How Do You Report Tax Evasion

Tax evasion is a serious offense that undermines the financial integrity of a nation and can have significant repercussions for individuals and businesses. Reporting tax evasion is an important step in ensuring a fair and transparent tax system. In this comprehensive guide, we will explore the process of reporting tax evasion, shedding light on the steps individuals and businesses can take to contribute to a just fiscal environment.

Understanding Tax Evasion

Tax evasion refers to the illegal practice of intentionally avoiding or underreporting tax liabilities to reduce one’s tax burden. It involves various methods, such as underreporting income, overstating expenses, or concealing assets. Tax evasion is distinct from tax avoidance, which is the legal use of tax laws to minimize tax liabilities.

Tax evasion not only undermines the financial stability of a country but also creates an unfair advantage for those who engage in such practices. It leads to a loss of revenue for the government, impacting essential services, infrastructure, and social programs. By reporting tax evasion, individuals and businesses can play a crucial role in promoting tax compliance and ensuring a level playing field.

Recognizing Signs of Tax Evasion

Identifying potential tax evasion requires a keen eye and an understanding of common red flags. Here are some signs that may indicate tax evasion:

- Significant discrepancy between declared income and lifestyle.

- Unreported or underreported business income.

- Use of cash-only transactions to avoid record-keeping.

- Failure to file tax returns or consistent late filing.

- Hiding assets or transferring ownership to avoid taxes.

- Overstating expenses or claiming false deductions.

- Unusual patterns in financial statements or accounting practices.

- Refusal to provide financial records or cooperate with tax authorities.

While these signs may indicate potential tax evasion, it's important to note that they do not automatically prove illegal activity. A thorough investigation by tax authorities is necessary to establish the facts.

Reporting Tax Evasion: A Step-by-Step Guide

Reporting tax evasion is a responsible action that can be undertaken by anyone with knowledge of potential illegal activities. Here’s a step-by-step guide to the reporting process:

Step 1: Gather Evidence

Before making a report, it’s crucial to gather as much evidence as possible. Evidence can include financial records, emails, photographs, or any other documentation that supports your claim. Ensure that the evidence is accurate and relevant to the suspected tax evasion.

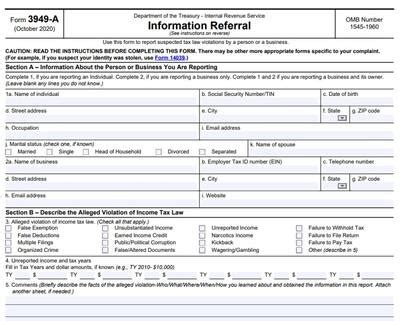

Step 2: Identify the Tax Authority

Different countries have their own tax authorities responsible for investigating and prosecuting tax evasion. In the United States, the Internal Revenue Service (IRS) is the primary agency. Identify the appropriate tax authority in your jurisdiction and ensure you are familiar with their reporting procedures.

Step 3: Choose the Reporting Method

Tax authorities offer various methods for reporting tax evasion, including online forms, phone calls, and written submissions. Evaluate your options and choose the method that best suits your circumstances. Consider factors such as anonymity, ease of use, and the level of detail required.

Step 4: Provide Detailed Information

When reporting tax evasion, provide as much detail as possible. Include the names of individuals or businesses involved, their addresses, and any relevant contact information. Describe the suspected tax evasion activities, citing specific examples and evidence. The more detailed your report, the easier it is for tax authorities to investigate.

Step 5: Maintain Anonymity (If Desired)

If you wish to remain anonymous, most tax authorities provide options for confidential reporting. Confidential reporting ensures that your identity is protected, and you may be assigned a code or identifier to facilitate further communication if needed. However, it’s important to note that anonymous reports may limit the scope of the investigation.

Step 6: Follow Up (If Necessary)

After submitting your report, you may choose to follow up with the tax authority to inquire about the status of your case. Depending on the jurisdiction and the nature of the case, follow-up procedures may vary. Contact the tax authority directly to understand their process and any available options for updates.

Protecting Yourself and Your Business

Reporting tax evasion can sometimes carry potential risks, especially if the individuals involved are aware of the report. It’s essential to take steps to protect yourself and your business:

- Ensure you have a strong understanding of the tax laws and regulations in your jurisdiction.

