Tax Of France

The French tax system is a complex and comprehensive framework that plays a crucial role in the country's economic landscape. It is designed to fund various public services, infrastructure, and social programs while ensuring the fair distribution of wealth and promoting economic growth. Understanding the French tax system is essential for both residents and businesses operating within the country, as it influences financial planning, investment strategies, and overall financial health.

Understanding the French Tax System

France’s tax system is characterized by its diversity, encompassing various types of taxes that target different aspects of economic activity. These taxes can be broadly categorized into personal income taxes, corporate taxes, value-added taxes (VAT), social contributions, and property taxes, among others. Each of these tax categories serves a specific purpose and is subject to distinct rules and regulations.

Personal Income Tax

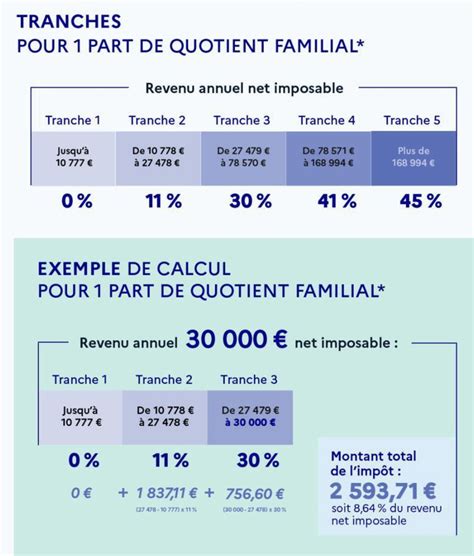

Personal income tax in France is progressive, meaning that higher income earners pay a higher proportion of their income as tax. The tax rate ranges from approximately 0% to 45%, with various brackets in between. Additionally, France has a wealth tax, known as Impôt de Solidarité sur la Fortune (ISF), which targets individuals with substantial net worth. This tax has been a subject of debate and has undergone reforms in recent years.

| Income Bracket (Euros) | Tax Rate |

|---|---|

| Up to 10,093 | 0% |

| 10,094 to 27,756 | 14% |

| 27,757 to 74,587 | 30% |

| 74,588 to 158,669 | 41% |

| Over 158,669 | 45% |

Corporate Taxes

Corporate taxes in France are levied on the profits of companies and are an essential source of revenue for the government. The corporate income tax rate is currently set at 28% for standard companies and 31% for large companies with revenues exceeding €250 million. However, there are also various tax incentives and credits available to encourage investment and promote specific sectors, such as research and development.

Value-Added Tax (VAT)

VAT is a consumption tax applied to the sale of goods and services within France. It is a crucial revenue generator for the government and is an integral part of the European Union’s tax system. The standard VAT rate in France is 20%, but there are also reduced rates for specific products and services, such as 10% for restaurant meals and 5.5% for essential goods like food and books.

The Impact of French Taxes on Economic Activity

The French tax system significantly influences the country’s economic landscape. High tax rates, particularly for higher income earners and large corporations, can incentivize businesses to optimize their tax strategies, potentially impacting investment decisions and the overall business environment. Additionally, the complexity of the tax system can pose challenges for both individuals and businesses, requiring expert guidance to navigate the regulations effectively.

Tax Optimization and Planning

Given the complexity of the French tax system, tax optimization and planning have become essential practices for individuals and businesses alike. This involves strategically structuring financial affairs to minimize tax liabilities while remaining compliant with the law. Tax optimization strategies can include investing in eligible sectors, utilizing deductions and credits, and optimizing corporate structures.

Social Contributions and Welfare State

France is known for its robust welfare state, which is funded in part by social contributions. These contributions are mandatory and are used to finance social security programs, including healthcare, unemployment benefits, and retirement pensions. The social contribution system is an integral part of the French tax framework, ensuring the sustainability of the country’s social safety net.

The Future of French Taxation

The French tax system is continually evolving to adapt to changing economic conditions and societal needs. In recent years, there have been discussions and reforms aimed at simplifying the tax code, reducing tax rates for certain sectors, and promoting economic growth. The government’s focus on attracting investment and fostering entrepreneurship has led to initiatives such as tax breaks for start-ups and incentives for foreign investors.

Digital Taxation

The rise of digital economies and the challenges they pose for traditional tax systems have not escaped the attention of French policymakers. France has been at the forefront of discussions on digital taxation, advocating for a fairer tax system that accounts for the revenue generated by digital giants within the country. This has led to the implementation of a digital services tax, targeting large technology companies.

International Tax Cooperation

France actively participates in international tax cooperation initiatives, working with other countries to combat tax evasion and promote tax transparency. The country is a signatory to various international tax agreements, including the OECD’s Base Erosion and Profit Shifting (BEPS) project, which aims to address the challenges posed by multinational enterprises’ tax strategies.

What are the key differences between the French tax system and other European countries’ systems?

+While European countries share certain tax principles, there are notable differences in their tax systems. France, for instance, has a more progressive income tax system compared to some of its European neighbors. Additionally, the French tax system is known for its complexity, with various deductions and credits, whereas other countries may have simpler structures. The VAT rates also vary across Europe, with some countries opting for lower rates to boost consumption.

How does the French tax system affect foreign investors and businesses?

+The French tax system can present both opportunities and challenges for foreign investors. On one hand, the country offers various tax incentives and a supportive business environment, particularly for start-ups and innovative companies. However, the complex tax structure and high tax rates can be a deterrent, requiring thorough tax planning and expert advice to navigate the system effectively.

What are the main challenges faced by individuals and businesses in navigating the French tax system?

+The complexity of the French tax system is a significant challenge, with its numerous tax categories, rates, and regulations. Keeping up with the ever-changing tax laws and optimizing tax strategies to minimize liabilities can be daunting. Additionally, the language barrier can pose an obstacle for non-French speakers, making it crucial to seek professional guidance.