Do American Indians Pay Taxes

Taxation laws and the unique legal status of American Indians and their tribal nations create a complex landscape when it comes to tax obligations. This article aims to demystify the tax system for American Indians, shedding light on their tax responsibilities, exemptions, and the broader implications of these laws.

Understanding Tax Exemptions for American Indians

American Indians, as members of federally recognized tribal nations, often enjoy certain tax exemptions due to their sovereign status. This is a legacy of treaties and agreements between the United States government and tribal nations, which recognize the inherent sovereignty of these tribes.

Tribal Sovereignty and Tax Exemptions

The foundation of tax exemptions for American Indians lies in the concept of tribal sovereignty. Tribal sovereignty grants tribes the power to govern themselves, manage their lands, and make their own laws, including tax laws. This means that members of these tribes may not be subject to certain state and local taxes, such as sales tax, income tax, and property tax on reservation lands.

| Tax Category | Exemption Status |

|---|---|

| Sales Tax | Exempt on reservation lands |

| Income Tax | Varies by tribe and individual circumstances |

| Property Tax | Exempt for tribal-owned properties |

However, it's important to note that the tax landscape is not a one-size-fits-all scenario. The tax obligations of American Indians can vary greatly depending on various factors, including the individual's residence, employment, and the specific laws and regulations of their tribe.

Income Tax: A Case of Individual Circumstances

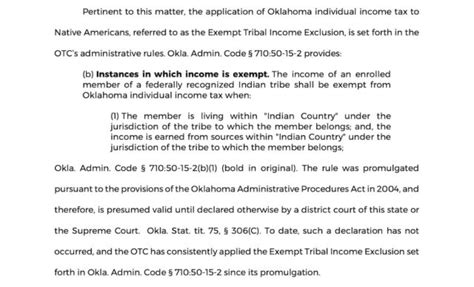

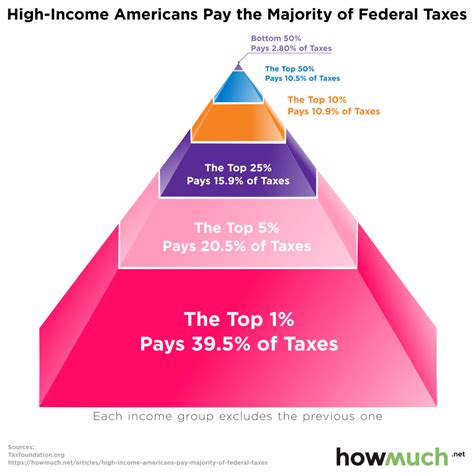

When it comes to income tax, the exemption is often misunderstood. While tribal members are generally exempt from paying state and local income taxes on reservation lands, they may still be subject to federal income tax. This is because federal tax laws apply to all U.S. citizens, regardless of tribal affiliation.

The exemption from state and local income taxes is a result of the McClanahan v. Arizona State Tax Commission ruling in 1973, which established that states cannot impose income taxes on tribal members living and working on reservation lands. However, this ruling doesn't exempt them from federal income tax, which is administered by the Internal Revenue Service (IRS) and applies to all U.S. citizens.

In practice, this means that an American Indian who earns income off the reservation or receives income from non-tribal sources, such as investments or rental properties, may still be required to pay federal income tax on that income.

Taxation on Reservation Lands

On reservation lands, the tax system is often quite different from the rest of the United States. Here’s a breakdown of the taxes typically levied and those that are often exempt:

Sales Tax

American Indians are generally exempt from sales tax on reservation lands. This exemption is a result of the tribes’ sovereign status, which allows them to set their own tax laws. Many tribes choose to impose their own sales tax, often at a lower rate than surrounding states, to generate revenue for tribal operations and services.

Property Tax

Property tax is another area where tribal sovereignty comes into play. Tribal members are often exempt from property tax on tribal lands. This exemption is significant, as property tax can be a substantial financial burden for homeowners. However, it’s important to note that this exemption typically applies only to tribal members who own property on reservation lands. Off-reservation properties may be subject to standard state and local property taxes.

