Sales Tax For Cars In California

When purchasing a car in California, understanding the sales tax implications is crucial. Sales tax is an essential component of the car-buying process, and its application can significantly impact the overall cost of your vehicle. In this comprehensive guide, we will delve into the specifics of sales tax for cars in California, covering everything from tax rates to exemptions and providing you with valuable insights to navigate this aspect of car ownership.

Understanding California’s Sales Tax Structure

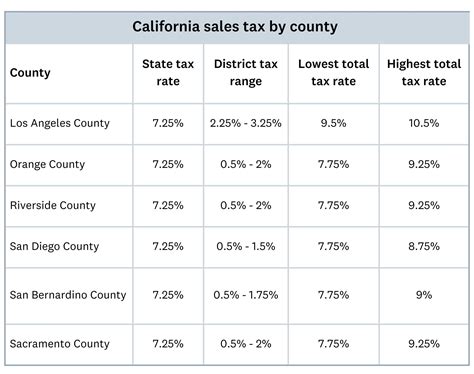

California’s sales tax system is relatively straightforward but varies based on the location of the sale and the type of vehicle being purchased. The state imposes a base sales tax rate, but local jurisdictions, including cities and counties, can add additional taxes, creating a complex landscape of tax rates across the state.

The base sales tax rate in California is currently set at 7.25%, which applies uniformly across the state. However, this is not the only tax you might encounter when buying a car. Local governments have the authority to levy additional taxes, known as local option taxes, which can further increase the overall sales tax burden.

| Tax Category | Rate |

|---|---|

| Base Sales Tax | 7.25% |

| Local Option Taxes | Varies by Location |

Local Option Taxes: A Variable Factor

Local option taxes are a significant consideration when purchasing a car in California. These taxes are determined by the city or county where the sale takes place and can add a considerable percentage to the base sales tax rate. For instance, in San Francisco, the local option tax is 1.25%, bringing the total sales tax rate to 8.5%. On the other hand, in Los Angeles County, the local option tax is 2%, resulting in a total sales tax rate of 9.25%.

To illustrate the impact of these local variations, consider the following example: If you were to purchase a car priced at $30,000 in San Francisco, you would pay a sales tax of $2,250 (7.5% of $30,000), while in Los Angeles County, the same purchase would result in a sales tax of $2,775 (9.25% of $30,000). This highlights the importance of considering not just the base sales tax rate but also the local option taxes when budgeting for your car purchase.

Calculating Sales Tax for Your Car Purchase

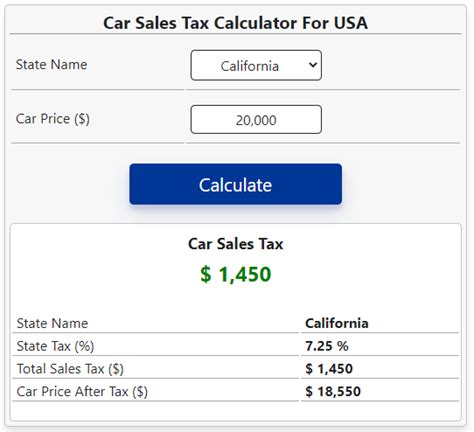

Calculating the sales tax for your car purchase in California involves a simple formula: Multiply the purchase price of the vehicle by the applicable sales tax rate, which includes both the base rate and any local option taxes. Let’s break down this calculation step by step.

Step 1: Determine the Base Sales Tax Rate

As mentioned earlier, the base sales tax rate in California is 7.25%. This rate is set by the state and applies universally.

Step 2: Consider Local Option Taxes

The next step is to factor in any local option taxes that may apply to your purchase. These taxes vary based on your location, so it’s essential to research the specific tax rates for your city or county. For example, if you’re buying a car in San Diego, you’ll need to add the local option tax rate to the base rate.

Step 3: Calculate the Total Sales Tax

To find the total sales tax you’ll owe, simply add the base sales tax rate to the local option tax rate (if applicable). This gives you the combined sales tax rate for your purchase.

Now, multiply the combined sales tax rate by the purchase price of your vehicle. This calculation will provide you with the exact amount of sales tax you need to pay when finalizing your car purchase.

For instance, if you're buying a car priced at $40,000 in San Diego, where the local option tax rate is 1%, the calculation would be as follows:

Combined Sales Tax Rate: 7.25% (base rate) + 1% (local option tax) = 8.25%

Sales Tax Amount: $40,000 (purchase price) x 8.25% (combined rate) = $3,300

So, in this example, you would owe $3,300 in sales tax for your $40,000 car purchase in San Diego.

Exemptions and Special Considerations

While most car purchases in California are subject to sales tax, there are certain situations where exemptions or special considerations apply. It’s crucial to be aware of these scenarios to ensure you’re not overpaying or missing out on potential savings.

