New Jersey Property Tax Relief

In the state of New Jersey, property taxes are a significant financial burden for many homeowners and businesses. With one of the highest property tax rates in the nation, residents and property owners seek various relief options to ease the financial strain. This comprehensive guide delves into the world of New Jersey property tax relief, exploring the programs, strategies, and insights that can help taxpayers navigate this complex landscape.

Understanding New Jersey’s Property Tax Landscape

New Jersey’s property tax system is renowned for its complexity, with a wide range of factors influencing tax assessments and rates. The state’s property tax is a local tax, meaning each of the 565 municipalities sets its own tax rate, resulting in vast variations across the state.

The property tax rate is typically expressed as a percentage, such as the 3.5% rate seen in many northern New Jersey towns. This rate is applied to the assessed value of a property to calculate the annual tax bill. For instance, a property assessed at $500,000 in a town with a 3.5% rate would incur an annual tax of $17,500.

The assessed value of a property is determined through a complex process, often involving professional appraisers. This value can fluctuate based on market conditions and property improvements, leading to potential increases or decreases in tax bills.

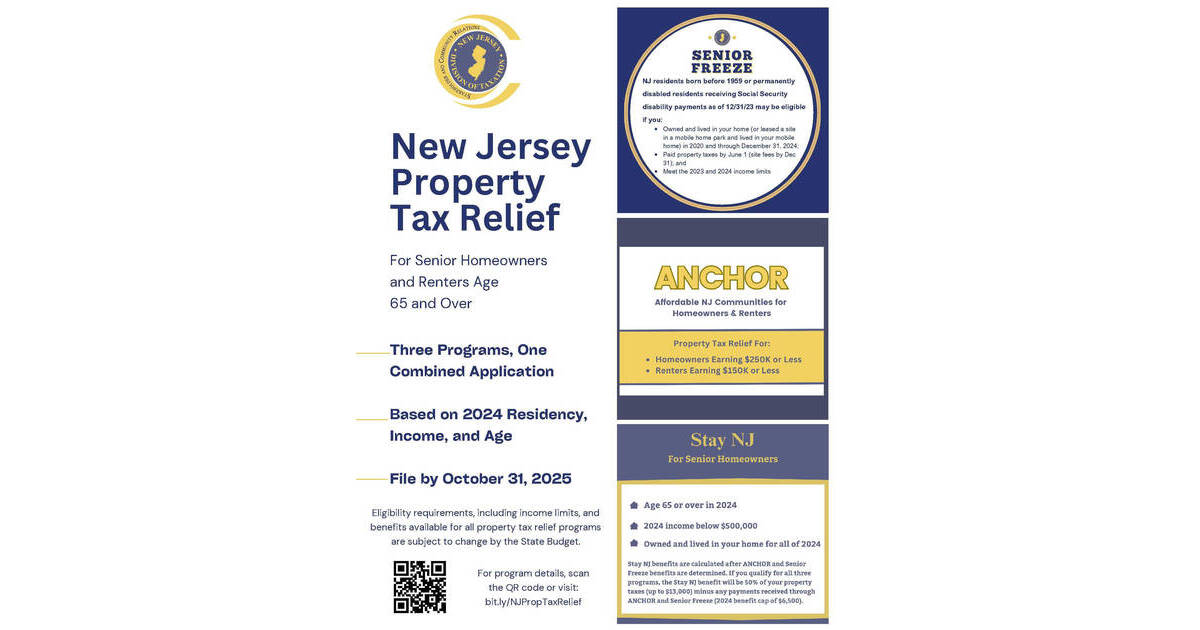

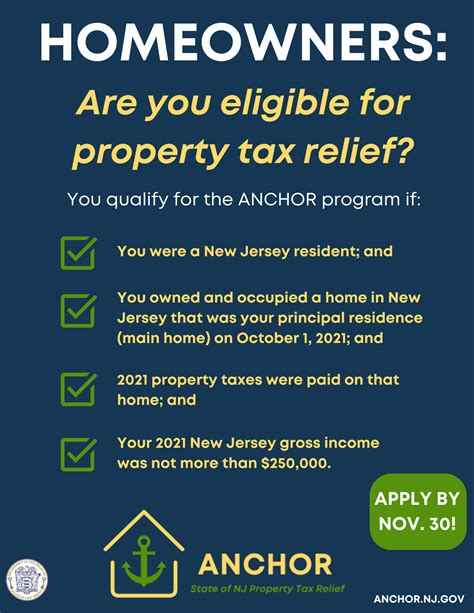

Property Tax Relief Programs in New Jersey

New Jersey offers a variety of programs aimed at providing tax relief to eligible homeowners and renters. These initiatives aim to make property ownership more affordable and sustainable, especially for low- and moderate-income households.

Homestead Rebate Program

One of the most prominent relief programs is the Homestead Rebate Program, which provides direct financial assistance to eligible homeowners. This program, funded by the state, offers rebates to homeowners based on their income and property tax payments. To qualify, homeowners must meet specific income criteria and reside in their property as their primary residence.

For instance, consider a homeowner with an annual income of $60,000 and a property tax bill of $5,000. If they meet the program's eligibility criteria, they could receive a rebate of up to $2,000, significantly reducing their tax burden.

