Md Tax Rate

Welcome to this comprehensive guide on the Maryland Tax Rate, an essential aspect of financial planning for individuals and businesses operating within the state of Maryland. In this expert-driven analysis, we will delve into the intricacies of Maryland's tax structure, offering a detailed breakdown of tax rates, categories, and implications. Whether you're a resident, a business owner, or simply curious about Maryland's tax landscape, this article will provide you with the insights and knowledge you need to navigate this complex yet vital topic.

Understanding Maryland’s Tax System

Maryland, like many states, employs a comprehensive tax system to generate revenue for various state functions and services. This system is designed to balance the needs of the government with the economic realities of its residents and businesses. Understanding this system is crucial for making informed financial decisions and ensuring compliance with state regulations.

The State’s Tax Structure

Maryland’s tax system is composed of a range of taxes, each designed to target specific aspects of economic activity. These taxes include income taxes, sales taxes, property taxes, and various other levies. Each of these tax categories serves a unique purpose and contributes to the overall fiscal health of the state.

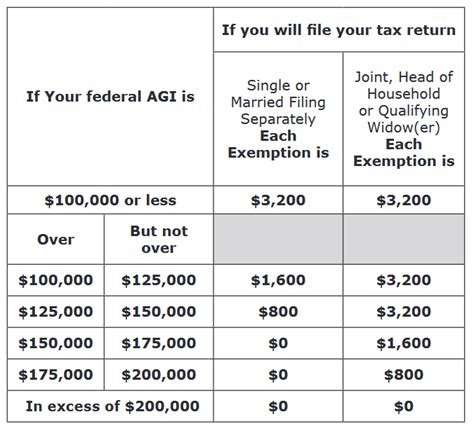

One of the key features of Maryland's tax system is its progressive income tax structure. This means that as an individual's income increases, so does the tax rate applied to that income. This approach aims to ensure that those with higher earning capacities contribute a greater share of their income to state revenues. In contrast, those with lower incomes are taxed at a lower rate, reflecting the state's commitment to economic fairness.

| Income Bracket | Tax Rate |

|---|---|

| $0 - $1,000 | 2.00% |

| $1,001 - $3,000 | 3.00% |

| $3,001 - $4,000 | 4.75% |

| Over $4,000 | 6.25% |

Income Tax Rates

The income tax is a significant component of Maryland’s tax revenue. The state imposes a progressive tax system, which means that the tax rate increases as your income rises. This progressive structure ensures that higher-income earners contribute a larger share of their income to state coffers. For the 2023 tax year, the Maryland income tax brackets and rates are as follows:

| Income Bracket | Tax Rate |

|---|---|

| $0 - $1,000 | 2.0% |

| $1,001 - $3,000 | 3.0% |

| $3,001 - $4,000 | 4.75% |

| $4,001 and above | 5.75% |

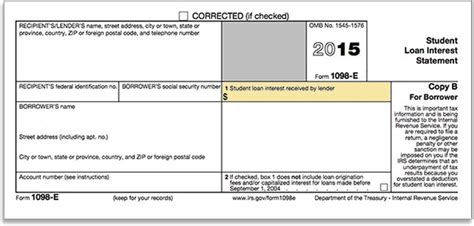

These rates are applicable to Maryland residents and non-residents who earn income within the state. It's crucial to understand that the income brackets are cumulative, meaning that if your income falls within multiple brackets, you'll pay the corresponding tax rate for each bracket your income falls into.

Sales and Use Tax

In addition to income taxes, Maryland also imposes a Sales and Use Tax on the sale of goods and certain services. This tax is collected at the point of sale and is often included in the displayed price of an item. The current sales tax rate in Maryland is 6%, which is applicable to most goods and some services. However, there are certain exceptions and exemptions, such as groceries and prescription drugs, which are not subject to the sales tax.

Maryland also has a Use Tax, which is similar to a sales tax but applies to purchases made outside the state but used within Maryland. This ensures that individuals and businesses are not avoiding taxes by purchasing goods in states with lower tax rates.

Property Tax

Property owners in Maryland are subject to a Property Tax, which is levied on the assessed value of their real estate. This tax is used to fund local services such as schools, police, and fire departments. The property tax rate varies by jurisdiction within Maryland, with each county and municipality setting its own rate. On average, the property tax rate in Maryland is around 1.1% of the assessed value, but it’s important to check with your local tax assessor’s office for the precise rate in your area.

Other Taxes

Maryland, like many states, has a range of other taxes to support specific programs and services. These include:

- Excise Taxes: These are taxes on specific goods and services, such as tobacco, alcohol, and fuel.

- Corporate Income Tax: Businesses operating in Maryland are subject to a corporate income tax, which is calculated based on their net income.

- Estate and Inheritance Taxes: These taxes are applied to the transfer of property upon an individual's death.

- Vehicle Taxes: Maryland imposes taxes on the purchase and ownership of vehicles, including registration fees and titling fees.

Tax Incentives and Credits

Maryland offers various tax incentives and credits to encourage economic growth, support specific industries, and assist certain populations. These incentives can significantly reduce a taxpayer’s liability and should be considered when planning tax strategies.

Business Tax Incentives

Maryland provides a range of incentives to attract and support businesses. These include:

- Enterprise Zones: Designated areas within the state offer reduced tax rates and other incentives to encourage business development.

- Research and Development Tax Credits: Businesses engaged in research and development activities may be eligible for tax credits, reducing their overall tax liability.

