Unpaid Property Taxes

Property taxes are a significant source of revenue for local governments and municipalities, contributing to the funding of essential public services such as education, infrastructure development, and emergency response. However, when property owners fail to pay their taxes, it can lead to a cascade of issues that affect not only the government but also the community and the property owners themselves.

This article aims to delve into the complex world of unpaid property taxes, exploring the reasons behind these defaults, the legal implications, and the potential consequences for all stakeholders involved. By examining real-world examples and industry data, we will provide a comprehensive understanding of this issue and offer insights into effective strategies for managing and mitigating the impact of unpaid property taxes.

The Impact of Unpaid Property Taxes

Unpaid property taxes can have far-reaching consequences that extend beyond the individual property owner. Local governments rely heavily on property tax revenue to maintain and improve the community’s infrastructure, schools, and emergency services. When a significant portion of property owners fail to pay their taxes, it creates a funding gap, impacting the overall quality of life in the area.

Financial Strain on Local Governments

The immediate effect of unpaid property taxes is a financial strain on local governments. This strain can lead to budget cuts, delayed payments to service providers, and even the reduction or elimination of essential services. For example, a 2020 report by the National Association of Counties (NACo) revealed that counties across the United States experienced a 3.8% decline in property tax revenue due to the COVID-19 pandemic, forcing many to make difficult decisions regarding public spending.

| Year | Property Tax Revenue Decline |

|---|---|

| 2020 | 3.8% |

| 2019 | 2.1% |

In extreme cases, prolonged periods of unpaid property taxes can lead to a debt crisis for local governments, hindering their ability to borrow funds for critical projects and potentially impacting their creditworthiness.

Community Infrastructure and Services

The ripple effect of unpaid property taxes is evident in the deterioration of community infrastructure and the reduction of essential services. As local governments struggle to balance their budgets, they may be forced to delay or cancel maintenance projects, leading to declining road conditions, underfunded public safety initiatives, and reduced support for public schools.

For instance, in Detroit, Michigan, a city grappling with high rates of unpaid property taxes, the lack of revenue has contributed to a 15% decrease in police officer staffing between 2010 and 2017, according to a report by The Detroit News. This reduction in public safety resources can have a profound impact on the community's well-being.

Property Owners’ Legal and Financial Woes

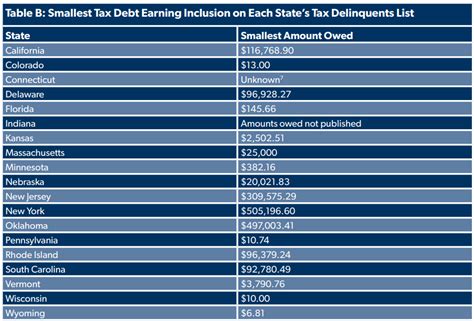

Unpaid property taxes not only affect local governments but also create significant legal and financial challenges for property owners. Most jurisdictions have legal mechanisms in place to enforce tax collection, and failure to comply can result in severe consequences.

One common strategy employed by local governments is the lien process. A lien is a legal claim against a property that gives the local government the right to sell the property to recover unpaid taxes. This process can lead to foreclosure, where the property is sold at a public auction, often resulting in the owner losing their property.

| Jurisdiction | Lien Process Duration |

|---|---|

| California | 5 years |

| Texas | 2 years |

| New York | 3 years |

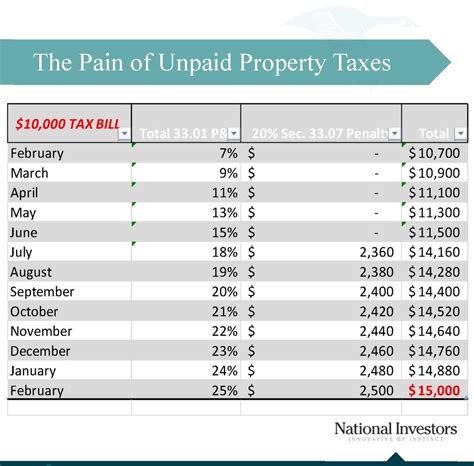

Furthermore, property owners with unpaid taxes may face interest and penalty charges, which can quickly accumulate, making it even more challenging to catch up on payments. In some cases, these charges can exceed the original tax amount, putting property owners in a difficult financial position.

