Sales Tax In Florida On Cars

Understanding the sales tax landscape in Florida, especially when purchasing big-ticket items like cars, is crucial for consumers and businesses alike. Florida's sales tax system, while straightforward in many aspects, can present nuances and variations that impact the overall cost of purchasing a vehicle. This comprehensive guide aims to demystify the sales tax process in Florida, focusing specifically on the purchase of cars, to help you navigate the financial aspects of your next automotive acquisition with confidence.

The Fundamentals of Florida Sales Tax

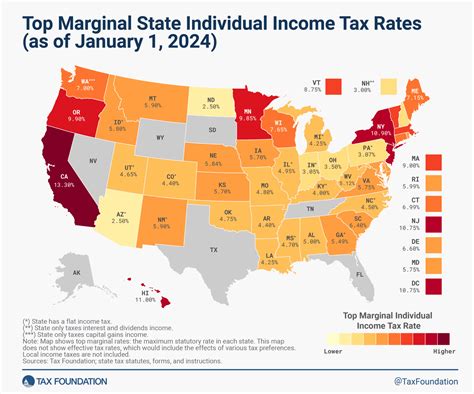

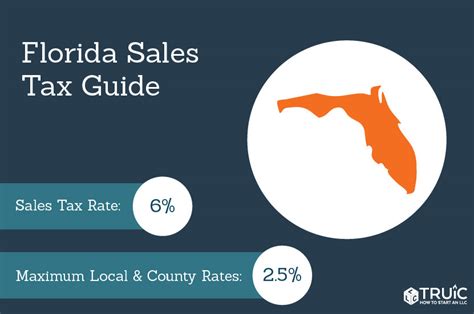

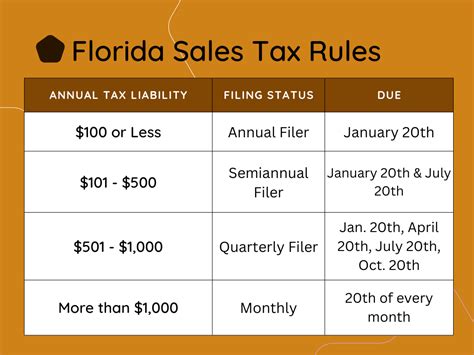

Florida’s sales tax structure is a key component of the state’s revenue system, applicable to various goods and services. At its core, the state imposes a standard sales tax rate of 6% on most tangible personal property and certain services. However, it’s important to note that local governments, including counties and municipalities, have the authority to levy additional sales taxes, resulting in variations across the state.

When purchasing a car in Florida, the sales tax due is calculated based on the purchase price of the vehicle, including any optional equipment, dealer preparation fees, and destination charges. This total amount, often referred to as the gross sales price, forms the basis for determining the sales tax liability.

An Illustrative Example

Let's consider a hypothetical scenario where you're purchasing a new car in Miami-Dade County, which has an additional 1% sales tax on top of the state's standard rate. If you're buying a car with a gross sales price of $30,000, here's how the sales tax calculation would break down:

| Component | Amount |

|---|---|

| State Sales Tax (6%) | $1,800 |

| County Sales Tax (1%) | $300 |

| Total Sales Tax | $2,100 |

In this example, you would owe a total sales tax of $2,100 on the purchase of your new car.

Special Considerations for Vehicle Sales

While the sales tax on cars follows a standard structure, there are certain considerations and exceptions that buyers should be aware of. These nuances can impact the overall tax liability and purchasing process.

Leased Vehicles

For individuals leasing a vehicle in Florida, the sales tax calculation differs from that of a traditional purchase. In this case, the tax is applied to each monthly lease payment, including any applicable county or local surcharges. It's important to factor this into the overall cost of leasing a car, as it can significantly impact the total financial commitment.

Vehicle Registration and Title Fees

In addition to sales tax, buyers in Florida should also anticipate various fees associated with registering and titling their newly purchased vehicle. These fees, which are separate from sales tax, can include title transfer fees, registration fees, and license plate fees. These costs can vary based on the type of vehicle, its age, and the county in which it is registered.

Exemptions and Special Programs

Florida offers certain exemptions and special programs that can impact the sales tax liability for specific categories of vehicles or buyers. For instance, military personnel and veterans may be eligible for tax exemptions on vehicle purchases. Additionally, Florida has implemented the Florida Affordable Solar Energy Choice Act, which provides a 100% sales tax exemption for the purchase of certain electric vehicles (EVs) and associated charging equipment.

Understanding the Process

The sales tax process in Florida, particularly for vehicle purchases, involves a series of steps that buyers should familiarize themselves with. These steps ensure compliance with state and local tax regulations and facilitate a smooth transaction.