- Maintain accurate and up-to-date financial records for your business.

- Implement robust internal controls to prevent tax evasion within your organization.

- Encourage a culture of tax compliance and integrity within your workforce.

- Consider seeking legal advice if you are concerned about potential retaliation.

The Role of Tax Authorities

Tax authorities play a crucial role in investigating and prosecuting tax evasion. They have the resources and expertise to conduct thorough investigations, gather evidence, and take legal action against those who engage in tax evasion. Tax authorities also provide support and guidance to individuals and businesses reporting tax evasion, ensuring a fair and transparent process.

The Impact of Reporting Tax Evasion

Reporting tax evasion has a significant impact on the overall tax system. It helps:

- Reduce tax gaps and increase revenue for governments.

- Promote fairness and equal treatment under the law.

- Deter potential tax evaders and encourage voluntary compliance.

- Protect honest taxpayers and businesses from unfair competition.

- Strengthen the integrity and credibility of the tax system.

Case Studies: Real-World Examples

Understanding the practical implications of reporting tax evasion can be insightful. Here are a few case studies showcasing the impact of reporting:

Case Study 1: Corporate Tax Evasion

In a high-profile case, a multinational corporation was found to have engaged in complex tax evasion schemes. A whistleblower, an employee within the company, reported the illegal activities to the tax authorities. The subsequent investigation revealed a sophisticated network of offshore accounts and shell companies used to avoid taxes. The corporation was held accountable, resulting in significant fines and a public scandal.

Case Study 2: Individual Tax Evasion

A local business owner consistently underreported their income and failed to file tax returns for several years. A concerned neighbor, aware of the business’s success, reported the suspected tax evasion to the IRS. The investigation uncovered a pattern of underreported income and hidden assets. The business owner was prosecuted, resulting in a substantial tax liability and penalties.

Case Study 3: Cross-Border Tax Evasion

An international collaboration between tax authorities led to the exposure of a global tax evasion network. The investigation began with a single report from a concerned citizen, who provided information about a suspected offshore tax haven. The case involved multiple countries, and the coordinated effort resulted in the identification and prosecution of numerous individuals and entities involved in cross-border tax evasion.

Conclusion: A Collective Responsibility

Reporting tax evasion is not just a legal obligation but also a collective responsibility. By actively participating in the process, individuals and businesses contribute to a fair and equitable tax system. It is through these actions that we can foster a culture of integrity and transparency, ensuring that everyone pays their fair share.

Remember, if you suspect tax evasion, take action and report it. Your contribution can make a significant difference in promoting a just and prosperous society.

How do I know if I am dealing with tax evasion or tax avoidance?

+Tax evasion and tax avoidance are distinct concepts. Tax evasion involves illegal activities, such as intentionally underreporting income or hiding assets to reduce tax liabilities. Tax avoidance, on the other hand, refers to the legal use of tax laws and loopholes to minimize tax obligations. If you suspect illegal activities, it is important to report them to the appropriate tax authorities.

Can I report tax evasion anonymously?

+Yes, most tax authorities provide options for anonymous reporting. This allows you to report suspected tax evasion without revealing your identity. However, it’s important to note that anonymous reports may limit the scope of the investigation and follow-up options.

What happens after I report tax evasion?

+After submitting a report, the tax authority will investigate the suspected tax evasion. The investigation may involve gathering additional evidence, interviewing witnesses, and conducting audits. The outcome will depend on the findings and the severity of the case. If the tax authority finds sufficient evidence, they may initiate legal proceedings against the individuals or entities involved.

Are there any consequences for reporting tax evasion falsely?

+Yes, making false reports or providing misleading information to tax authorities is a serious offense. It can result in legal consequences, including fines and potential imprisonment. It is crucial to ensure the accuracy and reliability of the information you provide when reporting tax evasion.

How can I protect myself after reporting tax evasion?

+If you are concerned about potential retaliation after reporting tax evasion, consider seeking legal advice. You can also take steps to protect yourself by maintaining accurate financial records, implementing robust internal controls, and fostering a culture of tax compliance within your organization. It’s important to stay informed about your rights and the available support systems.