counties in Georgia have a higher millage rate than Henry County, resulting in higher property tax liabilities for homeowners. On the other hand, certain counties offer more generous exemptions, particularly for senior citizens and veterans, which can significantly reduce the taxable value of properties.

Assessment practices also vary across counties. While Henry County employs a thorough and transparent assessment process, other counties may have different methodologies, which can impact the accuracy and fairness of property valuations. Some counties may utilize mass appraisal techniques, while others may rely on more detailed individual assessments.

| County | Millage Rate | Assessment Method | Exemptions Offered |

|---|---|---|---|

| Henry County | 7.65 mills | Individual Property Assessments | Homestead, Senior Citizen, Veteran |

| Fulton County | 10.25 mills | Mass Appraisal | Homestead, Senior Citizen |

| Gwinnett County | 9.65 mills | Individual Assessments | Homestead, Veteran, Disability |

This comparative analysis highlights the diversity of property tax systems within Georgia, each with its own advantages and considerations. It underscores the importance of understanding the unique characteristics of each county's taxation system when making real estate decisions.

The Future of Henry County Property Taxes

As we look ahead, several factors will shape the future of Henry County’s property tax landscape. The county’s continued growth and development will impact the demand for services, which in turn will influence the millage rate and the overall taxation strategy.

Technological advancements will also play a significant role. Henry County is already leveraging digital tools to enhance transparency and accessibility, and further integration of technology is expected to streamline processes, improve data accuracy, and provide even more convenience for taxpayers.

Additionally, the county's commitment to community engagement and education will continue to foster a culture of informed taxpayers. Regular town hall meetings, online resources, and community outreach programs will ensure that property owners remain active participants in the taxation process, contributing to a more equitable and efficient system.

How often does Henry County reassess property values?

+Henry County conducts a comprehensive reassessment of all properties every four years. However, the Tax Assessor’s Office may perform partial reassessments more frequently to ensure that property values remain current and accurate.

Are there any tax breaks or incentives for new construction in Henry County?

+Yes, Henry County offers a temporary tax abatement program for new construction. This program provides a reduced tax assessment for a limited period, encouraging investment in the county’s real estate market.

Can I appeal my property tax assessment if I disagree with it?

+Absolutely. Henry County provides a formal appeal process for property owners who believe their assessment is inaccurate or unfair. The appeal process ensures that property owners have a chance to present their case and seek a fair resolution.