Washington County Taxes

Washington County, nestled in the heart of [State], is renowned for its picturesque landscapes, vibrant communities, and a thriving economy. However, alongside its natural and cultural allure, the county's tax system plays a pivotal role in shaping its financial landscape. This article delves into the intricacies of Washington County taxes, offering an in-depth analysis of the tax structure, its impact on residents and businesses, and its unique features.

Understanding Washington County’s Tax Structure

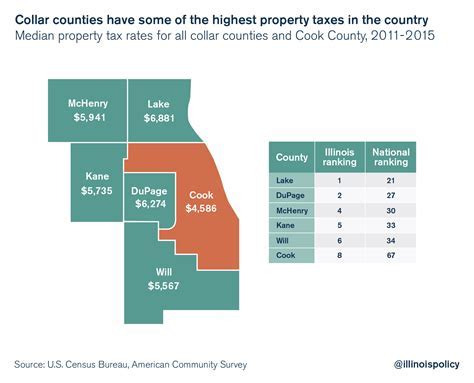

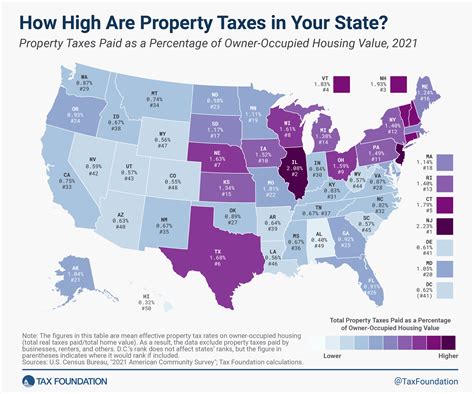

Washington County’s tax system is a complex interplay of various tax categories, each serving a specific purpose and contributing to the overall financial health of the county. At the core of this system are property taxes, which form a significant portion of the county’s revenue. The county assesses properties annually, taking into account factors such as location, size, and recent sales data to determine the fair market value. This value is then used to calculate the property tax liability for each homeowner or business owner.

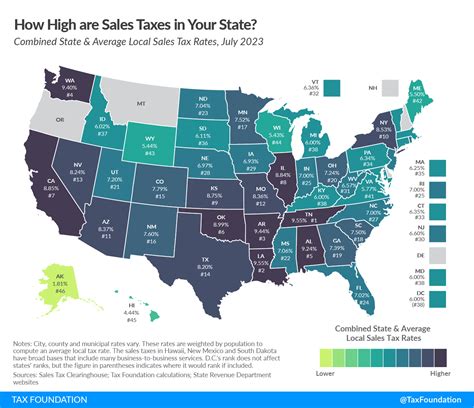

In addition to property taxes, Washington County levies a range of other taxes to generate revenue. These include sales taxes, which are applied to various goods and services purchased within the county, providing a steady stream of income for essential services and infrastructure projects. The county also collects income taxes from residents and businesses, contributing to the overall tax base. Furthermore, specialized taxes, such as vehicle registration fees and business license taxes, add to the diverse revenue streams of Washington County.

| Tax Category | Description |

|---|---|

| Property Tax | Based on property value, it is a primary source of revenue for the county. |

| Sales Tax | Applied to goods and services, it funds public services and projects. |

| Income Tax | Collected from residents and businesses, contributing to the tax base. |

| Vehicle Registration Fee | A specialized tax for vehicle owners, supporting transportation infrastructure. |

| Business License Tax | Paid by businesses, it contributes to the county's revenue stream. |

Property Taxes: A Closer Look

Property taxes in Washington County are assessed at a uniform rate across the county, ensuring fairness and consistency. The assessment process involves a detailed evaluation of each property, taking into account its unique characteristics. This includes the property’s physical attributes, such as square footage, number of rooms, and any recent renovations or improvements. Additionally, the assessor considers the property’s location and its proximity to amenities, as well as any environmental factors that may impact its value.

