Ga Ad Valorem Tax Estimator

Welcome to the ultimate guide to understanding and utilizing the Ga Ad Valorem Tax Estimator, a powerful tool designed to simplify the process of estimating property taxes in the state of Georgia. As a homeowner or real estate investor in Georgia, it's crucial to have a clear understanding of your tax obligations. The Ga Ad Valorem Tax Estimator serves as an invaluable resource, providing accurate estimates and valuable insights into your potential tax liabilities. In this comprehensive article, we will delve into the intricacies of this estimator, exploring its features, benefits, and real-world applications.

Unraveling the Ga Ad Valorem Tax Estimator

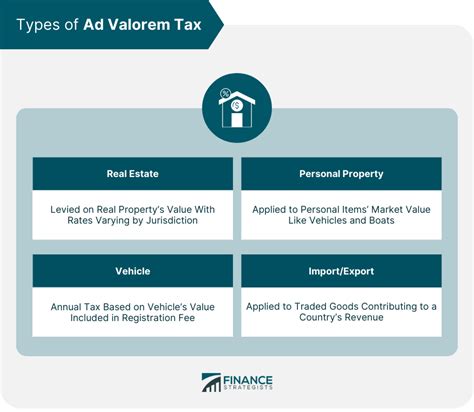

The Ga Ad Valorem Tax Estimator is an innovative online tool developed by the Georgia Department of Revenue to assist property owners in estimating their annual property taxes. Ad Valorem, derived from Latin, translates to “according to value,” and this term aptly describes the nature of this tax, which is based on the assessed value of a property.

The estimator takes into account various factors, including the location of the property, its assessed value, and the applicable tax rates set by local governments. By providing users with a user-friendly interface and a comprehensive database of tax information, the Ga Ad Valorem Tax Estimator empowers individuals to make informed decisions regarding their property tax obligations.

Key Features and Benefits

The Ga Ad Valorem Tax Estimator offers a multitude of features and benefits that make it an indispensable tool for property owners and investors:

- Accuracy: The estimator utilizes official tax rates and assessment data, ensuring that the estimated taxes are as accurate as possible. This accuracy is vital for financial planning and budgeting purposes.

- User-Friendly Interface: Designed with ease of use in mind, the estimator’s interface is intuitive and straightforward. Users can navigate through the process seamlessly, entering their property details and receiving estimates without any complexities.

- Real-Time Updates: The tool is regularly updated with the latest tax rates and assessment information, providing users with up-to-date estimates. This real-time aspect is crucial, especially during periods of fluctuating property values.

- Multiple Property Support: Whether you own one property or manage a portfolio of investments, the Ga Ad Valorem Tax Estimator accommodates various scenarios. It allows users to estimate taxes for multiple properties simultaneously, saving time and effort.

- Historical Data Analysis: The estimator provides access to historical tax data, enabling users to analyze trends and make comparisons. This feature is particularly beneficial for assessing the long-term financial implications of property ownership.

A Real-World Scenario

Let’s illustrate the practical application of the Ga Ad Valorem Tax Estimator with a real-world example. Imagine you are a homeowner in Atlanta, Georgia, and you recently received a property assessment indicating a significant increase in your home’s value. Concerned about the potential impact on your tax obligations, you decide to utilize the Ga Ad Valorem Tax Estimator to gain insights.

You input your property's details, including its new assessed value, and the estimator provides you with an estimated tax liability for the upcoming year. This estimate takes into account the specific tax rates applicable to your neighborhood and any relevant exemptions or discounts. Armed with this information, you can now make informed decisions regarding your financial planning and potentially explore options to mitigate the tax impact.

| Property Location | Assessed Value | Estimated Taxes |

|---|---|---|

| Atlanta, GA | $350,000 | $3,200 |

Navigating the Estimator Process

To maximize the benefits of the Ga Ad Valorem Tax Estimator, it’s essential to understand the step-by-step process of utilizing this tool effectively:

- Access the Estimator: Visit the official Georgia Department of Revenue website and locate the Ga Ad Valorem Tax Estimator tool. It is typically easily accessible and prominently displayed on the homepage.

