Stamford Taxes

When it comes to understanding and navigating the world of taxes, it's essential to delve into the specifics of different regions and jurisdictions. In this comprehensive guide, we will explore the intricate realm of Stamford Taxes, shedding light on the various aspects that impact individuals and businesses within this dynamic city. From property taxes to income tax structures, we will provide a detailed analysis to help you make informed decisions.

Unraveling the Complexity of Stamford’s Tax Landscape

Stamford, Connecticut, boasts a vibrant economy and a diverse population, making its tax system a fascinating subject to explore. The city’s tax policies are designed to support its growth while ensuring fairness and efficiency. Let’s break down the key components and shed light on the unique tax considerations within Stamford.

Property Taxes: A Cornerstone of Stamford’s Revenue

One of the primary sources of revenue for Stamford is its property tax system. With a diverse range of residential and commercial properties, the city relies heavily on property assessments to determine tax obligations. The mill rate, a crucial metric in property taxation, plays a significant role in Stamford’s tax structure.

The mill rate, expressed in mills per dollar, represents the tax rate per $1,000 of assessed property value. Stamford’s mill rate varies annually, influenced by factors such as the city’s budget requirements and the need to fund essential services like education, public safety, and infrastructure development.

| Year | Mill Rate (mills/dollar) |

|---|---|

| 2022 | 23.27 |

| 2021 | 22.90 |

| 2020 | 22.53 |

Income Taxes: Navigating the Stamford Earnings Landscape

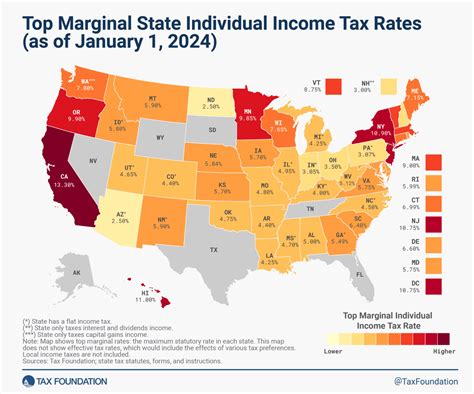

Stamford’s income tax structure is a crucial aspect for individuals and businesses alike. The city imposes a local income tax on earned income, with rates varying based on the taxpayer’s residency status.

For residents of Stamford, the income tax rate stands at 14.75%, while non-residents who work within the city limits are subject to a slightly lower rate of 8.90%. This differentiation is designed to promote fairness and ensure that those who reside in Stamford contribute proportionally to the city’s finances.

It’s worth noting that Stamford’s income tax structure operates alongside Connecticut’s state income tax, which has its own set of rates and brackets. Residents of Stamford must navigate both the local and state income tax systems, adding an extra layer of complexity to their tax obligations.

Sales and Use Taxes: Impact on Consumer Spending

Like many other jurisdictions, Stamford imposes sales and use taxes on the purchase of goods and services. These taxes contribute significantly to the city’s revenue stream and impact the daily lives of its residents and visitors.

The sales tax rate in Stamford, as mandated by the state of Connecticut, is 6.35%. This rate applies to most tangible personal property and certain services. However, it’s important to note that specific items, such as groceries and prescription drugs, are exempt from sales tax to alleviate the financial burden on essential goods.

Additionally, Stamford businesses must also consider use taxes, which are applicable when goods are purchased outside the state and brought into Stamford for use. This ensures that the city receives its fair share of tax revenue, regardless of where the purchase was made.

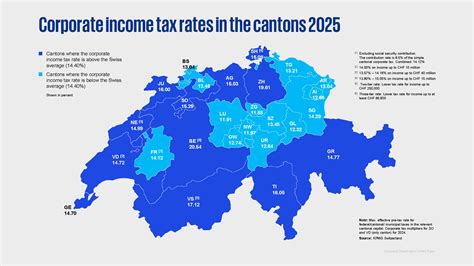

Business Taxes: Attracting and Supporting Enterprise

Stamford’s economic vitality is closely tied to its business-friendly tax environment. The city offers a range of incentives and tax structures to attract and support businesses, fostering a thriving entrepreneurial ecosystem.

