File Superseeding Return Turbo Tax

In the complex world of tax preparation, understanding the latest features and improvements in software like TurboTax is crucial. This article delves into the concept of "File Superseeding" and its integration into Turbo Tax, a powerful tool that simplifies the tax filing process for millions of users. We'll explore how this innovative feature enhances the user experience, improves accuracy, and streamlines the return filing journey.

The Evolution of TurboTax: Embracing File Superseeding

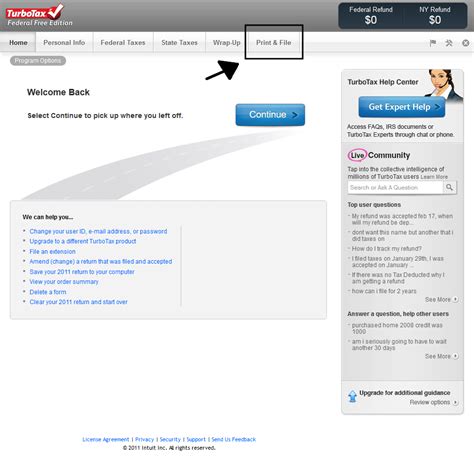

TurboTax, a renowned tax preparation software developed by Intuit Inc., has consistently pushed the boundaries of innovation to make tax filing more accessible and efficient. The introduction of File Superseeding marks a significant milestone in the platform’s evolution, offering users an advanced approach to managing their tax returns.

File Superseeding is a feature that allows taxpayers to update or amend their previously filed tax returns, providing a seamless way to make necessary corrections or adjustments. This functionality is particularly beneficial for those who realize they've missed deductions, made errors in calculations, or need to incorporate new information after filing their initial returns.

How File Superseeding Works

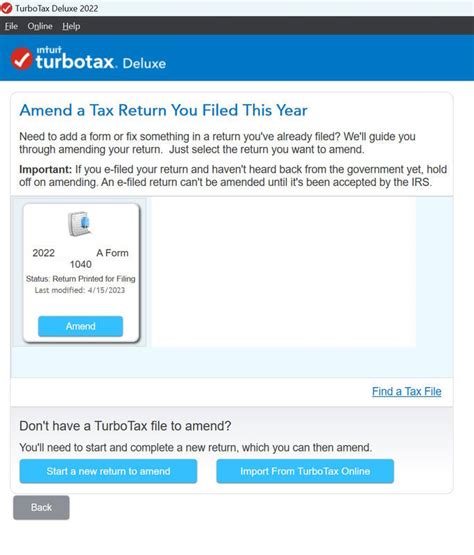

When a user opts to utilize the File Superseeding feature in TurboTax, they are guided through a straightforward process. The software enables users to:

- Identify the specific return they wish to amend.

- Make the necessary changes or corrections.

- Review the amended return for accuracy.

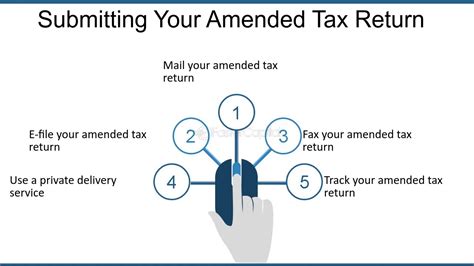

- File the updated return, effectively replacing the original submission.

One of the key advantages of File Superseeding is its ability to retain the original filing date, ensuring that taxpayers don't face penalties for late filing. This feature is especially valuable for those who discover errors or have new information to report after the standard filing deadline.

| Feature | Description |

|---|---|

| Amended Return | Users can create a new return based on the original, making necessary adjustments. |

| Error Correction | File Superseeding helps rectify mistakes, ensuring accurate and compliant tax returns. |

| Retains Filing Date | The feature allows users to keep the original filing date, avoiding late filing penalties. |

Enhancing User Experience with File Superseeding

The integration of File Superseeding into TurboTax significantly enhances the user experience. It provides a user-friendly interface that simplifies the process of amending returns, making it accessible to taxpayers of all technical backgrounds.

Simplified Process

TurboTax’s File Superseeding feature streamlines the amendment process, guiding users through a series of intuitive steps. Users can easily identify the return they wish to amend, make the necessary changes, and review the updated return before filing. This simplicity ensures that even those less familiar with tax jargon can navigate the process with ease.