Once the property's value is determined, the county applies a tax rate, which is set annually by the county commissioners. This rate is typically expressed as a percentage of the assessed value, and it can vary slightly from year to year. The resulting tax liability is then divided into installments, with payments due at specified intervals throughout the year. This system ensures a steady flow of revenue for the county, allowing for efficient planning and management of public services.

Sales Taxes: Supporting the Community

Washington County’s sales tax is an essential component of its tax structure, providing a significant portion of revenue for the county’s operations. The sales tax is applied to a wide range of goods and services, including groceries, clothing, electronics, and entertainment. This tax is collected at the point of sale, with businesses acting as agents for the county, remitting the collected tax to the appropriate authorities.

The revenue generated from sales taxes is used to fund a variety of public services and infrastructure projects. This includes maintaining and improving roads and transportation networks, supporting local schools and educational institutions, and providing essential services such as fire protection, emergency medical services, and law enforcement. Additionally, sales tax revenue contributes to the county's budget for community development initiatives, ensuring a vibrant and thriving local economy.

Income Taxes: Contributing to the Tax Base

Washington County collects income taxes from both individuals and businesses operating within its boundaries. These taxes are a vital source of revenue, helping to sustain the county’s financial stability and support its various initiatives. For individuals, the income tax is typically calculated based on their taxable income, which takes into account deductions and credits. The tax rate can vary depending on the taxpayer’s income bracket and may be subject to changes annually.

Businesses, on the other hand, are subject to different tax rates and structures depending on their legal entity and revenue. Washington County offers a range of incentives and tax benefits to attract and retain businesses, promoting economic growth and job creation. These incentives may include tax credits for job creation, research and development, or investments in renewable energy. By providing a supportive business environment, the county aims to foster a thriving economic ecosystem, benefiting both residents and the local economy.

Specialized Taxes: Targeted Revenue Streams

In addition to the core tax categories, Washington County utilizes specialized taxes to generate targeted revenue for specific purposes. One such tax is the vehicle registration fee, which is paid by vehicle owners annually or biennially, depending on the vehicle’s age and type. This fee contributes to the county’s transportation fund, supporting the maintenance and improvement of roads, bridges, and other transportation infrastructure. By ensuring a dedicated revenue stream, the county can effectively plan and execute infrastructure projects, enhancing the overall quality of life for its residents.

Another specialized tax is the business license tax, which is levied on businesses operating within Washington County. This tax varies depending on the nature of the business, its size, and the services it provides. The revenue generated from this tax is often earmarked for specific purposes, such as economic development initiatives, small business support programs, or community enhancement projects. By targeting these specialized taxes, the county can allocate resources efficiently, addressing the unique needs and priorities of its diverse business community.

Impact of Washington County Taxes on Residents and Businesses

The tax system in Washington County has a profound impact on both residents and businesses, shaping their financial obligations and influencing their decision-making processes. For residents, the property tax is a significant expense, often constituting a substantial portion of their annual household expenses. The tax liability can vary based on the value of their property, the tax rate, and any applicable exemptions or deductions. Understanding the property tax system is crucial for residents to effectively manage their finances and plan for the future.

Similarly, businesses operating in Washington County are subject to a range of taxes, including property taxes, income taxes, and specialized taxes. The tax obligations can vary significantly depending on the nature and size of the business, impacting their profitability and growth prospects. Businesses must carefully navigate the tax landscape, taking advantage of available incentives and deductions to minimize their tax burden while remaining compliant with the law. The tax system's impact on businesses extends beyond financial considerations, influencing their strategic decisions, such as expansion plans, investment strategies, and workforce management.

Tax Incentives and Exemptions: Encouraging Growth

Washington County recognizes the importance of fostering a business-friendly environment and encourages economic growth through a range of tax incentives and exemptions. These incentives are designed to attract new businesses, support existing ones, and promote job creation. One common incentive is the property tax abatement, where businesses can receive a reduction or exemption from property taxes for a specified period, typically in exchange for meeting certain criteria, such as creating a certain number of jobs or making significant investments in the community.