- Job Creation Tax Credits: Companies that create new jobs in the state may be eligible for tax credits, supporting Maryland's employment goals.

Personal Tax Credits

Maryland also offers tax credits to individuals to support various initiatives. Some of these credits include:

- Property Tax Credit for the Elderly and Disabled: This credit reduces the property tax burden for eligible seniors and individuals with disabilities.

- Homestead Tax Credit: This credit provides a reduction in property taxes for homeowners, helping to make homeownership more affordable.

- Earned Income Tax Credit: A refundable tax credit for low- to moderate-income workers, helping to offset the burden of state taxes.

Filing and Payment Procedures

Understanding the filing and payment procedures is crucial to ensure timely and accurate tax compliance. Maryland provides various options for filing and paying taxes, catering to the needs of different taxpayers.

Online Filing and Payment

Maryland offers an online platform, My Maryland Taxes, which allows taxpayers to file their returns and make payments electronically. This platform is secure, efficient, and offers real-time updates on tax obligations and refunds. Taxpayers can also set up direct deposit for their refunds, ensuring faster and more secure transactions.

Paper Filing and Payment

For those who prefer traditional methods, Maryland accepts paper filing of tax returns. Taxpayers can download and print the appropriate forms from the Maryland Comptroller’s website, fill them out, and mail them along with any necessary documentation and payment to the designated address.

Payment Options

Maryland offers several payment options to cater to different financial situations. These include:

- Credit Card or Debit Card: Taxpayers can use their credit or debit cards to make payments online or over the phone.

- Electronic Funds Transfer (EFT): This method allows for the direct transfer of funds from a taxpayer's bank account to the state's account.

- Check or Money Order: Traditional payment methods are also accepted and can be mailed along with the tax return.

Tax Planning and Compliance

Effective tax planning is crucial to ensure that individuals and businesses optimize their tax strategies while remaining compliant with state regulations. Maryland provides resources and guidance to help taxpayers navigate the complex world of tax compliance.

Resources for Taxpayers

The Maryland Comptroller’s Office offers a wealth of resources to assist taxpayers. These include:

- Tax Guides and Publications: Comprehensive guides and publications are available online, covering various tax topics and providing step-by-step instructions for filing and paying taxes.

- Taxpayer Assistance: The Comptroller's Office provides assistance through various channels, including phone, email, and in-person appointments at local offices.

- Online Tools and Calculators: Interactive tools and calculators help taxpayers estimate their tax liabilities and understand the impact of different tax scenarios.

Compliance and Audits

Maryland takes tax compliance seriously and may conduct audits to ensure taxpayers are accurately reporting their income and paying the correct amount of tax. If an audit is initiated, it’s important to cooperate fully with the Comptroller’s Office and provide all requested documentation in a timely manner.

Tax Policy and Future Developments

Maryland’s tax policy is an evolving landscape, with ongoing discussions and potential changes to the tax structure. Understanding these developments is crucial for taxpayers to adapt their strategies and stay informed about potential impacts.

Recent Tax Policy Changes

In recent years, Maryland has implemented several tax policy changes, including:

- Income Tax Reform: Maryland has been gradually reducing income tax rates for certain brackets, making the tax system more competitive with neighboring states.

- Sales Tax Exemptions : The state has expanded sales tax exemptions for certain goods and services, reducing the tax burden on specific industries and consumers.

- Property Tax Assessments: Changes in property tax assessment procedures have been implemented to ensure fairness and accuracy in property valuations.

Future Tax Policy Prospects

Looking forward, Maryland’s tax policy is likely to continue evolving. Potential areas of focus include:

- Tax Simplification: Efforts to simplify the tax code and reduce complexities that may hinder compliance and understanding.

- Tax Equity: Discussions around ensuring the tax system remains equitable, particularly in light of changing economic landscapes and societal needs.

- Revenue Generation: With ongoing state budget considerations, there may be discussions around new tax initiatives or adjustments to existing tax rates to generate additional revenue.

Conclusion

In conclusion, understanding the Maryland Tax Rate is a critical aspect of financial planning and compliance for individuals and businesses. With a progressive income tax, sales tax, property tax, and a range of other taxes, Maryland’s tax system is designed to support the state’s operations and services. By leveraging tax incentives, staying informed about tax procedures, and planning strategically, taxpayers can optimize their tax strategies and contribute effectively to the state’s fiscal health.

What is the current Maryland income tax rate for 2023?

+

For the 2023 tax year, the Maryland income tax rates range from 2.0% for the lowest income bracket to 5.75% for the highest income bracket. These rates are subject to change, so it’s important to verify the current rates with the Maryland Comptroller’s Office.

Are there any tax incentives for businesses in Maryland?

+

Yes, Maryland offers various tax incentives to attract and support businesses. These include Enterprise Zones with reduced tax rates, Research and Development Tax Credits, and Job Creation Tax Credits. These incentives aim to encourage economic growth and job creation.

How can I pay my Maryland taxes online?

+

You can pay your Maryland taxes online through the My Maryland Taxes platform. This secure platform allows you to file your tax returns electronically and make payments using various methods, including credit/debit card, electronic funds transfer (EFT), or direct deposit for refunds.

What happens if I don’t file my Maryland taxes on time?

+

Failing to file your Maryland taxes on time can result in penalties and interest charges. It’s important to file your taxes by the deadline to avoid these additional costs and maintain compliance with state regulations. If you cannot file by the deadline, consider applying for an extension to avoid penalties.