Property Tax Calculator By Zip Code

Welcome to this comprehensive guide on understanding and managing your property taxes with the aid of a Property Tax Calculator by Zip Code. Property taxes are an essential component of owning real estate, and being well-informed can save you time, money, and potential headaches. This article will delve into the intricacies of property tax assessments, calculations, and how a zip code-based calculator can simplify the process for you.

The Significance of Property Taxes

Property taxes are a vital source of revenue for local governments, counties, and municipalities. These taxes contribute to the funding of essential services such as public schools, road maintenance, emergency services, and various community development projects. As a property owner, it’s crucial to understand your obligations and rights when it comes to property taxes.

The assessment and calculation of property taxes can vary significantly from one jurisdiction to another. Factors like the type of property, its location, improvements made, and local tax rates all play a role in determining the final tax liability. This complexity often leads property owners to seek out tools and resources that can provide accurate and timely information.

How a Property Tax Calculator Works

A Property Tax Calculator by Zip Code is an innovative online tool designed to provide property owners with an estimate of their potential tax liability based on their zip code. Here’s a breakdown of how these calculators function and the information they provide:

1. Data Collection

Property tax calculators gather data from various sources, including local government records, property assessment databases, and historical tax rate information. This data is essential for providing accurate estimates.

2. Property Value Estimation

The calculator uses algorithms to estimate the value of properties within a given zip code. This estimation considers factors such as recent sales in the area, property size, and improvements. The accuracy of this estimation is crucial for a precise tax calculation.

3. Tax Rate Application

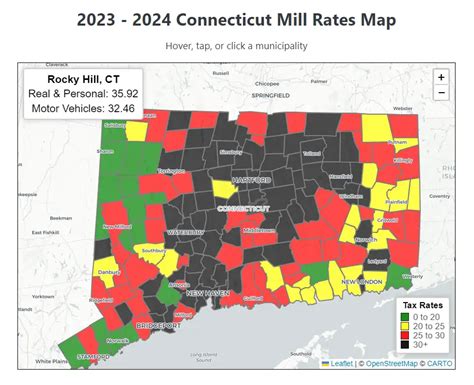

Once the property value is estimated, the calculator applies the relevant tax rates for that specific zip code. Tax rates can vary significantly, even within the same city, due to different taxing jurisdictions and their specific funding needs.

4. Calculation and Estimation

By combining the estimated property value and the applicable tax rate, the calculator provides an estimated tax liability for the property owner. This estimate serves as a valuable guide for property owners to plan their finances and understand their tax obligations.

5. Additional Features

Advanced property tax calculators often offer additional features such as historical tax rate comparisons, assessment history, and even projected tax liability based on potential future scenarios. These features enhance the calculator’s utility and provide property owners with a comprehensive view of their tax situation.

Benefits of Using a Property Tax Calculator

Utilizing a Property Tax Calculator by Zip Code offers several advantages to property owners, including:

- Convenience: Property tax calculators are easily accessible online, providing quick and convenient estimates without the need for property owners to navigate complex tax documents or visit government offices.

- Accuracy: These calculators use advanced algorithms and up-to-date data to provide accurate estimates, ensuring property owners have reliable information to work with.

- Planning: By knowing their estimated tax liability, property owners can better plan their finances, budget for tax payments, and make informed decisions regarding property improvements or investments.

- Comparison: Calculators allow property owners to compare their tax estimates with those of similar properties in their area, ensuring fairness and providing a basis for potential challenges if needed.

- Awareness: Property tax calculators keep owners informed about their tax obligations, helping them stay compliant with local tax laws and avoid potential penalties or late fees.

Potential Limitations and Considerations

While property tax calculators are powerful tools, it’s important to be aware of their limitations:

- Estimates: The estimates provided by calculators are just that - estimates. Actual tax liabilities may vary based on individual property characteristics and local tax assessments.

- Data Accuracy: The accuracy of the calculator's estimates relies on the quality and timeliness of the data it uses. Outdated or incorrect data can lead to inaccurate results.

- Local Variations: Tax laws and assessment practices can vary significantly from one jurisdiction to another, so it's essential to verify the calculator's results with local tax authorities or professionals.

- Tax Appeals: If a property owner disagrees with their assessed value or tax liability, they should consult with a tax professional or local authorities to understand the appeal process.

Real-World Applications

Property tax calculators have become invaluable tools for various stakeholders, including:

- Homeowners: For individuals purchasing a new home or assessing the financial implications of home improvements, property tax calculators provide essential insights into their potential tax obligations.

- Real Estate Investors: Investors can use these calculators to evaluate the financial viability of potential property acquisitions, especially when considering rental properties or multi-unit developments.

- Business Owners: Commercial property owners can estimate their tax liabilities, which is crucial for budgeting and understanding the financial health of their business.

- Local Governments: Governments and tax authorities can utilize these calculators to provide taxpayers with transparent and accessible information about their tax obligations.

Future Implications and Innovations

As technology advances, property tax calculators are likely to become even more sophisticated and accurate. Here are some potential future developments:

- Machine Learning: Advanced machine learning algorithms could enhance the accuracy of property value estimations, especially when coupled with high-resolution satellite imagery and data analytics.

- Blockchain Integration: Blockchain technology could provide secure and transparent record-keeping for property assessments, potentially reducing errors and enhancing data integrity.

- Real-Time Updates: Property tax calculators may integrate with local government databases to provide real-time updates on tax rates and assessments, ensuring users have the most current information.

- Personalized Recommendations: Calculators could offer personalized recommendations based on an individual's financial goals, helping them optimize their property investments and tax strategies.

Conclusion

A Property Tax Calculator by Zip Code is a valuable resource for property owners seeking to understand and manage their tax obligations effectively. By leveraging technology and data, these calculators provide accessible, accurate estimates that empower individuals and businesses to make informed decisions. As the real estate market continues to evolve, property tax calculators will remain essential tools for navigating the complex world of property taxes.

How often should I use a property tax calculator?

+It’s recommended to use a property tax calculator at least annually, especially when property values or tax rates may have changed. Additionally, consider using it whenever you make significant improvements to your property or are planning to sell or purchase a new property.

Are property tax calculators free to use?

+Many property tax calculators are available online for free. However, some advanced calculators or those offered by specialized tax services may have associated fees. Always check the terms and conditions before using a calculator.

Can I trust the estimates provided by property tax calculators?

+Property tax calculators provide reliable estimates based on accurate data and algorithms. However, it’s important to understand that they are estimates and may not reflect your exact tax liability. Always verify the results with local tax authorities or professionals for precise information.

What happens if my estimated tax liability is significantly higher or lower than my actual tax bill?

+If your estimated tax liability differs significantly from your actual tax bill, it’s essential to review your assessment and consult with local tax authorities. They can provide insights into any changes in your property’s assessed value or tax rates that might account for the difference.

Are there any alternatives to property tax calculators for estimating tax liability?

+Yes, alternatives include consulting with tax professionals, reviewing historical tax records, or utilizing tax estimation tools provided by local government websites. These methods can offer more personalized insights but may require more effort and research.