Sales Tax Nd

In the complex world of taxation, sales tax emerges as a crucial component, impacting businesses and consumers alike. This comprehensive guide delves into the intricacies of sales tax, specifically focusing on the nuances of the Sales Tax Nd system, an essential aspect of modern commerce.

Understanding Sales Tax Nd

Sales Tax Nd, or Northern Dakota Sales Tax, is a critical component of the taxation framework in the state of Northern Dakota, USA. It is a consumption tax levied on the sale of goods and services within the state, playing a pivotal role in the state’s revenue generation.

This tax system is designed to ensure a fair and equitable distribution of tax burdens, contributing significantly to the state's financial stability and infrastructure development. Sales Tax Nd, like other sales taxes, is collected at the point of sale, making it an essential consideration for both retailers and consumers.

Key Features of Sales Tax Nd

-

Statewide Application: Sales Tax Nd is a statewide tax, applicable to all retail sales within Northern Dakota. This uniformity ensures a level playing field for businesses and simplifies tax compliance for both residents and visitors.

-

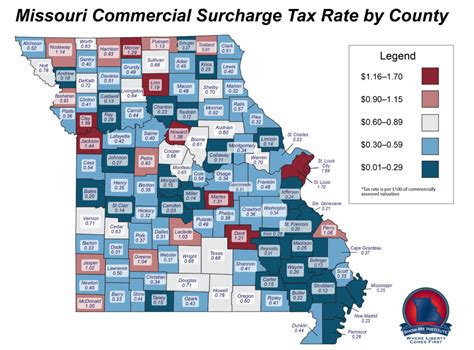

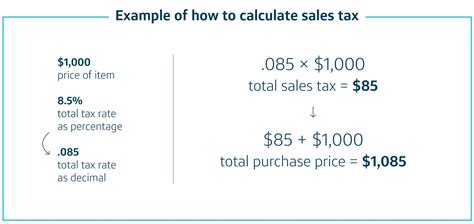

Tax Rates: The sales tax rate in Northern Dakota varies depending on the county. For instance, in Fargo, the tax rate is 7.5%, while in Grand Forks, it stands at 7%. These rates are inclusive of both state and local sales taxes, with the state tax rate fixed at 5% and the remaining portion allocated to local governments.

-

Exemptions: Certain goods and services are exempt from Sales Tax Nd. These include most groceries, prescription drugs, and medical devices. Additionally, non-prepared food items, such as raw meat, produce, and baked goods, are also exempt from sales tax.

-

Collection and Remittance: Retailers are responsible for collecting Sales Tax Nd from customers at the point of sale. They must then remit these taxes to the state, usually on a monthly or quarterly basis, depending on the business’s tax liability.

| County | Sales Tax Rate |

|---|---|

| Fargo | 7.5% |

| Grand Forks | 7% |

| Bismarck | 6.5% |

Compliance and Registration

Compliance with Sales Tax Nd is a critical aspect for businesses operating in Northern Dakota. To ensure compliance, businesses must register with the Northern Dakota Office of State Tax Commissioner, obtain a sales tax permit, and collect and remit sales tax accurately and timely.

The registration process involves submitting relevant business information, including the business's legal name, physical address, and federal tax identification number. Once registered, businesses receive a unique sales tax permit number, which must be displayed at all retail locations.

Filing and Remittance

Sales tax returns in Northern Dakota are due on the 20th day of the month following the end of the reporting period. For instance, sales taxes collected in January must be filed and remitted by February 20th. Late filings may incur penalties and interest charges.

Businesses have the option to file sales tax returns electronically through the Northern Dakota Tax & Information Payment System (NTIPS), a secure online platform designed for tax compliance. This system allows for efficient tax management, providing real-time updates on tax obligations and payments.

Impact on Businesses and Consumers

Sales Tax Nd has a significant impact on both businesses and consumers in Northern Dakota. For businesses, especially retailers, Sales Tax Nd is a critical consideration in pricing strategies and financial planning. It influences profit margins, cash flow, and overall financial health.

From a consumer perspective, Sales Tax Nd adds to the final cost of goods and services. Understanding this tax is essential for making informed purchasing decisions and budgeting effectively. Consumers in Northern Dakota are accustomed to seeing sales tax as a separate line item on their receipts, providing transparency in pricing.

Price Transparency and Awareness

The implementation of Sales Tax Nd promotes price transparency, as businesses are required to display the tax separately on receipts. This practice educates consumers about the tax and ensures they are aware of the total cost of their purchases. It also fosters a culture of financial literacy, enabling consumers to make more informed choices.

Future Implications and Potential Reforms

As with any tax system, Sales Tax Nd is subject to ongoing evaluation and potential reforms. The state’s changing economic landscape, demographic shifts, and technological advancements may prompt revisions to the tax structure, rates, or exemptions.

For instance, with the rise of e-commerce, the state may consider implementing sales tax on online transactions, ensuring a level playing field for brick-and-mortar retailers. Additionally, changes in consumer behavior and spending patterns may also influence the need for tax reforms.

Furthermore, the state may explore the possibility of simplifying the tax structure, potentially reducing the number of tax rates or standardizing rates across counties. Such reforms could enhance tax compliance, reduce administrative burdens, and improve overall tax fairness.

Conclusion

Sales Tax Nd is an integral part of Northern Dakota’s taxation landscape, contributing significantly to the state’s revenue and financial stability. Understanding this tax system is crucial for both businesses and consumers, as it impacts pricing, profit margins, and purchasing decisions.

With ongoing evaluations and potential reforms, Sales Tax Nd is poised to adapt to the evolving economic landscape, ensuring a sustainable and equitable tax system for all stakeholders.

How often do businesses need to file Sales Tax Nd returns?

+Businesses in Northern Dakota typically file Sales Tax Nd returns on a monthly or quarterly basis, depending on their tax liability. However, they must ensure timely filing to avoid penalties and interest charges.

Are there any online tools available for Sales Tax Nd compliance?

+Yes, the Northern Dakota Office of State Tax Commissioner provides the NTIPS platform, which offers a user-friendly interface for registering, filing returns, and making payments. This online tool simplifies tax compliance and provides real-time updates.

What happens if a business fails to collect and remit Sales Tax Nd?

+Failure to collect and remit Sales Tax Nd can result in penalties, interest charges, and potential legal consequences. It is essential for businesses to understand their tax obligations and comply with the state’s tax laws to avoid such issues.

Are there any ongoing discussions about Sales Tax Nd reforms?

+Yes, the state of Northern Dakota is continuously evaluating its tax structure, including Sales Tax Nd. Potential reforms may include changes in tax rates, exemptions, or the implementation of new taxes to adapt to the evolving economic landscape.