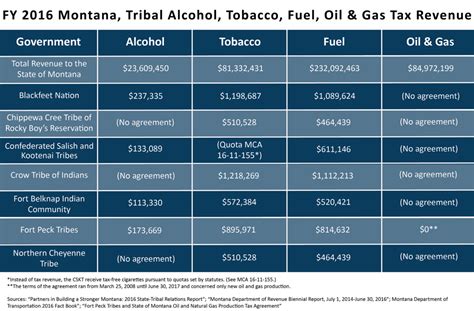

Federal Excise Taxes

Federal excise taxes, which are levied on specific goods like gasoline, tobacco, and alcohol, also apply to American Indians. These taxes are imposed by the federal government and are not tied to an individual’s tribal affiliation or residence. So, whether an American Indian is purchasing these goods on or off the reservation, they will likely be subject to federal excise taxes.

Employment and Tax Obligations

Employment status is a key factor in determining an American Indian’s tax obligations. Here’s a closer look at how employment impacts taxation:

Tribal Employment

Individuals employed by tribal governments or tribal enterprises are often exempt from state and local income taxes on their tribal earnings. This is because tribal governments, like state and local governments, have the authority to impose income taxes on their employees. However, tribal employees may still be subject to federal income tax, as well as Social Security and Medicare taxes.

Non-Tribal Employment

When an American Indian works for a non-tribal employer, whether on or off the reservation, their tax obligations change. In these cases, they are typically subject to the same tax laws as any other U.S. citizen. This means paying federal income tax, as well as state and local income taxes if applicable. Additionally, they will be subject to Social Security and Medicare taxes, just like any other employee.

The Future of Taxation for American Indians

The tax landscape for American Indians is complex and often evolving. As tribes continue to assert their sovereignty and engage in economic development, the tax system will likely see further changes and adaptations. Here are some potential future developments:

Tribal Tax Authorities

Some tribes have already established their own tax authorities, separate from state and federal agencies. These tribal tax authorities administer and enforce tribal tax laws, which can include income taxes, sales taxes, and property taxes. As more tribes establish their own tax systems, we may see a greater diversification of tax structures and rates across Indian Country.

Treaty Rights and Taxation

Many tribes have historical treaties with the federal government that outline their sovereign rights and privileges. These treaties often include provisions related to taxation, and as these treaties are re-examined and re-interpreted, we may see shifts in the tax obligations of tribal members. For instance, some treaties may provide for additional tax exemptions or benefits that have yet to be fully realized.

Economic Development and Tax Incentives

Tribal nations are increasingly engaged in economic development efforts, such as the establishment of tribal enterprises and the attraction of outside investment. As these initiatives gain traction, we may see the implementation of tax incentives to encourage further growth. This could include tax breaks for businesses operating on tribal lands or tax credits for individuals investing in tribal enterprises.

Conclusion

The tax system for American Indians is a unique and evolving aspect of U.S. taxation. While certain exemptions exist due to tribal sovereignty, the tax obligations of American Indians can vary widely based on their individual circumstances, employment status, and tribal affiliation. As tribal nations continue to assert their sovereign rights and engage in economic development, the tax landscape will likely continue to adapt and change, offering both challenges and opportunities for tribal members and their communities.

Are American Indians exempt from all taxes?

+No, American Indians are not exempt from all taxes. While they enjoy certain exemptions due to tribal sovereignty, they are still subject to federal income tax, federal excise taxes, and other federal obligations. Additionally, they may be subject to state and local taxes if they work or reside off the reservation or own property off the reservation.

Do American Indians pay state income tax on reservation lands?

+Generally, American Indians are exempt from state and local income taxes on reservation lands. This exemption is a result of the McClanahan v. Arizona State Tax Commission ruling. However, they may still be subject to federal income tax, as well as other federal obligations.

Are there any tribal taxes on reservation lands?

+Yes, many tribes have established their own tax systems, which may include income taxes, sales taxes, and property taxes. These taxes are imposed by the tribal government and are separate from state and federal taxes.