How To Calculate Taxes On Tips

In the world of service industries, tips play a significant role in supplementing the income of workers, particularly in sectors such as food service, hospitality, and personal services. However, the earnings from tips are not exempt from taxation. In this comprehensive guide, we will delve into the intricacies of calculating taxes on tips, providing you with a clear understanding of the process and ensuring you stay compliant with tax regulations.

Understanding the Importance of Tip Reporting

Tips are a vital part of the service industry’s culture, providing an incentive for excellent service and offering a much-needed boost to the incomes of service workers. However, from a tax perspective, tips are considered earnings and are therefore subject to income tax, social security, and Medicare contributions, just like any other form of income.

Failing to accurately report tip earnings can lead to significant penalties and legal consequences. It is crucial for service workers to understand their tax obligations and ensure they report their tips honestly and accurately. This guide aims to provide a comprehensive overview of the process, helping you navigate the complexities of tip taxation.

Determining Tipped Income and Reporting Methods

Tipped income is the amount received by an employee from customers as tips, in addition to their regular wages. The Internal Revenue Service (IRS) requires employees to report all tip income to their employer, who will then include it in their taxable income for the year.

There are two primary methods for reporting tips: the actual tip reporting method and the tip allocation method. Let's explore each of these in more detail.

Actual Tip Reporting Method

The actual tip reporting method is a straightforward approach where employees report their daily or weekly tips to their employer. This method is ideal for workers who receive most of their tips in cash, as it allows for an accurate and honest declaration of earnings.

Under this method, employees are required to provide their employer with a written statement detailing the amount of tips received. The employer then includes this amount in the employee's wages for tax purposes. It is important to note that the employer may also have the right to request additional proof, such as customer receipts or witness statements, to verify the reported tip amounts.

Tip Allocation Method

The tip allocation method is more commonly used in establishments where employees share tips, such as restaurants with a tip-pooling policy. In this method, the employer allocates a portion of the total tips received by the business to each employee based on their contribution to the service.

The employer calculates the allocation by considering factors such as the number of hours worked, the employee's role, and the overall tip revenue. The allocated tips are then added to the employee's wages and subject to the appropriate tax deductions.

Calculating Taxes on Tips

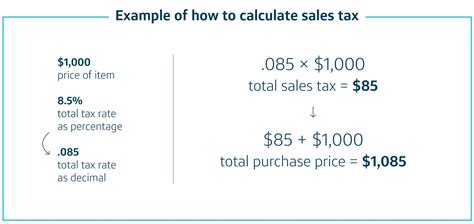

Once the tipped income is determined through either the actual tip reporting or tip allocation method, it becomes part of the employee’s taxable income. The taxes on tips are calculated in the same way as taxes on regular wages.

The exact tax rate will depend on the employee's total income, including both wages and tips, as well as their personal circumstances, such as their filing status and any deductions or credits they may be eligible for.

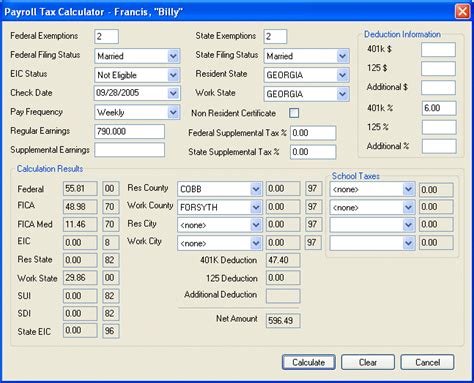

The tax calculation involves several steps, including determining the tax bracket, calculating the taxable income, applying the appropriate tax rates, and factoring in any applicable credits or deductions. It is recommended to use tax calculators or seek professional advice to ensure accuracy.

Withholding and Reporting Tips

Employees are responsible for ensuring that the correct amount of tax is withheld from their wages and tips. This can be done by completing a W-4 form, which specifies the number of allowances the employee claims, affecting the amount of tax withheld from their paycheck.

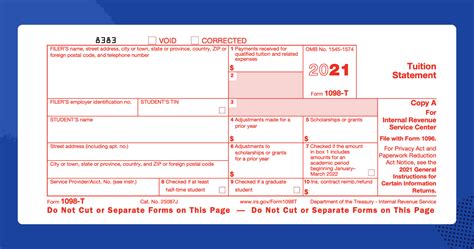

Additionally, employers are required to report the total amount of tips received by their employees to the IRS using Form 8027, Employer's Annual Information Return of Tip Income and Allocated Tips. This form is due by the last day of February each year and provides the IRS with an overview of the tip income reported by employers.

Best Practices for Tip Reporting

To ensure compliance and accuracy in tip reporting, employees should consider the following best practices:

- Keep detailed records of all tips received, including the date, amount, and source (customer or tip pool). This documentation will be invaluable in case of an audit or if there are any discrepancies in the reported amounts.

- Report tips regularly and honestly. Delayed or inaccurate reporting can lead to penalties and interest charges, so it is important to maintain an open and transparent relationship with your employer regarding tip earnings.

- Understand the tax implications of tips. Educate yourself on the tax rates and deductions applicable to your income, and consider seeking professional tax advice to ensure you are optimizing your tax position.

- If you are an employer, establish clear tip reporting policies and procedures. Provide training to your staff on the importance of accurate tip reporting and the potential consequences of non-compliance. Regularly review and update your policies to stay aligned with tax regulations.

Conclusion

Calculating taxes on tips may seem daunting, but with a clear understanding of the reporting methods and tax calculations, it becomes a manageable process. Accurate tip reporting not only ensures compliance with tax regulations but also helps service workers maximize their earnings and plan their finances effectively.

By following the guidelines outlined in this guide and staying informed about tax laws and regulations, you can navigate the complexities of tip taxation with confidence. Remember, honest and timely reporting of tip income is not only a legal obligation but also a matter of integrity and financial well-being.

What happens if I don’t report my tips accurately?

+Failing to report tips accurately can result in significant penalties and interest charges from the IRS. In addition, it may lead to legal consequences and damage your reputation as a reliable and honest employee.

Can I claim any deductions for my tip income?

+Yes, you may be eligible for certain deductions related to your tip income. These could include expenses for uniforms, tools, or other work-related items. However, it is important to consult a tax professional to understand which expenses are deductible and how to claim them accurately.

Are there any tax benefits for reporting tips early?

+While there may not be specific tax benefits for early tip reporting, it is generally advisable to report your tips promptly. Early reporting helps ensure accurate records and avoids the risk of forgetting or misreporting tip amounts, which could lead to potential issues during tax season.