- Input Property Details: Begin by entering the necessary information about your property, including its address, assessed value, and any relevant exemptions or deductions. Ensure that the data is accurate and up-to-date.

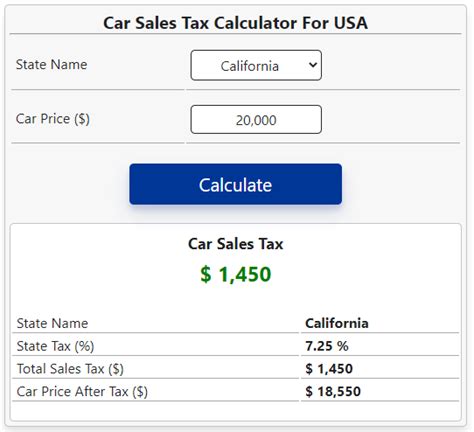

- Review Tax Rates: The estimator will display the applicable tax rates for your property’s location. Take the time to understand these rates and how they are calculated. This information is crucial for interpreting your estimated taxes accurately.

- Estimate Generation: Once you have provided all the required details, the estimator will generate an estimated tax liability for your property. Review this estimate carefully and consider any potential adjustments or appeals if necessary.

- Compare and Analyze: If you own multiple properties or are exploring investment opportunities, use the estimator to compare tax liabilities across different locations. This analysis can help you make strategic decisions regarding property acquisitions or management.

Future Implications and Considerations

As you utilize the Ga Ad Valorem Tax Estimator, it’s important to keep in mind the broader implications and considerations associated with property taxes in Georgia:

- Local Government Policies: Tax rates and assessment practices can vary significantly between different counties and municipalities in Georgia. Stay informed about local government policies and any potential changes that may impact your tax obligations.

- Assessment Appeals: If you believe your property’s assessed value is inaccurate, you have the right to appeal. Understanding the assessment process and your options for appeal is crucial for ensuring fair taxation.

- Tax Incentives and Exemptions: Georgia offers various tax incentives and exemptions, such as homestead exemptions and tax credits for certain property types. Explore these opportunities to potentially reduce your tax burden.

- Long-Term Financial Planning: Property taxes are a significant component of your overall financial obligations. By using the Ga Ad Valorem Tax Estimator regularly, you can incorporate accurate tax estimates into your long-term financial planning and budgeting processes.

Frequently Asked Questions

How often should I use the Ga Ad Valorem Tax Estimator?

+It is recommended to use the estimator annually, especially after receiving your property assessment. This ensures that you have the most up-to-date estimates and can plan accordingly.

Are the estimates provided by the estimator 100% accurate?

+While the estimator strives for accuracy, actual tax assessments may vary based on individual circumstances and local government decisions. It is a valuable tool for estimates, but it is important to review official tax notices for the final assessment.

Can I estimate taxes for commercial properties using this tool?

+Yes, the Ga Ad Valorem Tax Estimator is applicable to both residential and commercial properties. Simply input the relevant details for your commercial property to generate an estimate.

What if I have multiple properties in different counties in Georgia?

+The estimator allows you to input and estimate taxes for multiple properties. You can easily manage and compare tax liabilities for properties across different counties in Georgia.

Is there a mobile app version of the Ga Ad Valorem Tax Estimator?

+Currently, there is no dedicated mobile app for the estimator. However, the online tool is optimized for mobile devices, allowing you to access and use it conveniently on your smartphone or tablet.

The Ga Ad Valorem Tax Estimator stands as a testament to Georgia’s commitment to transparency and accessibility in property taxation. By harnessing the power of this tool, property owners and investors can navigate the complexities of property taxes with confidence and make informed decisions. Remember, while the estimator provides valuable estimates, it is always advisable to consult official tax notices and seek professional advice for comprehensive tax planning.