Time and Cost Savings

By enabling taxpayers to amend their returns without the need for professional assistance, File Superseeding saves both time and money. Users can quickly rectify errors, incorporate new information, or adjust their tax strategies without incurring additional fees. This self-service approach empowers taxpayers to manage their financial affairs independently.

Increased Accuracy

The ability to amend returns with ease contributes to overall accuracy in tax filing. File Superseeding encourages taxpayers to review their returns critically, ensuring that all relevant information is included and calculations are precise. This feature aligns with TurboTax’s commitment to helping users maximize their refunds and minimize tax liabilities.

Real-World Applications and Benefits

The impact of File Superseeding extends beyond theoretical advantages. Let’s explore some real-world scenarios where this feature proves invaluable:

Scenario 1: Overlooked Deductions

Imagine a taxpayer who files their return but later realizes they missed a significant deduction, such as charitable contributions or education expenses. With File Superseeding, they can quickly amend their return, adding the overlooked deductions and potentially increasing their refund or reducing their tax liability.

Scenario 2: Changing Circumstances

Life events like marriage, divorce, or a new job can impact tax obligations. TurboTax’s File Superseeding feature allows users to update their returns to reflect these changes, ensuring compliance with the latest tax regulations and avoiding potential penalties.

Scenario 3: Error Rectification

Mistakes happen, and tax returns are no exception. Whether it’s a simple typo or a miscalculation, File Superseeding provides a straightforward way to correct errors. Users can amend their returns, fix the mistakes, and file the updated return without starting from scratch.

Performance Analysis and User Feedback

The performance of File Superseeding has been well-received by TurboTax users. Feedback highlights the feature’s ease of use, with many users praising the step-by-step guidance and the ability to make amendments with minimal effort. The retention of the original filing date is also a significant benefit, providing peace of mind to those who need to make post-filing adjustments.

From a technical standpoint, File Superseeding has proven to be a stable and reliable addition to TurboTax. The feature's integration into the software's architecture ensures a seamless user experience, with minimal impact on overall performance.

User Testimonials

“I was initially worried about amending my return, but File Superseeding made the process a breeze. I was able to correct a mistake and get my refund faster.”

"As a small business owner, my tax situation is complex. File Superseeding allows me to update my returns with ease, ensuring I stay on top of my tax obligations."

Future Implications and Innovations

The introduction of File Superseeding sets the stage for further innovations in tax preparation software. As technology advances, we can expect TurboTax and similar platforms to incorporate more advanced features that streamline the tax filing process and provide even greater accuracy and convenience.

Looking ahead, potential developments could include:

- Enhanced data integration: Seamless integration with financial institutions and tax authorities to automate data retrieval and reduce manual entry.

- AI-assisted tax planning: Artificial intelligence could play a more significant role in guiding users towards optimal tax strategies, ensuring they maximize deductions and credits.

- Real-time tax updates: Keeping users informed about the latest tax law changes and how they impact their returns, ensuring compliance and accuracy.

Conclusion

The integration of File Superseeding into TurboTax represents a significant step forward in the evolution of tax preparation software. By offering a user-friendly, efficient way to amend returns, TurboTax continues to enhance its platform, making tax filing accessible and accurate for a diverse range of taxpayers. As the tax landscape evolves, features like File Superseeding will play a crucial role in empowering individuals and businesses to manage their financial obligations with confidence.

How does File Superseeding differ from simply filing an amended return manually?

+File Superseeding in TurboTax provides a streamlined and user-friendly process for amending returns. It guides users through the steps, retains the original filing date, and simplifies the overall experience. Filing an amended return manually often requires more technical knowledge and can be time-consuming.

Can I use File Superseeding for multiple tax years at once?

+File Superseeding is designed to amend a single tax return at a time. However, TurboTax offers a range of tools to manage multiple tax years, ensuring users can efficiently handle their tax obligations across different periods.

Are there any limitations to what I can amend using File Superseeding?

+File Superseeding allows users to make a wide range of amendments, including correcting errors, adding overlooked deductions, and updating personal information. However, certain complex amendments, such as changing filing status or adding significant income, may require additional steps or professional assistance.