Placer County Property Taxes

Placer County, nestled in the heart of California's Gold Country, is renowned for its vibrant communities, stunning natural landscapes, and thriving economy. As one of the fastest-growing counties in the state, it boasts a diverse range of residential and commercial properties, making property taxes a significant aspect of local governance and community funding.

Understanding Placer County Property Taxes

Property taxes in Placer County are a vital source of revenue for the local government, schools, and special districts, contributing to the maintenance of public services and infrastructure. These taxes are assessed annually based on the assessed value of each property, which is determined by the county’s Assessor’s Office.

The process of property tax assessment in Placer County involves a thorough evaluation of each property's characteristics, including its location, size, improvements, and recent sales data. This data is then used to calculate the assessed value, which forms the basis for the property tax bill.

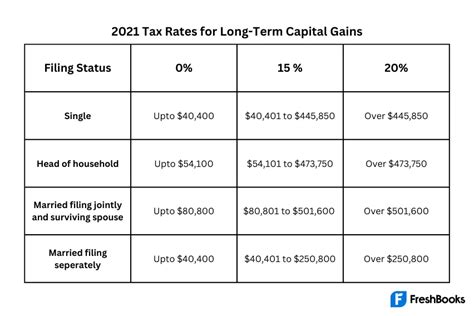

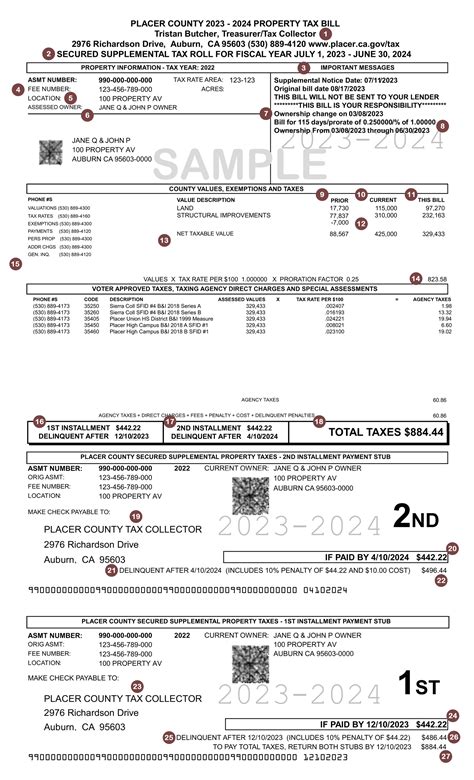

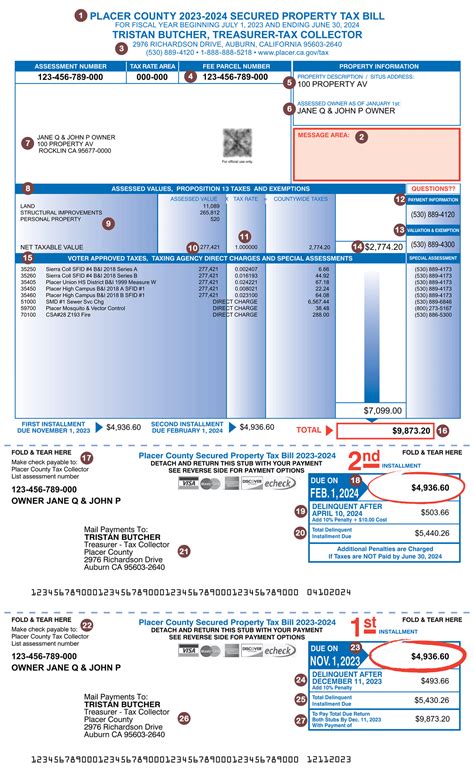

The tax rate in Placer County is set by the local government and is typically composed of several components. These include the base tax rate, voter-approved bond measures, and special assessments for specific services or improvements. The final tax rate is then applied to the assessed value of the property to determine the annual tax bill.

Factors Influencing Property Taxes

Several factors can influence the property tax landscape in Placer County. These include:

- Property Value: The assessed value of a property is a primary determinant of the tax bill. Properties with higher values generally incur higher taxes.

- Market Conditions: The real estate market's fluctuations can impact property values and, consequently, the tax burden. During periods of rapid appreciation, properties may see increased assessments and higher taxes.

- Tax Rate Changes: The county's governing bodies can propose and approve changes to the tax rate, which can affect the overall tax liability for property owners.

- Voter-Approved Measures: Special taxes or bonds approved by voters may be added to the property tax bill to fund specific projects or services.

- Special Assessments: Certain properties may be subject to additional assessments for services like lighting, fire protection, or water districts.