Additionally, the county offers tax credits for businesses engaged in research and development, renewable energy projects, or those that provide specific community benefits. These credits can offset a portion of the business's tax liability, providing a financial boost and encouraging innovative and sustainable practices. Washington County also provides tax incentives for businesses that locate in designated economic development zones, aiming to stimulate growth and investment in targeted areas. By offering these incentives, the county aims to create a competitive business environment, attract new industries, and support the long-term prosperity of its residents and businesses.

Community Development and Tax Revenue Allocation

The revenue generated from Washington County’s tax system is allocated strategically to support community development initiatives and improve the overall quality of life for its residents. A significant portion of the tax revenue is dedicated to education, ensuring that local schools receive the necessary funding for infrastructure, technology, and teacher support. This investment in education contributes to a well-rounded and thriving community, attracting families and businesses alike.

Furthermore, tax revenue is directed towards healthcare initiatives, enhancing access to quality medical services and supporting public health programs. The county also invests in transportation infrastructure, using tax funds to maintain and upgrade roads, bridges, and public transportation systems. These improvements not only enhance mobility but also contribute to economic growth by facilitating efficient movement of goods and people. Additionally, Washington County allocates tax revenue to cultural and recreational amenities, such as parks, museums, and community centers, enriching the lives of its residents and promoting a vibrant local culture.

Future Implications and Potential Reforms

As Washington County continues to evolve and adapt to changing economic and social landscapes, its tax system will play a crucial role in shaping its future. The county’s leadership and tax authorities are tasked with the challenging responsibility of ensuring that the tax system remains fair, efficient, and responsive to the needs of its residents and businesses. This entails regularly reviewing and updating tax policies, rates, and structures to maintain a competitive and sustainable fiscal environment.

One potential area of reform is the property tax system, which is often a subject of discussion and debate. Washington County could explore alternatives to the current assessment process, such as implementing a property value cap or limiting the annual increase in assessed values. These measures could provide relief to homeowners and businesses, especially in times of rapid economic growth or inflation. Additionally, the county could consider introducing or expanding tax credits and exemptions for low-income residents or homeowners facing financial hardships, ensuring that the tax system remains equitable and supportive of all members of the community.

In the business landscape, Washington County may consider further incentives and reforms to attract and retain businesses, particularly in industries that align with the county's economic development goals. This could involve offering tax breaks or streamlined processes for businesses engaged in sustainable practices, technology innovation, or community-focused initiatives. By actively engaging with the business community and understanding their needs, the county can create a tax environment that fosters growth, encourages investment, and positions Washington County as a desirable location for businesses to thrive.

How are property taxes calculated in Washington County?

+

Property taxes in Washington County are calculated based on the assessed value of the property and the tax rate set by the county commissioners. The assessed value is determined by considering factors such as location, size, and recent sales data. The tax rate is expressed as a percentage of the assessed value and can vary slightly from year to year.

What is the sales tax rate in Washington County?

+

The sales tax rate in Washington County varies depending on the type of goods or services being purchased. The county collects sales tax on a wide range of items, including groceries, clothing, electronics, and entertainment. The specific rate may be subject to change, so it’s advisable to check with the county’s tax authority for the most up-to-date information.

Are there any tax incentives for businesses in Washington County?

+

Yes, Washington County offers a range of tax incentives to attract and support businesses. These incentives may include property tax abatements, tax credits for research and development, renewable energy projects, and community benefits. The county aims to create a business-friendly environment by offering these incentives and fostering economic growth.

How does Washington County allocate its tax revenue?

+

Washington County allocates its tax revenue to support various community development initiatives. A significant portion goes towards education, healthcare, transportation infrastructure, and cultural amenities. The county strategically invests in these areas to enhance the quality of life for its residents and promote a thriving local economy.

What potential reforms are being considered for Washington County’s tax system?

+

Washington County is exploring potential reforms to its tax system to ensure fairness and sustainability. This may include reforms to the property tax system, such as implementing value caps or limiting annual increases in assessed values. The county is also considering expanding tax credits and exemptions for low-income residents and providing further incentives for businesses engaged in sustainable practices and community initiatives.