Does Idaho Have Sales Tax

The tax landscape in the United States is a diverse and intricate web, with varying regulations across states and even within different jurisdictions. Idaho, a state known for its natural beauty and outdoor adventures, has its own unique tax system, which includes a sales tax component. Understanding the specifics of Idaho's sales tax is crucial for both residents and businesses operating within the state.

Sales Tax in Idaho: An Overview

Idaho imposes a sales tax on various goods and services, which is a common method used by states to generate revenue and fund essential public services. The sales tax rate in Idaho is not a one-size-fits-all figure; it varies depending on the type of transaction and the location where the sale occurs. This variability is a key aspect of Idaho’s tax system and can have significant implications for consumers and businesses.

Sales Tax Rates in Idaho: A Complex Picture

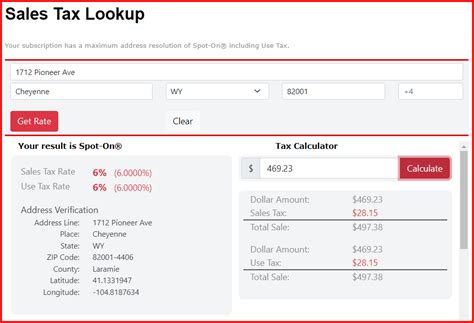

The sales tax rate in Idaho is composed of a state-level tax rate and, in many cases, additional local taxes. The state-level sales tax rate is currently set at 6%, which is applied uniformly across the state. However, the story doesn’t end there. Many cities and counties in Idaho have the authority to impose their own local option taxes, resulting in a combined sales tax rate that can vary significantly from one location to another.

| Location | Combined Sales Tax Rate |

|---|---|

| Boise | 6.75% |

| Coeur d'Alene | 7.00% |

| Idaho Falls | 6.75% |

| Meridian | 7.00% |

| Nampa | 6.75% |

These local option taxes are often used to fund specific projects or initiatives, such as infrastructure development or tourism promotion. As a result, the sales tax rate in Idaho can range from 6% to 7.5% or even higher in certain areas, making it a critical consideration for businesses planning their pricing strategies and for consumers budgeting their purchases.

Exemptions and Special Considerations

Like many states, Idaho has a list of goods and services that are exempt from sales tax. These exemptions can be based on the nature of the product, the purpose for which it’s purchased, or the identity of the purchaser. For example, certain food items, prescription drugs, and some agricultural equipment are exempt from sales tax in Idaho.

Additionally, Idaho offers a resale exemption, which allows businesses that resell goods to purchase those goods without paying sales tax. This exemption is a critical aspect of the state's tax system, as it prevents the same item from being taxed multiple times as it moves through the supply chain.

The Impact on E-Commerce and Remote Sellers

With the rise of e-commerce, the collection of sales tax on online purchases has become a complex issue. Idaho, like many states, has implemented laws requiring remote sellers to collect and remit sales tax under certain circumstances. This is known as economic nexus, where a business’s economic activity in the state, regardless of physical presence, triggers a sales tax collection obligation.

The threshold for economic nexus in Idaho is sales exceeding $100,000 or 200 transactions in a calendar year. This means that many online businesses, especially those with a significant Idaho customer base, may be required to collect and remit sales tax to the state.

Sales Tax Returns and Compliance

Businesses operating in Idaho must remit sales tax to the state on a regular basis. The frequency of these remittances depends on the business’s tax liability. Larger businesses with significant sales may be required to remit sales tax monthly, while smaller businesses may be able to remit quarterly or even annually.

Compliance with Idaho's sales tax laws is critical for businesses to avoid penalties and maintain good standing with the state. This includes accurate reporting of sales, proper collection and remittance of sales tax, and staying up-to-date with any changes to the state's tax laws and regulations.

The Future of Sales Tax in Idaho

The landscape of sales tax in Idaho is not static. As the state’s economy evolves and new technologies reshape the way business is conducted, the tax system will likely undergo changes. For instance, the rise of the gig economy and the increasing popularity of online sales present new challenges for tax collection and compliance.

Additionally, there are ongoing discussions at both the state and national levels about the fairness and efficiency of sales tax systems. Some propose a shift towards a consumption-based tax system, while others advocate for more uniform sales tax rates across states to simplify compliance and reduce administrative burdens for businesses.

Conclusion: Navigating Idaho’s Sales Tax Landscape

Idaho’s sales tax system is a complex but essential component of the state’s fiscal framework. For businesses, understanding and complying with Idaho’s sales tax laws is a critical aspect of their operations, impacting pricing, budgeting, and tax compliance strategies. The state’s variable sales tax rates, exemptions, and economic nexus rules present unique challenges that require a nuanced understanding of the tax system.

For consumers, being aware of the sales tax rates in their area and understanding the impact of these taxes on their purchases is crucial for financial planning and budgeting. As Idaho's economy continues to evolve, staying informed about changes to the sales tax system will be increasingly important for both businesses and individuals.

Are there any sales tax holidays in Idaho?

+Yes, Idaho occasionally offers sales tax holidays, typically for back-to-school shopping or energy-efficient appliances. These holidays waive sales tax for certain items during specified periods. Check the Idaho State Tax Commission’s website for the latest information.

What is the penalty for non-compliance with Idaho’s sales tax laws?

+Penalties for non-compliance can be significant, including fines, interest, and potential criminal charges. The Idaho State Tax Commission can assess penalties for late or incorrect filings, as well as for underreported sales. It’s crucial for businesses to understand their obligations and seek professional advice if needed.

How does Idaho handle sales tax for online sales?

+Idaho has implemented economic nexus laws, which require remote sellers to collect and remit sales tax if they meet certain thresholds of sales or transactions in the state. This applies to many online businesses, especially those with a significant Idaho customer base.