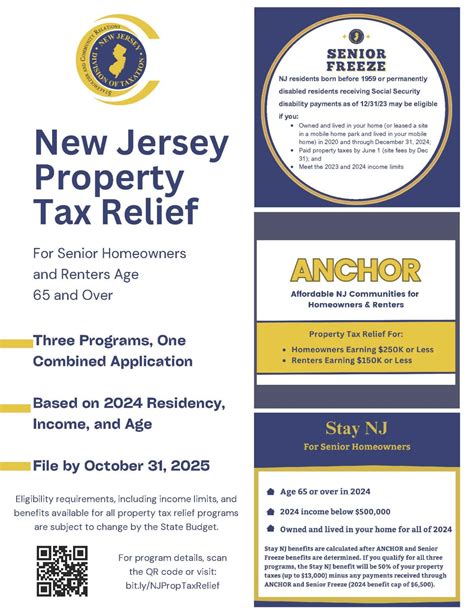

Senior Freeze Program

The Senior Freeze Program, officially known as the Property Tax Reimbursement Program, is designed to provide relief to New Jersey’s senior citizens. This program offers reimbursement for property tax increases, ensuring that seniors aren’t disproportionately burdened by rising tax rates.

To illustrate, imagine a senior homeowner who has lived in their home for many years. If their property tax increases by $300 one year, the Senior Freeze Program would reimburse them for this increase, ensuring their tax burden doesn't escalate beyond their means.

Property Tax Deductions and Exemptions

New Jersey also offers a range of deductions and exemptions that can reduce the taxable value of a property. These include:

- Veteran’s Exemption: Eligible veterans can receive a property tax exemption based on their service.

- Senior Citizen Deduction: Seniors may be eligible for a deduction on their property taxes, reducing their overall bill.

- Farmland Assessment Program: Owners of farmland can apply for this program, which assesses their land at its agricultural value rather than its development potential.

Strategies for Reducing Property Taxes

In addition to the relief programs, there are several strategies homeowners can employ to potentially reduce their property tax burden.

Appealing Property Assessments

If a homeowner believes their property’s assessed value is too high, they have the right to appeal. This process involves gathering evidence, such as recent sales of similar properties, to argue for a lower assessment. A successful appeal can lead to a reduced tax bill.

For example, if a homeowner discovers that their property was assessed at $600,000, but recent sales of comparable properties suggest a more realistic value of $550,000, they can use this data to support their appeal for a lower assessment.

Improving Energy Efficiency

Investing in energy-efficient upgrades can not only reduce utility bills but also potentially lower property taxes. Many municipalities offer tax incentives or deductions for homeowners who make energy-efficient improvements to their properties.

Installing solar panels, for instance, can lead to a significant reduction in energy costs. In addition, some municipalities offer tax abatements or credits for such improvements, further enhancing the financial benefits.

Maintaining and Improving Property Condition

Well-maintained properties often receive more favorable assessments. Regular maintenance and improvements can help keep property values stable or even increase them, potentially leading to a lower tax rate.

Simple upgrades like repainting, landscaping, or updating fixtures can enhance a property's curb appeal and value. These improvements, when coupled with a favorable assessment, can result in a reduced tax bill.

Future Implications and Ongoing Challenges

While New Jersey’s property tax relief programs and strategies offer significant benefits, there are ongoing challenges and considerations.

Sustainability and Funding

Many of the relief programs rely on state funding, which can be impacted by economic fluctuations and budgetary constraints. Ensuring the long-term sustainability of these programs is a continuous challenge for policymakers.

The state's fiscal health and its ability to allocate resources towards tax relief initiatives play a crucial role in determining the future of these programs. As such, the financial health of the state is a key factor in the ongoing viability of property tax relief efforts.

Equity and Fairness

New Jersey’s diverse municipalities present a challenge in ensuring equitable tax relief across the state. With wide variations in tax rates and property values, it can be difficult to implement policies that provide fair relief to all residents.

Addressing this issue requires a nuanced approach, taking into account the unique circumstances of each municipality. Policymakers must navigate these complexities to ensure that relief programs benefit all residents, regardless of their location within the state.

| Relief Program | Eligibility | Benefits |

|---|---|---|

| Homestead Rebate | Income-based, primary residence | Direct rebates on property taxes |

| Senior Freeze | Seniors, based on income and property tax increases | Reimbursement for tax increases |

| Veteran's Exemption | Eligible veterans | Property tax exemption based on service |

| Senior Citizen Deduction | Seniors, income-based | Deduction on property taxes |

Conclusion

New Jersey’s property tax system presents a unique set of challenges and opportunities for homeowners and businesses. By understanding the relief programs, strategies, and ongoing challenges, taxpayers can make informed decisions to manage their property tax burden effectively. As the state continues to evolve, so too will its tax policies, offering new opportunities for relief and financial stability.

How often are property assessments conducted in New Jersey?

+Property assessments in New Jersey are typically conducted every year, although some municipalities may reassess properties less frequently.

Are there any online tools to estimate property tax relief benefits?

+Yes, the New Jersey Division of Taxation provides an online calculator to estimate potential property tax relief benefits. This tool considers factors like income, property value, and eligibility for specific programs.

Can I appeal my property tax assessment if I disagree with it?

+Absolutely! If you believe your property tax assessment is inaccurate or too high, you have the right to appeal. The process typically involves gathering evidence and presenting your case to the local tax assessor’s office.