How to Complete and File the Schedule 2 Tax Form for Accurate Tax Reporting

For tax professionals, accountants, and individual taxpayers alike, the intricacies of accurately completing and filing Schedule 2 of the IRS Form 1040 can present considerable challenges—especially given the complexities introduced by evolving tax laws and supplemental schedules. Schedule 2, which captures additional taxes such as the Alternative Minimum Tax or the repayment of the ACA health coverage tax credits, demands meticulous attention to detail and a thorough understanding of specific thresholds, calculations, and documentation. Navigating this part of the tax return requires a strategic approach rooted in a deep grasp of the interrelated components of the tax code.

Understanding the Fundamentals of Schedule 2 for Precise Tax Reporting

Schedule 2 is designed to report income-driven taxes that don’t fit within the main Form 1040 categories. This includes income adjustments, additional taxes, and refundable credits that can significantly influence an individual’s overall tax liability. Misreporting or overlooking entries on Schedule 2 can lead to discrepancies, audits, or penalties—making accuracy indispensable.

Dissecting the Core Components of Schedule 2

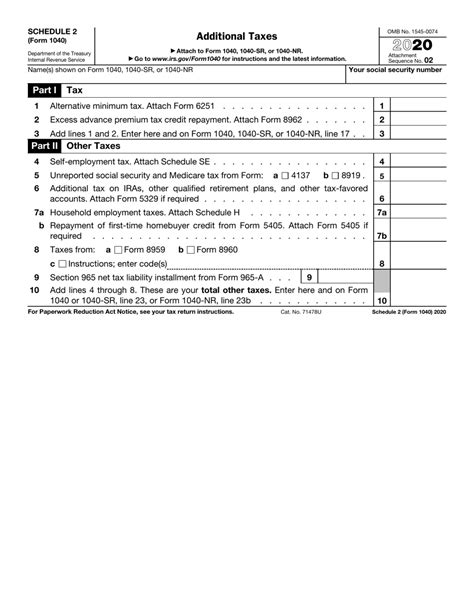

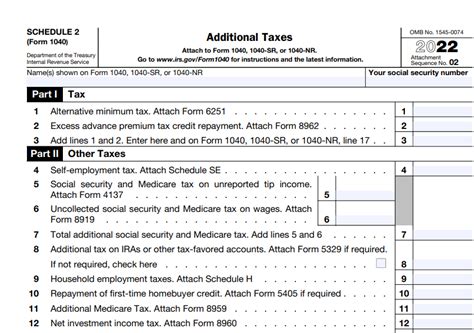

The schedule primarily divides into two sections: Part I — Additional Taxes, and Part II — Other Taxes. Each part covers distinct categories, and understanding their specific functions enhances the precision of reporting.

- Part I — Additional Taxes: Includes the Alternative Minimum Tax (AMT), excess advance premium tax credit repayment, and other miscellaneous taxes. Calculating AMT, in particular, involves complex adjustments based on a taxpayer’s income, deductions, and preferences, often requiring the use of supplemental worksheets.

- Part II — Other Taxes: Covers taxes such as the self-employment tax, household employment taxes, or early withdrawal penalties. These often necessitate referencing Schedule SE or Schedule C for accurate data extraction.

Each component demands attention not only to the numbers but also to the relevant thresholds and phase-in ranges, which can vary annually based on inflation adjustments and legislative changes.

Step-by-Step Process for Completing Schedule 2

The task begins before doing the math—gathering all necessary documentation. This includes W-2s, 1099s, Schedule C or Schedule SE, and relevant receipts or statements evidencing taxes paid or credits claimed. The next steps involve methodical calculation and cross-referencing.

Gathering and Verifying Source Data

Before plunging into the form, compile all relevant source documents. For instance, the accuracy of the AMT calculations hinges on correct reporting of tax preference items, such as private activity bond interest or certain depreciation adjustments. Ensuring these entries are correctly identified and categorized is paramount for correct Schedule 2 completion.

| Relevant Category | Substantive Data |

|---|---|

| Most common source documents | W-2s, 1099s, Schedule C, Schedule SE |

| Thresholds for AMT exemption | $75,900 (single), $116,300 (married filing jointly) (2023 values) |

| Additional taxes penalty rates | Varies up to 25% for penalties on early IRA withdrawals |

Approaching the Calculation and Entry Process

Calculations on Schedule 2 are sequential but often require iterative review. For example, completing Part I—Additional Taxes—involves a detailed worksheet to compute the AMT, entailing income adjustments, ordinary income additions, and specific preference items.

Calculating the Alternative Minimum Tax (AMT)

The AMT process begins with the taxpayer’s regular taxable income, then adds or subtracts adjustments and preference items. The resulting figure is compared with the AMT exemption, which phases out at higher income levels. If the applicable AMT exceeds the regular tax, the taxpayer owes the difference, which is then reported on Schedule 2, Part I, Line 3.

Properly calculating this offset requires knowing the applicable exemption amount and understanding the phase-out thresholds. These thresholds are adjusted annually based on inflation, necessitating an up-to-date reference.

| Metric | Actual Value |

|---|---|

| 2023 AMT exemption for single filers | $75,900 |

| AMT phase-out threshold for married filing jointly | $578,150 |

| Maximum AMT tax rate | 28% |

Filing and Submission: Ensuring Accuracy and Compliance

Once completed, Schedule 2 must be integrated into the main Form 1040, with the totals accurately transferred to relevant lines. For example, the total additional taxes are reported on Schedule 1 (Additional Income and Adjustments) and then combined into the overall taxable income calculation.

Final Review and Documentation

Accuracy checks should include verifying arithmetic, ensure consistency with source documents, and confirming the correct application of thresholds and exemptions. It is advantageous to maintain detailed records of assumptions, worksheets, and supporting correspondences in case of IRS review or audit.

Key Points

- Precision in calculations: Ensures compliance and minimizes audit risks.

- Proper documentation: Supports audit defense and future reference.

- Understanding thresholds: Critical for accurate AMT and additional tax calculations.

- Reconciliation with other schedules: Ensures consistency across the tax return.

- Use of technology: Software tools can aid but do not replace manual validation for complex calculations.

What are the common mistakes when completing Schedule 2?

+Common errors include misreporting income adjustments, neglecting to include all relevant preference items, incorrect threshold application, and arithmetic mistakes. Ensuring thorough review and cross-referencing source documents reduces these risks.

How does the IRS verify Schedule 2 entries?

+The IRS cross-checks Schedule 2 figures against other schedules, forms, and third-party reports. Discrepancies trigger audit alerts, making meticulous record-keeping and accurate entries vital for compliance.

Can I use software to complete Schedule 2?

+Yes. Most professional tax software packages incorporate Schedule 2 calculations, especially for AMT and supplementary taxes. However, understanding the underlying theory enhances accuracy and troubleshooting skills.