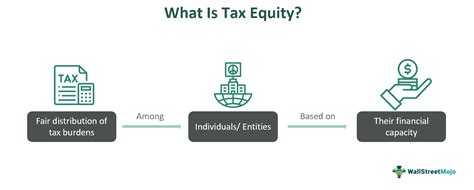

Tax Equity

Tax Equity, a fundamental concept in financial and tax planning, is a strategy that aims to optimize an individual's or business's financial position by leveraging tax laws and incentives to their advantage. This strategic approach has gained prominence in recent years as a powerful tool for reducing tax liabilities and maximizing financial returns. With the ever-evolving landscape of tax regulations, understanding and effectively implementing tax equity strategies has become essential for achieving financial success.

The Core Principles of Tax Equity

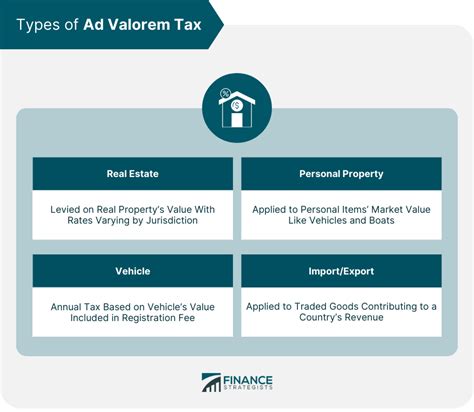

Tax Equity revolves around the idea of leveling the playing field for taxpayers by ensuring that individuals and businesses with similar financial situations are treated fairly under the tax code. It promotes equality and justice in the tax system, ensuring that no one is unfairly advantaged or disadvantaged due to their tax status.

At its core, Tax Equity is about minimizing tax burdens while maximizing the benefits available through various tax incentives and credits. This involves a deep understanding of the tax code and the ability to navigate its complexities to identify opportunities for optimization.

Key Components of Tax Equity Strategies

- Tax Credits and Incentives: Utilizing tax credits, such as the Research and Development Tax Credit or Energy Efficiency Credits, can significantly reduce tax liabilities. These credits are often offered to encourage specific behaviors or investments, providing a financial incentive to taxpayers.

- Tax-Efficient Investment Strategies: Investing in tax-advantaged accounts like Individual Retirement Accounts (IRAs) or 529 Plans can reduce the tax burden on investment returns. Additionally, strategies like tax-loss harvesting can help offset capital gains and minimize overall tax obligations.

- Business Structuring: For businesses, choosing the right legal structure, such as an S Corporation or Limited Liability Company (LLC), can impact tax liabilities. Each structure has unique tax implications, and selecting the most suitable one can lead to significant tax savings.

- International Tax Planning: In a globalized economy, understanding international tax laws is crucial. Strategies like transfer pricing and tax treaty benefits can help multinational corporations manage their tax obligations effectively.

| Tax Equity Strategy | Key Benefits |

|---|---|

| Tax Credits | Direct reduction in tax liabilities |

| Tax-Advantaged Investments | Reduced tax on investment returns |

| Business Structuring | Minimized tax obligations for businesses |

| International Tax Planning | Efficient management of global tax obligations |

Tax Equity in Action: Real-World Examples

The concept of Tax Equity comes to life through real-world applications, demonstrating its impact and effectiveness. Let’s explore a few scenarios where Tax Equity strategies have made a significant difference:

Case Study: Small Business Tax Planning

Consider a small business owner, Jane Smith, who operates a local bakery. By working with a tax advisor, Jane restructured her business as an S Corporation. This move allowed her to distribute business income as dividends, which are taxed at a lower rate compared to regular income. As a result, Jane reduced her tax liability significantly, allowing her to reinvest more funds into her business for expansion.

International Tax Strategies for Corporations

A multinational corporation, GlobalTech Inc., faced challenges with managing its tax obligations across various countries. By implementing a transfer pricing strategy, they were able to allocate profits to jurisdictions with lower tax rates. Additionally, by leveraging tax treaty benefits, they minimized double taxation and optimized their global tax position.

Tax-Efficient Retirement Planning

An individual, Michael Johnson, approached a financial planner to discuss his retirement goals. The planner suggested a Roth IRA strategy. Unlike traditional IRAs, Roth IRAs offer tax-free withdrawals in retirement. By contributing to a Roth IRA, Michael can grow his retirement savings tax-free, ensuring a larger nest egg for his golden years.

| Case Study | Tax Equity Strategy | Impact |

|---|---|---|

| Small Business | Business Structuring | Reduced tax liability, enabling business expansion |

| Multinational Corporation | International Tax Planning | Optimized global tax position, minimizing double taxation |

| Individual Retirement | Tax-Advantaged Investments | Tax-free retirement withdrawals, larger savings |

The Future of Tax Equity

As tax laws continue to evolve, the landscape of Tax Equity strategies will also adapt. The ongoing debate surrounding tax reform and the introduction of new tax incentives create a dynamic environment for taxpayers. Here are some key trends and considerations for the future:

Emerging Tax Incentives

Governments around the world are increasingly recognizing the role of tax incentives in driving economic growth and innovation. New tax credits, such as those supporting clean energy initiatives or technological advancements, are expected to shape future Tax Equity strategies.

Digital Taxation and Globalization

The rise of digital economies and cross-border transactions presents unique challenges for tax authorities. As countries work towards establishing a fair digital tax system, taxpayers will need to navigate these new regulations to maintain tax compliance and equity.

Tax Equity and Social Responsibility

There is a growing focus on the role of businesses in promoting social and environmental sustainability. Tax Equity strategies can align with these goals, with businesses leveraging tax incentives to support sustainable practices and community development.

The Role of Technology in Tax Equity

Advancements in tax software and data analytics are revolutionizing Tax Equity planning. These tools enable more precise tax calculations and strategy development, ensuring that taxpayers can make informed decisions to optimize their tax positions.

Conclusion

Tax Equity is a powerful tool for individuals and businesses to manage their financial positions effectively. By understanding the core principles and strategies of Tax Equity, taxpayers can navigate the complexities of the tax system and optimize their financial outcomes. As the tax landscape continues to evolve, staying informed and adaptable will be key to leveraging Tax Equity to its fullest potential.

Frequently Asked Questions

How can I stay updated with tax law changes?

+Regularly reviewing tax publications and resources provided by government agencies and reputable tax organizations is essential. Additionally, consulting with tax professionals can ensure you receive timely updates and expert guidance.

What are some common mistakes to avoid in Tax Equity planning?

+Avoiding common mistakes like failing to consider all available tax credits, overlooking tax-efficient investment options, or neglecting to review business structures regularly can significantly impact the effectiveness of Tax Equity strategies.

How does Tax Equity impact social responsibility initiatives?

+Tax Equity strategies can be aligned with social responsibility goals. For instance, businesses can leverage tax incentives to support community projects, promote environmental sustainability, or invest in employee development, all while optimizing their tax positions.