Reasons Behind Unpaid Property Taxes

Understanding the reasons why property owners fail to pay their taxes is crucial for developing effective strategies to address this issue. While there are various factors at play, some common causes include financial hardship, lack of awareness, and disputes over tax assessments.

Financial Hardship and Economic Downturns

One of the primary reasons for unpaid property taxes is financial hardship. Economic downturns, job losses, and unexpected expenses can strain household budgets, making it challenging for property owners to keep up with their tax obligations. During such times, many individuals may prioritize basic necessities over tax payments.

The Great Recession of 2008 provides a stark example of the impact of economic crises on property tax collections. According to a study by the Lincoln Institute of Land Policy, property tax delinquencies more than doubled in some states during this period, with states like Nevada and Florida experiencing a dramatic increase in foreclosures due to unpaid taxes.

Lack of Awareness and Miscommunication

Another factor contributing to unpaid property taxes is a lack of awareness or understanding of tax obligations. Property owners, especially those new to an area or first-time homeowners, may not be fully informed about the tax payment process, due dates, and potential consequences of non-payment.

Clear and effective communication from local governments is essential to ensure property owners are aware of their responsibilities. Some jurisdictions have implemented digital platforms and mobile apps to improve tax collection efficiency and provide real-time information to taxpayers.

Disputes and Challenges with Tax Assessments

Disputes over tax assessments can also lead to non-payment. Property owners who believe their tax assessment is unfair or inaccurate may withhold payment until the issue is resolved. These disputes can arise due to errors in property valuation, changes in the property’s condition, or disagreements over tax rates.

In such cases, local governments should establish transparent and accessible appeal processes to address these concerns. By providing a clear path for property owners to challenge assessments, governments can encourage compliance and reduce the likelihood of deliberate non-payment.

Strategies for Managing Unpaid Property Taxes

Addressing the issue of unpaid property taxes requires a multi-faceted approach that involves both proactive measures and effective enforcement strategies. Here are some strategies that local governments and communities can implement to mitigate the impact of unpaid taxes and improve collection rates.

Early Intervention and Payment Plans

One effective strategy is to implement early intervention programs that identify property owners who are at risk of non-payment. By reaching out to these individuals proactively, local governments can offer payment plans and financial assistance to help them manage their tax obligations.

For instance, the city of Seattle has a Property Tax Relief Program that provides partial tax exemptions to low-income seniors and individuals with disabilities. This program not only helps vulnerable individuals stay in their homes but also reduces the likelihood of tax delinquency.

Enhanced Communication and Outreach

Improving communication between local governments and property owners is crucial for fostering a culture of compliance. Governments should utilize a variety of communication channels, including email notifications, text messages, and social media campaigns, to remind taxpayers of upcoming due dates and provide information about payment options.

Additionally, hosting community workshops and town hall meetings can create a platform for open dialogue, allowing property owners to voice their concerns and receive personalized guidance on tax-related matters.

Efficient Tax Collection Systems

Investing in modern tax collection systems can significantly improve efficiency and reduce administrative burdens. Online payment portals and mobile apps not only provide convenience to taxpayers but also streamline the payment process for local governments, reducing the likelihood of errors and delays.

Furthermore, integrating data analytics into tax collection systems can help identify trends and patterns in non-payment, enabling governments to allocate resources more effectively and develop targeted intervention strategies.

Enforcement and Legal Remedies

While proactive measures are essential, local governments must also have robust enforcement mechanisms in place to address chronic non-payment. The lien process, as mentioned earlier, is a critical tool for recovering unpaid taxes. However, governments should ensure that this process is fair and transparent, providing property owners with ample notice and opportunities to resolve their tax debts.

In addition to liens, local governments may consider other legal remedies, such as wage garnishment or bank account levies, to collect unpaid taxes. These measures should be used as a last resort and in compliance with local laws and regulations to avoid unnecessary hardship for taxpayers.

