Miami Dade Real Estate Taxes

When it comes to real estate in Miami-Dade County, Florida, understanding the tax landscape is crucial for both homeowners and investors. The county's unique tax structure and regulations can significantly impact your financial planning and investment strategies. This comprehensive guide aims to unravel the complexities of Miami Dade real estate taxes, providing an in-depth analysis and expert insights to help you navigate this critical aspect of property ownership.

The Basics of Miami Dade Real Estate Taxes

Miami-Dade County, known for its vibrant real estate market, has a tax system that is both comprehensive and dynamic. The county’s tax structure is designed to support local government functions, including education, infrastructure, and public services, while also ensuring the continued growth and development of the region.

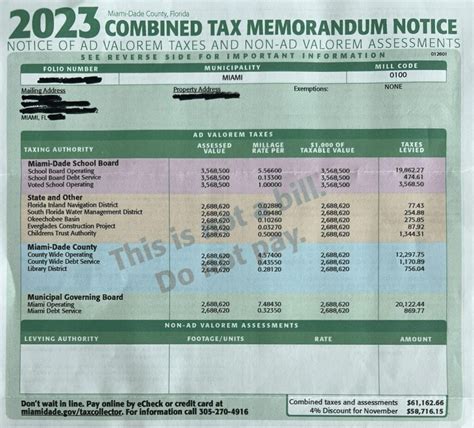

The primary tax levied on real estate in Miami-Dade is the ad valorem tax, a Latin term meaning "according to value." This tax is calculated based on the assessed value of the property and is applied to both residential and commercial properties. The assessed value is determined by the Miami-Dade Property Appraiser's Office, which takes into account factors such as location, improvements, and market conditions.

Tax Assessment Process

The tax assessment process in Miami-Dade is an annual affair. The Property Appraiser’s Office assesses the value of each property as of January 1st of each year. This assessment is based on a combination of physical inspection, sales data, and market analysis. Property owners receive a Notice of Proposed Property Taxes, also known as a TRIM (Truth in Millage) Notice, which details the assessed value and the proposed taxes.

Property owners have the right to appeal their assessments if they believe the value is inaccurate. The Miami-Dade Value Adjustment Board (VAB) handles these appeals, providing a formal process for property owners to dispute their assessments.

| Tax Year | Assessment Date | Notice Mailing Date |

|---|---|---|

| 2023 | January 1, 2023 | August 1, 2023 |

| 2024 | January 1, 2024 | August 1, 2024 |

Tax Rates and Millage

The tax rate, or millage, in Miami-Dade is determined by the county’s Board of County Commissioners and other taxing authorities. The millage rate is expressed in mills, with one mill representing 1 of tax for every 1,000 of assessed value. These rates can vary across different areas within the county, as well as between residential and commercial properties.

For instance, in 2023, the county-wide millage rate for residential properties was set at 10.0881, while for commercial properties, it was slightly higher at 11.1357. These rates are subject to change annually and are influenced by the budgetary needs of the county and its municipalities.

Tax Exemptions and Relief Programs

Miami-Dade County offers a range of tax exemptions and relief programs to eligible property owners, aimed at reducing the tax burden and promoting homeownership. These programs can significantly impact your overall tax liability, making it essential to understand the qualifications and application processes.

Homestead Exemption

The Homestead Exemption is one of the most significant tax relief programs in Florida. It provides a substantial reduction in the assessed value of a primary residence, resulting in lower ad valorem taxes. To qualify for the Homestead Exemption, a property must be the owner’s permanent residence, and the owner must be a Florida resident.

The exemption amount is based on the assessed value of the property and can be as high as $50,000 for those aged 65 and older. For younger homeowners, the exemption is $25,000, and an additional $25,000 is granted for "Save Our Homes," which limits annual increases in assessed value.

| Age | Exemption Amount |

|---|---|

| 65 and older | $50,000 |

| Under 65 | $25,000 |

Other Exemptions and Relief

Beyond the Homestead Exemption, Miami-Dade offers various other exemptions and relief programs. These include:

- Disability Exemption: Provides a $5,000 exemption for permanently and totally disabled individuals.

- Widow(er) Exemption: Offers a $500 exemption for surviving spouses of military veterans.

- Low-Income Senior Exemption: Reduces taxes for seniors with limited income and resources.

- Military Discounts: Active-duty military personnel and veterans may be eligible for tax discounts.

It's crucial to consult with the Miami-Dade Property Appraiser's Office or a tax professional to determine your eligibility for these exemptions and to ensure you receive the maximum tax relief available.

Taxes for Investors and Second Homeowners

For those investing in Miami-Dade real estate or owning a second home in the county, the tax landscape is slightly different. Investment properties and second homes are typically assessed at a higher rate, reflecting their potential for generating income. As a result, the ad valorem taxes on these properties can be significantly higher than those on primary residences.