Step-by-Step Guide

- Determine the Sales Tax Rate: Start by identifying the applicable sales tax rate for your county or municipality. This information is readily available on the Florida Department of Revenue's website or through your local tax office.

- Calculate the Sales Tax: Use the gross sales price of your vehicle to calculate the sales tax due. This can be done manually or by using online calculators, ensuring accuracy in the process.

- Include Additional Fees: Besides sales tax, factor in other fees such as title transfer fees, registration fees, and license plate fees. These fees can be estimated based on your vehicle's specifications and the county where it will be registered.

- Verify Exemptions and Programs: Check if you qualify for any exemptions or special programs that could reduce your tax liability. This step is crucial for ensuring you receive any applicable benefits.

- Submit the Necessary Documentation: When purchasing a vehicle, ensure you provide the necessary documentation to the dealer or seller. This typically includes proof of identity, residency, and vehicle ownership, along with any relevant tax exemption certificates.

- Pay the Sales Tax: The sales tax is typically paid at the time of purchase, along with the vehicle's purchase price. Ensure that you receive a proper receipt or documentation of payment to avoid any potential issues in the future.

By following these steps and staying informed about Florida's sales tax regulations, you can navigate the process of purchasing a car with confidence and ensure compliance with the state's tax requirements.

Future Implications and Considerations

The sales tax landscape in Florida, particularly concerning vehicle purchases, is subject to potential changes and developments that buyers should remain aware of. These changes can impact the overall cost of purchasing a car and the tax liability associated with it.

Potential Rate Changes

While the state’s standard sales tax rate of 6% has remained stable, local governments have the authority to adjust their sales tax rates. This means that counties and municipalities can increase or decrease their sales tax, impacting the overall tax liability for vehicle purchases. It’s crucial for buyers to stay informed about any potential rate changes in their area to accurately estimate their tax liability.

Impact of Technological Advancements

The rise of electric vehicles (EVs) and autonomous vehicles presents a unique challenge to Florida’s sales tax system. As the state works to incentivize the adoption of EVs through programs like the Florida Affordable Solar Energy Choice Act, the sales tax landscape for these vehicles may continue to evolve. Additionally, the potential for remote vehicle purchases, facilitated by technological advancements, could impact the jurisdiction in which sales tax is applied, adding another layer of complexity to the sales tax process.

Environmental and Policy Considerations

Florida’s commitment to environmental sustainability and its efforts to reduce greenhouse gas emissions may influence future sales tax policies. The state’s Clean Car Standards and initiatives to promote the adoption of electric vehicles could lead to further incentives or tax breaks for buyers of eco-friendly vehicles. On the other hand, the state’s ongoing debate over toll roads and transportation infrastructure funding could impact the overall tax burden for vehicle owners.

The Role of Online Sales

With the increasing popularity of online vehicle sales platforms, the question of sales tax jurisdiction becomes more complex. As buyers have the option to purchase vehicles from out-of-state dealers or private sellers, the determination of the applicable sales tax rate and jurisdiction can become challenging. This trend highlights the need for clear guidelines and regulations to ensure compliance and fairness in the sales tax process.

Legislative Updates and Policy Changes

Florida’s sales tax regulations are subject to legislative updates and policy changes, which can impact the tax liability for vehicle purchases. It’s essential for buyers and businesses to stay informed about any proposed or enacted legislation that could affect the sales tax landscape. This includes changes to the standard sales tax rate, the introduction of new taxes or fees, or the modification of existing exemptions and special programs.

How do I know if I’m eligible for any sales tax exemptions in Florida?

+Florida offers various sales tax exemptions for specific categories of vehicles or buyers. To determine your eligibility, you should consult the Florida Department of Revenue’s website or seek guidance from a tax professional. Common exemptions include those for military personnel, veterans, and the purchase of certain electric vehicles (EVs) under the Florida Affordable Solar Energy Choice Act.

Can I negotiate the sales tax on my vehicle purchase?

+The sales tax on a vehicle purchase is a legally mandated tax, and as such, it is not typically negotiable. However, you can negotiate the overall purchase price of the vehicle, which can indirectly impact the sales tax liability. It’s important to note that any reduction in the gross sales price will result in a lower sales tax amount.

What happens if I fail to pay the sales tax on my vehicle purchase?

+Failing to pay the sales tax on your vehicle purchase can result in penalties and interest charges. It’s important to ensure that you pay the sales tax in full and on time to avoid these additional costs and potential legal consequences. If you have any concerns or questions about your sales tax liability, it’s advisable to consult with a tax professional.