The Role of Tax Assessor Offices

Tax assessor offices play a crucial role in ensuring fair and accurate property tax assessments, which can help prevent disputes and reduce the likelihood of non-payment. These offices are responsible for evaluating the value of properties within their jurisdiction and assigning tax rates accordingly.

Fair and Accurate Assessments

By conducting thorough and unbiased assessments, tax assessor offices can build trust with property owners and reduce the potential for disputes. This involves considering various factors, such as market value, property improvements, and any applicable exemptions.

For example, the Orange County Property Appraiser's Office in Florida provides detailed explanations of their assessment methodology on their website, ensuring transparency and helping property owners understand the basis for their tax obligations.

Appeal Processes and Resolution

Establishing a clear and accessible appeal process is essential for resolving disputes over tax assessments. Tax assessor offices should provide property owners with a step-by-step guide on how to challenge an assessment, including the necessary documentation and timelines.

Many jurisdictions offer informal review boards or mediation services to facilitate the resolution of tax disputes. These alternative dispute resolution methods can help property owners reach a fair agreement without the need for costly and time-consuming litigation.

The Future of Property Tax Collection

As technology continues to advance, the future of property tax collection holds the promise of increased efficiency and improved taxpayer experience. Here are some potential developments that could shape the landscape of property tax collection in the coming years.

Blockchain and Smart Contracts

Blockchain technology and smart contracts have the potential to revolutionize property tax collection by creating a secure and transparent system for record-keeping and payment processing. Smart contracts, which are self-executing contracts with the terms of the agreement directly written into code, can automate various aspects of the tax collection process, reducing administrative overhead and minimizing errors.

For instance, a blockchain-based property tax system could automatically trigger tax payments based on predetermined conditions, such as the sale of a property or the completion of a building project. This would ensure timely and accurate payments, reducing the need for manual interventions.

Artificial Intelligence and Data Analytics

Artificial Intelligence (AI) and data analytics can be leveraged to identify patterns and predict potential non-payment. By analyzing historical data and taxpayer behavior, local governments can develop targeted intervention strategies and allocate resources more efficiently.

AI-powered systems can also assist in automating certain aspects of the tax assessment process, such as property valuation and the identification of tax-exempt properties. This can help tax assessor offices keep up with changing market conditions and ensure accurate assessments.

Community Engagement and Incentives

Engaging the community in the tax collection process can foster a sense of responsibility and encourage compliance. Local governments can explore innovative approaches, such as community tax incentives, where taxpayers who consistently pay their taxes on time are rewarded with discounts or other benefits.

Additionally, governments can collaborate with community organizations and local businesses to promote tax literacy and provide support to vulnerable taxpayers, ensuring that everyone has the resources and knowledge to meet their tax obligations.

Conclusion

Unpaid property taxes are a complex issue that affects local governments, communities, and property owners alike. By understanding the causes, consequences, and potential solutions, we can work towards a more sustainable and equitable tax system. Through a combination of proactive measures, effective communication, and technological innovations, we can strive for a future where property tax collection is efficient, fair, and beneficial to all stakeholders.

What happens if I can’t pay my property taxes on time?

+

If you’re unable to pay your property taxes on time, it’s important to reach out to your local government or tax assessor’s office to discuss your options. They may offer payment plans or financial assistance programs to help you manage your tax obligations. Ignoring the issue can lead to penalties, interest charges, and potential legal consequences, including liens or foreclosure.

How can I challenge a property tax assessment if I believe it’s unfair?

+

If you disagree with your property tax assessment, you have the right to appeal. Contact your local tax assessor’s office to inquire about their appeal process. They will provide you with the necessary steps, which often involve submitting documentation and attending a hearing to present your case. It’s important to act promptly, as there are typically strict deadlines for filing an appeal.

Are there any programs or assistance available for low-income property owners to help with tax payments?

+

Yes, many jurisdictions have programs in place to assist low-income property owners with their tax payments. These programs may offer partial tax exemptions, grants, or low-interest loans. Reach out to your local government or tax assessor’s office to inquire about the specific programs available in your area and the eligibility requirements.