Vehicle Trade-Ins

When trading in your old vehicle as part of a new car purchase, the sales tax calculation can be more complex. California law allows for a trade-in credit, which reduces the taxable value of your new vehicle. The trade-in credit is calculated based on the trade-in value of your old car, effectively lowering the purchase price and, consequently, the sales tax owed.

For example, if you trade in a vehicle valued at $10,000 towards the purchase of a new car priced at $40,000, the taxable value of the new car would be $30,000 ($40,000 - $10,000). This reduced taxable value will directly impact the sales tax calculation, potentially saving you a significant amount.

Military Personnel and Veterans

Active-duty military personnel and veterans are entitled to certain tax exemptions when purchasing vehicles in California. Under the Military Exemption, eligible individuals can claim a sales tax exemption on vehicles purchased for personal use. This exemption applies to both new and used vehicles and can provide substantial savings.

To claim the Military Exemption, you must provide valid military identification and complete the necessary paperwork at the time of purchase. It's important to note that this exemption only applies to personal vehicle purchases and does not extend to commercial vehicles or those used for business purposes.

Disabled Individuals

California offers a Disabled Persons Sales and Use Tax Exemption for individuals with qualifying disabilities. This exemption applies to the purchase of vehicles specifically modified to accommodate the disability. To be eligible, individuals must obtain a disability certificate from the Department of Motor Vehicles (DMV) and present it at the time of purchase.

The exemption covers the sales tax on the modified vehicle and any related modifications, providing a significant financial benefit for individuals with disabilities. It's worth noting that this exemption does not extend to the purchase of non-modified vehicles or vehicles used for non-disability-related purposes.

Tips for Minimizing Sales Tax Burden

While sales tax is an inevitable part of car ownership in California, there are strategies you can employ to minimize the financial impact. Here are some practical tips to help you navigate the sales tax landscape and potentially save money on your next car purchase.

Shop Around for the Best Deal

Sales tax rates can vary significantly between cities and counties in California. By researching and comparing prices across different dealerships and locations, you may find opportunities to save on sales tax. For example, if you’re flexible with your purchase location, you could consider buying your car in a city or county with a lower sales tax rate.

Utilize Online Calculators

Numerous online resources offer sales tax calculators specifically tailored to California’s tax structure. These calculators allow you to input your vehicle’s purchase price and location to estimate the sales tax you’ll owe. Using these tools can help you budget accurately and compare the total cost of purchasing a car in different areas.

Consider Financing Options

Financing your car purchase can provide an opportunity to spread out the sales tax cost over time. Many dealerships offer financing plans that allow you to include the sales tax in your monthly payments. While this may increase the overall cost of financing, it can make the initial purchase more manageable and provide flexibility in your budget.

Negotiate with Dealerships

Don’t be afraid to negotiate with dealerships to find the best possible deal. While sales tax is a fixed cost, there may be room for negotiation on the purchase price of the vehicle itself. By negotiating a lower price, you can effectively reduce the sales tax amount you’ll owe. Remember, dealerships want to make sales, so be assertive and aim for the best possible outcome.

Future Implications and Changes

The landscape of sales tax for cars in California is subject to change over time. While the base sales tax rate is relatively stable, local option taxes and various exemptions can be subject to legislative modifications. Staying informed about any potential changes is crucial to ensure you’re prepared for any adjustments to the sales tax system.

Additionally, technological advancements and the shift towards electric and hybrid vehicles may introduce new considerations in the sales tax landscape. As California continues to promote sustainable transportation options, the tax structure may evolve to accommodate these changes. Keeping an eye on industry trends and governmental policies can help you anticipate and adapt to any future alterations in sales tax regulations.

Conclusion

Understanding the intricacies of sales tax for cars in California is an essential step towards a well-informed car-buying experience. By familiarizing yourself with the base sales tax rate, local option taxes, and available exemptions, you can make more confident financial decisions. Remember to research, compare prices, and explore financing options to minimize the sales tax burden and find the best deal on your next car purchase.

How often do sales tax rates change in California?

+Sales tax rates in California are relatively stable, but local option taxes can change periodically. It’s recommended to check with your local government or tax authorities for the most up-to-date information on any changes.

Are there any sales tax holidays in California for car purchases?

+California does not currently have specific sales tax holidays for car purchases. However, there may be promotional events or deals offered by dealerships or manufacturers, so it’s worth keeping an eye out for those opportunities.

Can I deduct sales tax on my car purchase from my taxes?

+In most cases, sales tax on car purchases is not deductible for federal income tax purposes. However, there may be specific circumstances or tax credits available for certain individuals. It’s advisable to consult with a tax professional to determine your eligibility.