Madison County Real Estate Taxes

Welcome to Madison County, a vibrant and thriving community nestled in the heart of New York State. This article delves into the intricacies of real estate taxes within this picturesque county, providing an in-depth analysis to guide homeowners, prospective buyers, and investors alike. Real estate taxes play a crucial role in the financial landscape of any community, influencing property values, local development, and the overall economic health of the region. As we navigate the complex world of taxation, we'll uncover the unique aspects of Madison County's tax system, offering clarity and insight to help you make informed decisions about your financial obligations and investments.

Understanding Madison County’s Real Estate Tax Structure

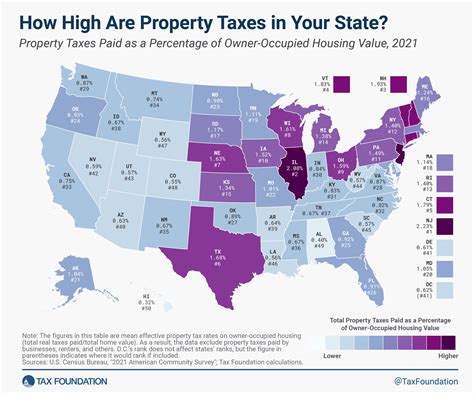

Madison County operates under a property tax system, a common practice across many local governments in the United States. This system ensures that property owners contribute to the funding of essential community services and infrastructure. Real estate taxes in Madison County are assessed annually, taking into account various factors such as the property’s value, location, and specific tax rates applied to different areas within the county.

The tax assessment process involves a thorough evaluation of each property by the Madison County Tax Assessor's Office. This office determines the taxable value of properties based on factors like market value, recent sales of comparable properties, and any improvements or alterations made to the property. This assessed value forms the basis for calculating the real estate tax owed by each property owner.

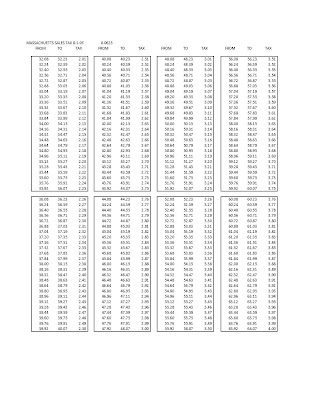

Real estate taxes in Madison County are levied at a certain rate, often referred to as the mill rate or tax rate, which is applied to the assessed value of the property. This rate can vary from year to year and may differ across various municipalities or districts within the county. It's important to note that while the tax rate is a crucial factor, it's not the sole determinant of your tax bill. Other factors, such as exemptions, credits, and special assessments, can also impact the final amount you owe.

Key Factors Influencing Real Estate Taxes in Madison County

Several key factors come into play when determining real estate taxes in Madison County. Understanding these factors can help property owners anticipate their tax obligations and plan their financial strategies effectively.

Property Value: The assessed value of your property is a primary factor in calculating your real estate taxes. Higher property values generally result in higher tax obligations. It's important to keep an eye on the real estate market and any changes in property values within your neighborhood, as these can impact your tax assessment.

Tax Rates: The tax rate, as mentioned earlier, is another critical factor. This rate is set annually by the local government and can vary significantly across different areas within the county. Understanding the tax rate in your specific location is essential for estimating your tax liability.

Exemptions and Credits: Madison County, like many other jurisdictions, offers various exemptions and tax credits to eligible property owners. These can include homestead exemptions, senior citizen exemptions, veterans' exemptions, and tax credits for specific improvements or energy-efficient upgrades. Taking advantage of these exemptions and credits can significantly reduce your tax burden.

Special Assessments: In certain circumstances, property owners may be subject to special assessments. These are charges levied by the local government to cover the costs of specific improvements or services that benefit a particular area. Examples include road improvements, water and sewer line upgrades, or the construction of new public facilities. Special assessments are typically added to your regular tax bill and are often spread out over several years.

| Factor | Description |

|---|---|

| Property Value | The assessed value of your property forms the basis for tax calculation. |

| Tax Rates | Annual rates set by the local government; can vary by location. |

| Exemptions and Credits | Reductions in tax liability for eligible property owners. |

| Special Assessments | Charges for specific improvements or services benefiting a particular area. |

The Impact of Real Estate Taxes on Madison County Residents

Real estate taxes play a pivotal role in the lives of Madison County residents, influencing their financial planning, property ownership, and overall quality of life. Understanding the impact of these taxes is crucial for making informed decisions about property ownership and investment in the county.

Financial Planning and Budgeting

For homeowners and prospective buyers, real estate taxes are a significant expense that must be carefully considered in financial planning. These taxes can significantly impact a household’s budget, affecting the amount of disposable income available for other expenses and savings. It’s crucial to factor in the annual tax obligation when determining the affordability of a property and developing a long-term financial strategy.

Understanding the tax implications can also guide investment decisions. Investors considering real estate opportunities in Madison County must assess the potential return on investment in light of the tax obligations. By factoring in the tax burden, investors can make more accurate projections of their potential profits and risks, ensuring a sound investment strategy.

