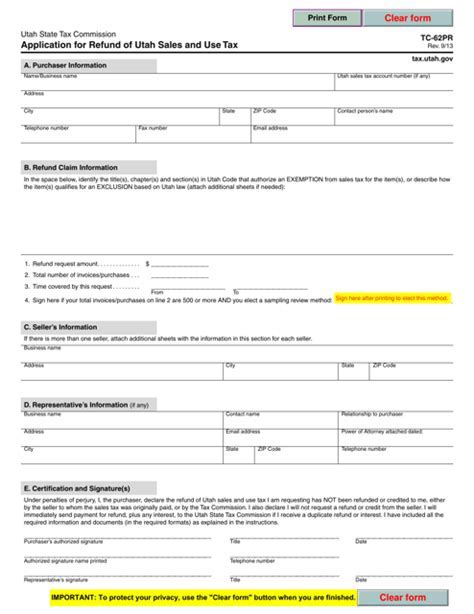

Utah Tax Refund Information

In the state of Utah, tax refunds are an important aspect of the financial landscape, offering residents and businesses a chance to reclaim overpaid taxes and providing a much-needed financial boost. The Utah State Tax Commission is responsible for processing tax refunds, ensuring a smooth and efficient system for residents to navigate. Understanding the process, timelines, and eligibility criteria is essential for anyone looking to claim a refund.

Understanding Utah’s Tax Refund Process

The Utah Tax Commission initiates the refund process after receiving and processing your tax return. The timeline for refunds varies depending on the method of filing and payment. For instance, those who e-file and choose direct deposit as their refund method can expect their refund within 7-10 business days. On the other hand, traditional mail-in filers may have to wait up to 6-8 weeks for their refund to arrive.

Online Tracking and Status Updates

The Utah Tax Commission provides an online service for tracking refund status. You can visit their official website and use your unique identifier, such as your Social Security Number or Tax ID, to check the progress of your refund. This real-time update system ensures that taxpayers stay informed about the status of their refund, providing transparency and reducing uncertainty.

| Refund Method | Estimated Timeframe |

|---|---|

| E-File with Direct Deposit | 7-10 business days |

| Mail-In Filing | 6-8 weeks |

Eligibility and Criteria for Refunds

To be eligible for a tax refund in Utah, you must have overpaid your taxes. This overpayment can occur for various reasons, including incorrect tax withholding by your employer, excess payments made during the year, or eligible deductions and credits claimed on your tax return. The Utah Tax Commission provides a comprehensive guide on their website, detailing the various scenarios that can lead to a tax refund.

Maximizing Your Tax Refund

While the primary purpose of a tax refund is to reclaim overpaid taxes, there are strategies to maximize this refund and make it work harder for you. Here are some tips to consider:

Claiming All Eligible Deductions and Credits

The Utah Tax Commission offers various deductions and credits that can reduce your tax liability. These include credits for dependent children, education expenses, and even energy-efficient home improvements. By ensuring you claim all eligible deductions and credits, you can significantly increase your refund.

Filing Early

Filing your tax return early not only ensures you receive your refund sooner but also reduces the risk of potential errors or delays. The Utah Tax Commission processes refunds on a first-come, first-served basis, so filing early can be advantageous.

Direct Deposit

Opting for direct deposit as your refund method is not only faster but also more secure. It eliminates the risk of mail-related delays or potential loss and ensures your refund is deposited directly into your designated bank account.

Common Misconceptions and Pitfalls

Despite the straightforward process, there are common misconceptions and pitfalls that taxpayers should be aware of:

Understanding the Difference Between a Refund and a Rebate

A tax refund is a reimbursement of overpaid taxes, while a rebate is a reduction in the current year’s tax liability. It’s essential to understand the difference to ensure you’re claiming the correct amount and not missing out on potential benefits.

Avoiding Scams and Fraud

With the increase in online tax filing, there has been a rise in tax-related scams. The Utah Tax Commission warns taxpayers to be vigilant and aware of potential scams, such as phishing emails or fake refund websites. Always ensure you are using the official Utah Tax Commission website and services to protect your personal and financial information.

The Future of Tax Refunds in Utah

The Utah State Tax Commission is continuously working to improve its refund system, with a focus on efficiency and security. The future of tax refunds in Utah looks promising, with potential advancements in online filing systems and faster refund processing times. The Commission is also exploring ways to better educate taxpayers on eligible deductions and credits, ensuring they receive the maximum refund possible.

The Impact of Technological Advancements

With the rapid advancement of technology, the Utah Tax Commission is investing in innovative solutions to streamline the refund process. This includes the potential use of artificial intelligence and machine learning to process refunds more efficiently and accurately. These technological advancements could lead to quicker refund times and a more seamless experience for taxpayers.

Expanding Eligibility and Awareness

The Utah Tax Commission is committed to ensuring all eligible taxpayers receive their refunds. As such, they are working to increase awareness of eligible deductions and credits, especially among underserved communities. By expanding outreach efforts and providing educational resources, the Commission aims to ensure no taxpayer misses out on their rightful refund.

How do I check the status of my Utah tax refund?

+You can check the status of your Utah tax refund by visiting the official Utah State Tax Commission website and using their online refund status tracker. You’ll need your Social Security Number or Tax ID to access this service.

What if my refund is delayed or I haven’t received it after the estimated timeframe?

+If your refund is delayed or you haven’t received it after the estimated timeframe, you should contact the Utah State Tax Commission. They will be able to provide you with an update on your refund status and offer guidance if there are any issues.

Can I receive my refund via check instead of direct deposit?

+Yes, you can choose to receive your refund via check instead of direct deposit. However, please note that this may result in a longer processing time, as checks are mailed out separately.