Assessed Value and Tax Bills

The assessed value of a property in Placer County is not necessarily the same as its market value. The county follows a Proposition 13 compliant assessment system, which means that the assessed value of a property typically increases by a maximum of 2% each year, even if the market value increases more significantly. However, there are situations where the assessed value can change beyond this 2% limit, such as when a property is sold or undergoes significant improvements.

The tax bill for a property is calculated by multiplying the assessed value by the applicable tax rate. This rate includes the base tax rate and any additional assessments or special taxes. The tax bill is then divided into two installments, due in February and November of each year.

| Tax Year | Base Tax Rate | Special Assessments | Total Tax Rate |

|---|---|---|---|

| 2022-2023 | $0.64 per $100 of assessed value | $0.20 per $100 of assessed value (example) | $0.84 per $100 of assessed value |

In the above example, a property with an assessed value of $500,000 would have an annual tax bill of $4,200, calculated as follows: ($500,000 x $0.84) / $100.

Property Tax Relief Programs

Placer County recognizes the financial burden that property taxes can place on certain individuals and offers several programs to provide relief. These include:

- Homeowner's Exemption: Eligible homeowners can apply for a reduction in their property's assessed value, which lowers their tax bill. The exemption amount varies but can provide significant savings.

- Senior Citizen Exemption: Senior citizens who meet certain income and residency requirements may qualify for an exemption, reducing their tax liability.

- Disabled Veteran Exemption: Qualified disabled veterans are entitled to an exemption from property taxes, helping them maintain their financial stability.

- Disaster Relief: In the event of a natural disaster, the county may offer tax relief to affected property owners.

Payment Options and Due Dates

Property tax payments in Placer County are due in two installments. The first installment is typically due on February 1st and becomes delinquent after April 10th. The second installment is due on November 1st and becomes delinquent after December 10th. Late payments incur penalties and interest.

Property owners have several payment options, including online payment through the county's website, mail-in payments, and in-person payments at designated locations. It's crucial to note that the payment due dates are strictly enforced, and late payments can result in additional fees and potential liens on the property.

Appealing Property Tax Assessments

If a property owner believes that their property’s assessed value is inaccurate, they have the right to appeal the assessment. The process involves submitting an application for changed assessment to the Assessor’s Office within specific timelines. The application should include evidence and supporting documentation to justify the requested change.

The Assessor's Office will review the appeal and may request additional information or schedule a hearing. If the appeal is successful, the assessed value of the property may be adjusted, which can lead to a reduction in the property tax bill for that year and potentially future years.

The Impact of Property Taxes on the Community

Property taxes in Placer County play a crucial role in funding essential services and infrastructure. These taxes support schools, roads, public safety, parks, and other vital community assets. By contributing to these services, property owners help maintain the high quality of life that makes Placer County such an attractive place to live and do business.

Moreover, property taxes are a key factor in economic development. They provide the funding needed to attract businesses, create jobs, and foster a vibrant economy. The tax revenue supports initiatives that enhance the county's business climate, making it an appealing location for companies to invest and grow.

Conclusion

Understanding property taxes in Placer County is essential for both homeowners and businesses. By grasping the assessment process, tax rates, relief programs, and payment options, property owners can ensure they are paying their fair share and potentially take advantage of available exemptions. Additionally, being informed about property taxes contributes to a sense of community responsibility and helps support the county’s thriving economy and quality of life.

Frequently Asked Questions

What is the current property tax rate in Placer County?

+The current property tax rate in Placer County is composed of the base tax rate and any additional assessments or special taxes. As of the 2022-2023 tax year, the base tax rate is 0.64 per 100 of assessed value. However, this rate may vary based on specific circumstances and additional assessments.

How can I calculate my property tax bill in Placer County?

+To calculate your property tax bill, multiply your property’s assessed value by the applicable tax rate. For example, if your property has an assessed value of 500,000 and the tax rate is 0.84 per 100 of assessed value, your annual tax bill would be (500,000 x 0.84) / 100, which equals $4,200.

Are there any property tax relief programs available in Placer County?

+Yes, Placer County offers several property tax relief programs. These include the Homeowner’s Exemption, Senior Citizen Exemption, Disabled Veteran Exemption, and Disaster Relief. Each program has specific eligibility criteria and can provide significant savings on property taxes.

How can I appeal my property tax assessment in Placer County?

+To appeal your property tax assessment, you must submit an application for changed assessment to the Assessor’s Office within specific timelines. The application should include evidence and supporting documentation to justify the requested change. The Assessor’s Office will review the appeal and may request additional information or schedule a hearing.

What happens if I miss the property tax payment deadline in Placer County?

+If you miss the property tax payment deadline, you will incur penalties and interest. Late payments can also lead to potential liens on your property. It’s crucial to stay informed about the payment due dates and take advantage of the various payment options available, including online, mail-in, and in-person payments.