For businesses operating within Stamford, the corporate income tax rate stands at 7.5%, which is applied to the net income of corporations. This rate is relatively competitive, positioning Stamford as an attractive destination for companies seeking to establish or expand their operations.

Furthermore, Stamford provides tax incentives for businesses that invest in the city’s growth and development. These incentives may include tax credits, abatements, or exemptions, depending on the nature of the business and its contribution to the local economy. Such measures aim to encourage job creation, promote innovation, and drive economic prosperity within Stamford.

Tax Credits and Exemptions: Unlocking Financial Benefits

Stamford’s tax landscape is not devoid of opportunities for tax relief. The city offers various tax credits and exemptions to eligible individuals and businesses, providing financial incentives and promoting specific objectives.

For instance, homeowners in Stamford may qualify for property tax exemptions based on factors such as age, disability, or military service. These exemptions reduce the taxable value of their properties, resulting in lower property tax obligations. Such initiatives not only provide financial support to vulnerable populations but also encourage homeownership and community stability.

Additionally, Stamford’s commitment to sustainable practices extends to its tax policies. The city offers tax credits for energy-efficient improvements to residential and commercial properties. By incentivizing the adoption of green technologies and practices, Stamford aims to reduce its carbon footprint while also providing financial benefits to its residents and businesses.

The Impact of Stamford’s Tax Policies on Economic Growth

Stamford’s tax system plays a pivotal role in shaping the city’s economic landscape. The careful balance of tax rates, incentives, and exemptions attracts businesses and investors, fostering a dynamic and prosperous environment.

The competitive corporate income tax rate, coupled with targeted tax incentives, encourages businesses to establish their headquarters or expand their operations within Stamford. This influx of businesses creates job opportunities, drives innovation, and boosts the local economy. As a result, Stamford experiences sustained economic growth, leading to improved infrastructure, enhanced public services, and a higher quality of life for its residents.

Conclusion: A Comprehensive Understanding of Stamford’s Taxes

In conclusion, Stamford’s tax system is a multifaceted and dynamic entity, designed to support the city’s growth while ensuring fairness and stability. From property taxes to income and business taxes, each component plays a crucial role in shaping the financial landscape of the city.

By providing a comprehensive guide to Stamford’s taxes, we aim to empower individuals and businesses with the knowledge they need to navigate this complex yet essential aspect of city life. Understanding the tax implications of residency, business operations, and investments in Stamford is key to making informed decisions and contributing to the city’s vibrant future.

How often are property tax assessments conducted in Stamford, and what is the process for appeals?

+

Property tax assessments in Stamford are conducted every five years. If you believe your property assessment is inaccurate, you have the right to appeal. The process involves submitting an appeal application and providing supporting documentation to the Board of Assessment Appeals. It’s advisable to consult with a tax professional or seek legal advice to ensure a successful appeal.

Are there any tax incentives for small businesses starting up in Stamford?

+

Yes, Stamford offers a range of tax incentives to support small businesses. These incentives may include tax credits, abatements, or exemptions based on factors such as job creation, investment in the community, or adoption of sustainable practices. It’s recommended to consult with the Stamford Economic Development Corporation or a tax professional to explore these opportunities.

What is the process for claiming tax credits for energy-efficient improvements in Stamford?

+

To claim tax credits for energy-efficient improvements, you must first ensure that your improvements meet the eligibility criteria set by Stamford. This may involve specific energy-saving technologies or practices. Once you’ve implemented the improvements, you can apply for the tax credit by submitting the necessary documentation to the city’s tax department. It’s advisable to consult with a tax professional to ensure you meet all the requirements.