Property Ownership and Maintenance

Real estate taxes are an ongoing commitment for property owners. Beyond the initial purchase of a property, owners must budget for and pay annual taxes to maintain their ownership rights. Failure to pay these taxes can result in legal consequences, including liens on the property and, in extreme cases, loss of ownership.

Moreover, real estate taxes can influence property maintenance and improvement decisions. Property owners may need to consider the impact of tax assessments when planning renovations or upgrades. For instance, certain improvements can increase the assessed value of a property, leading to higher tax obligations. Understanding these implications can help property owners make informed decisions about their maintenance and improvement strategies.

Community Development and Infrastructure

Real estate taxes are a primary source of revenue for local governments, funding essential community services and infrastructure development. These taxes contribute to the maintenance and improvement of roads, bridges, schools, parks, and other public facilities that enhance the quality of life for residents. They also support emergency services, public safety, and social programs, ensuring a well-rounded and vibrant community.

By paying real estate taxes, property owners in Madison County directly contribute to the development and upkeep of their community. This investment in local infrastructure and services can enhance property values and attract new residents and businesses, further strengthening the economic vitality of the county.

Strategies for Managing Real Estate Taxes in Madison County

Navigating the complexities of real estate taxes can be challenging, but there are strategies and resources available to help Madison County residents effectively manage their tax obligations.

Understanding Tax Assessments

One of the most crucial steps in managing real estate taxes is understanding the tax assessment process. Property owners should review their annual tax assessment notices carefully, ensuring the assessed value and tax rates are accurate. If there are discrepancies or if you believe your property’s value has been over-assessed, you have the right to appeal the assessment. The Madison County Tax Assessor’s Office provides guidance and resources for appealing assessments, ensuring a fair and transparent process.

Taking Advantage of Exemptions and Credits

Madison County offers a range of exemptions and tax credits that can significantly reduce your tax liability. It’s important to stay informed about these opportunities and ensure you meet the eligibility criteria. Some common exemptions include the homestead exemption, which reduces the taxable value of your primary residence, and exemptions for seniors, veterans, and disabled individuals. Additionally, tax credits are available for energy-efficient upgrades and improvements, providing incentives for environmentally conscious renovations.

By carefully reviewing the available exemptions and credits and ensuring you take advantage of those for which you're eligible, you can significantly lower your tax burden and improve your financial position.

Engaging with Local Authorities

Open communication with local government authorities is key to effectively managing your real estate taxes. The Madison County Tax Assessor’s Office and other relevant departments are resources for information and guidance. They can provide answers to specific questions about tax rates, assessments, and exemptions, helping you understand your obligations and navigate the tax system effectively.

Attending local government meetings and staying informed about tax policy changes can also be beneficial. By staying engaged with local authorities, you can influence tax decisions and advocate for fair and reasonable tax practices that benefit the entire community.

Planning for the Future

Long-term financial planning is essential for managing real estate taxes effectively. This involves creating a budget that accounts for annual tax obligations and ensuring you have the necessary funds set aside to meet these commitments. It’s also beneficial to explore options for tax-efficient investments or strategies that can reduce your overall tax burden over time.

Working with financial advisors or tax professionals who are familiar with Madison County's tax system can provide valuable insights and guidance. They can help you optimize your financial strategies, ensuring you're making the most of available exemptions and credits while minimizing your tax liability.

Conclusion: Navigating Real Estate Taxes in Madison County

Real estate taxes are a critical aspect of property ownership in Madison County, influencing financial planning, community development, and the overall economic landscape. Understanding the tax system, staying informed about tax rates and assessments, and taking advantage of available exemptions and credits are key strategies for effectively managing your tax obligations.

By actively engaging with local authorities, seeking professional guidance when needed, and planning for the future, Madison County residents can navigate the complexities of real estate taxes with confidence. This ensures a stable and thriving community, where property owners can contribute to and benefit from a vibrant and well-maintained local environment.

How often are real estate taxes assessed in Madison County?

+Real estate taxes in Madison County are assessed annually. The assessment process takes into account various factors such as property value, location, and tax rates to determine the tax liability for each property owner.

Are there any exemptions or credits available to reduce real estate taxes in Madison County?

+Yes, Madison County offers several exemptions and tax credits to eligible property owners. These include homestead exemptions, senior citizen exemptions, veterans’ exemptions, and tax credits for energy-efficient upgrades. These can significantly reduce your tax liability.

What should I do if I believe my property’s assessed value is inaccurate?

+If you believe your property’s assessed value is inaccurate, you have the right to appeal the assessment. The Madison County Tax Assessor’s Office provides guidance and resources for the appeals process, ensuring a fair and transparent review of your case.

How can I stay informed about changes in tax rates and assessments in Madison County?

+Staying informed about tax changes is crucial for effective financial planning. You can monitor local news and government websites, attend public meetings, and subscribe to official notifications from the Madison County Tax Assessor’s Office to stay updated on tax rate changes and assessment procedures.