Considerations for Investors

When investing in Miami-Dade real estate, it’s essential to factor in the tax implications. Here are some key considerations:

- Higher Tax Rates: Investment properties are often subject to higher tax rates than primary residences, impacting cash flow and investment returns.

- Vacancy and Maintenance Costs: Vacant properties may incur additional costs and may not qualify for certain tax exemptions.

- Tax Strategies: Consult with a tax advisor to explore strategies like cost segregation or depreciation to optimize tax savings.

Investors should also be aware of the county's tourist development tax, which applies to short-term rentals. This tax, typically 4%, is collected on the rent and must be remitted to the county.

Tax Appeals and Dispute Resolution

In the event that you disagree with your property’s assessed value or believe you are not receiving the correct tax exemptions, Miami-Dade County provides a formal process for appealing your taxes.

The Appeal Process

The Miami-Dade Value Adjustment Board (VAB) is responsible for hearing appeals against property assessments and tax exemptions. The appeal process typically involves the following steps:

- Filing an Appeal: Property owners must file a formal appeal with the VAB by the deadline specified on their TRIM Notice.

- Mediation: In some cases, the VAB may offer mediation as a means to resolve the dispute informally.

- Hearing: If mediation is unsuccessful or not offered, a formal hearing will be scheduled. Property owners can present their case to the VAB, providing evidence to support their appeal.

- Decision: The VAB will issue a decision, which can be either an affirmation of the original assessment or a reduction.

It's important to note that appeals can be complex and may require the assistance of a tax professional or attorney.

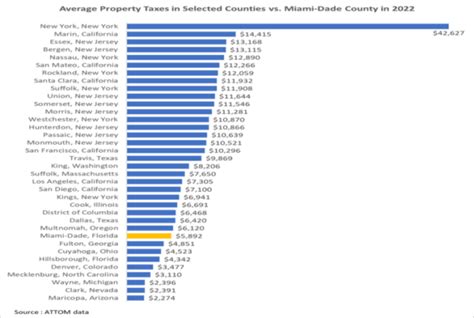

Future Implications and Market Impact

Understanding the tax landscape in Miami-Dade is not just about compliance; it’s also about strategic planning and market analysis. The county’s tax structure can have a significant impact on the real estate market, influencing investment decisions, property values, and the overall economic health of the region.

Market Dynamics

Tax rates and exemptions can affect the supply and demand dynamics of the real estate market. Higher taxes may discourage investment or lead to a shift in property values, while tax relief programs can encourage homeownership and stabilize the market.

For instance, the Homestead Exemption, by reducing the tax burden on primary residences, can make homeownership more affordable, leading to increased demand for residential properties. Conversely, higher taxes on investment properties may drive investors to seek opportunities in other markets.

Policy Changes and Market Response

Changes in tax policy, whether at the county or state level, can have far-reaching implications. The real estate market is highly sensitive to tax adjustments, and even minor changes can result in significant shifts in investor sentiment and property values.

Consider the impact of the recent changes to the federal tax code, which limited the deductibility of state and local taxes (SALT). This change had a direct impact on high-tax states like Florida, potentially reducing the appeal of Miami-Dade real estate for out-of-state investors.

Conclusion: Navigating the Complex Tax Landscape

The tax system in Miami-Dade County is intricate and multifaceted, requiring a deep understanding of local regulations and exemptions. Whether you’re a homeowner, investor, or second homeowner, being well-informed about the tax landscape is crucial for financial planning and strategic decision-making.

By staying informed about tax rates, exemptions, and the appeal process, you can ensure that you're not only complying with local regulations but also optimizing your tax position. This comprehensive guide aims to provide a solid foundation for understanding Miami Dade real estate taxes, empowering you to make informed decisions and navigate the complexities of this dynamic market.

What is the deadline for filing a tax appeal in Miami-Dade County?

+

The deadline for filing a tax appeal is typically 25 days after the TRIM Notice is mailed. It’s important to note that the specific deadline may vary based on the tax year and the date the notice is received. Property owners should refer to their TRIM Notice for the exact deadline.

Are there any tax benefits for green or energy-efficient homes in Miami-Dade County?

+

Yes, Miami-Dade County offers a Green Building Incentive Program, which provides a tax exemption for certain energy-efficient improvements to residential and commercial properties. This program aims to encourage sustainable building practices and reduce the environmental impact of real estate development.

How often do tax rates change in Miami-Dade County?

+

Tax rates in Miami-Dade County can change annually. The county’s Board of County Commissioners, along with other taxing authorities, sets the millage rates each year based on the budgetary needs of the county and its municipalities. Property owners should expect to see updated tax rates with each new tax year.