Ms Income Tax Refund

As tax season approaches, the topic of income tax refunds is one that garners significant interest and curiosity among taxpayers. Ms. Income Tax Refund, a concept personifying the much-awaited financial boost, is an intriguing subject that warrants a detailed exploration. This article aims to delve into the intricacies of income tax refunds, shedding light on the processes, benefits, and implications associated with this annual financial event.

Unraveling the Mystery of Ms. Income Tax Refund

The term “Ms. Income Tax Refund” is a playful personification of the refund process, bringing a human-like persona to an otherwise complex financial matter. It serves as a relatable metaphor, helping taxpayers understand and navigate the often-confusing world of tax returns.

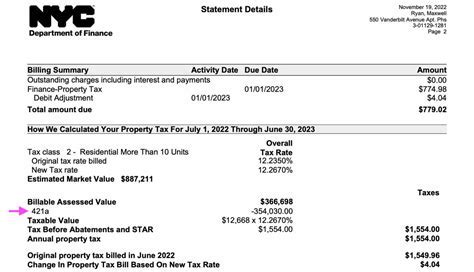

Income tax refunds are a direct result of the interplay between an individual's tax payments and their tax liability. When an individual's tax payments exceed their actual tax liability, the excess amount is refunded by the tax authority. This refund is a financial boon for many, often serving as a welcome boost to personal finances.

The Process of Securing Your Refund

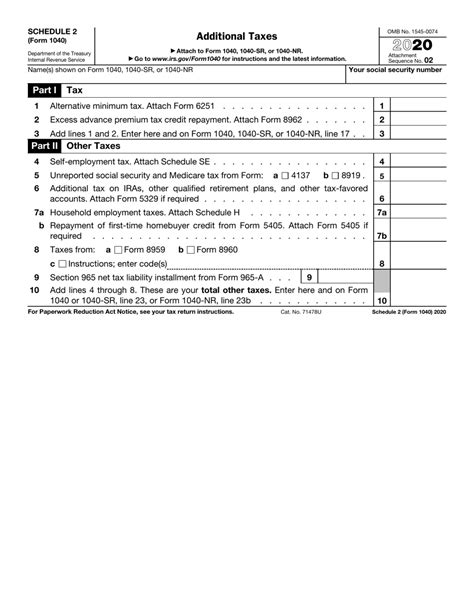

The journey towards obtaining your income tax refund begins with accurate record-keeping. Individuals must meticulously document their income, deductions, and credits to ensure they receive the maximum refund possible.

The tax return filing process involves submitting all relevant financial information to the tax authority. This process can be done manually or through specialized tax software, which simplifies the task and reduces the risk of errors.

Once the tax return is filed, the tax authority reviews the information and calculates the individual's tax liability. If the liability is less than the taxes paid, the difference is refunded to the taxpayer. The time taken for the refund to be processed varies depending on the jurisdiction and the method of filing.

| Country | Average Refund Processing Time |

|---|---|

| United States | 21 days (electronic filing) |

| Canada | 2 weeks (direct deposit) |

| United Kingdom | Up to 21 days (online filing) |

Maximizing Your Refund: Strategies and Considerations

Maximizing your income tax refund involves more than just accurate record-keeping. It requires a strategic approach to tax planning.

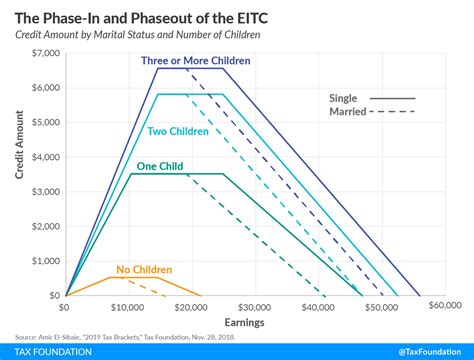

One key strategy is to take advantage of all eligible deductions and credits. These can significantly reduce your tax liability, leading to a larger refund. Some common deductions include mortgage interest, medical expenses, and charitable contributions.

Additionally, contributing to retirement accounts can provide tax benefits. For example, contributions to a traditional IRA are tax-deductible, reducing your taxable income and potentially increasing your refund.

Another strategy is to review your tax withholding throughout the year. If you have a significant refund each year, it might be beneficial to adjust your withholding to receive more of your income throughout the year rather than a large refund at tax time.

The Impact of Ms. Income Tax Refund on Personal Finances

The arrival of Ms. Income Tax Refund can have a substantial impact on an individual’s financial well-being. For many, it serves as a financial cushion, allowing them to pay off debts, build emergency funds, or invest in their future.

Debt Repayment and Emergency Funds

A sizeable tax refund can provide a significant boost to an individual’s debt repayment strategy. It can be used to pay down high-interest debt, such as credit card balances, reducing the overall financial burden.

Additionally, tax refunds can be a crucial component in building an emergency fund. Having a robust emergency fund provides financial security, allowing individuals to weather unexpected expenses or financial setbacks without incurring debt.

Investment Opportunities

For those with a long-term financial vision, tax refunds can present an excellent opportunity for investment. Whether it’s contributing to a brokerage account, investing in real estate, or starting a small business, a tax refund can provide the initial capital needed to pursue these ventures.

The Psychological Impact of Refunds

Beyond the financial implications, the psychological impact of receiving a tax refund should not be overlooked. For many, a tax refund signifies a reward for a year’s hard work and can boost morale and motivation.

However, it's essential to maintain financial discipline and avoid the trap of overspending the refund. Developing a thoughtful plan for the refund's use can ensure it is utilized effectively, contributing to long-term financial stability.

Looking Ahead: The Future of Tax Refunds

As tax systems evolve, the landscape of income tax refunds is also changing. Governments are increasingly exploring digital tax systems and real-time tax adjustments, which could impact the traditional refund process.

Digital tax systems, which leverage technology to streamline tax processes, may result in more frequent and smaller refunds. Real-time tax adjustments, on the other hand, could eliminate the need for large annual refunds, as taxes would be adjusted throughout the year based on an individual's financial situation.

While these changes may simplify the tax process, they could also require individuals to adapt their financial planning strategies. Staying informed about these developments is crucial for taxpayers to optimize their financial outcomes.

Conclusion: Embracing the Journey with Ms. Income Tax Refund

The concept of Ms. Income Tax Refund provides a unique and engaging perspective on the tax refund process. By understanding the intricacies of this process and adopting strategic financial planning, taxpayers can make the most of their refunds, leveraging them to achieve their financial goals.

As we navigate the ever-evolving world of taxation, staying informed and adaptable is key. Whether it's maximizing deductions, investing wisely, or simply enjoying the financial boost, Ms. Income Tax Refund is a welcome visitor each year, offering an opportunity to strengthen our financial foundations.

How can I maximize my income tax refund?

+Maximizing your income tax refund involves careful planning and understanding of eligible deductions and credits. Ensure you claim all applicable deductions, such as mortgage interest, medical expenses, and charitable contributions. Additionally, consider contributing to tax-advantaged retirement accounts and adjusting your tax withholding throughout the year to align with your financial goals.

What should I do with my tax refund?

+The use of your tax refund depends on your financial goals and circumstances. It can be used to pay off high-interest debt, build an emergency fund, invest in your future, or even as a reward for a job well done. The key is to have a thoughtful plan to ensure the refund contributes to your long-term financial stability and well-being.

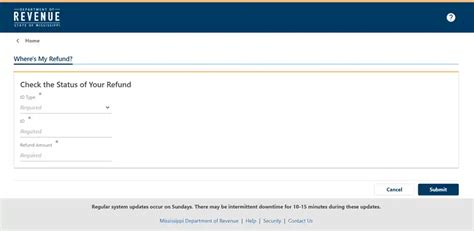

How can I track the status of my tax refund?

+Most tax authorities provide online tools to track the status of your tax refund. In the US, you can use the IRS’ “Where’s My Refund” tool, which requires your Social Security number, filing status, and refund amount. In other countries, similar online portals or apps are often available to provide real-time updates on your refund status.