Income Tax Rate Of Canada

The income tax system in Canada is a vital component of the country's economic framework, impacting individuals and businesses alike. Understanding the nuances of Canada's tax structure is essential for financial planning and decision-making. This article aims to provide an in-depth exploration of the income tax rates in Canada, offering a comprehensive guide to the current rates, how they are calculated, and their implications for taxpayers.

Income Tax Rates in Canada: A Comprehensive Overview

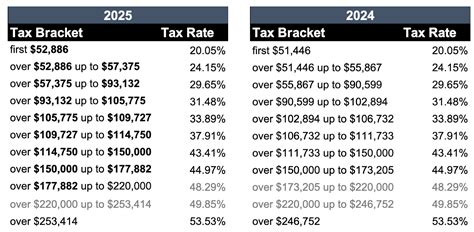

Canada's tax system operates on a progressive basis, meaning that higher income levels are subject to higher tax rates. This structure ensures a fair distribution of tax obligations across different income brackets. The income tax rates in Canada are determined by the federal government, with provinces and territories also imposing their own tax rates. This dual taxation system means that individuals and businesses pay taxes to both the federal government and their respective provincial or territorial governments.

Federal Income Tax Rates

As of [current year], the federal income tax rates in Canada are as follows:

| Income Bracket (in CAD) | Tax Rate |

|---|---|

| Up to $49,020 | 15% |

| $49,021 - $98,040 | 20.5% |

| $98,041 - $151,978 | 26% |

| $151,979 - $216,511 | 29% |

| Over $216,511 | 33% |

These rates are applied to taxable income, which is the amount remaining after eligible deductions and credits are applied. The tax brackets are designed to ensure that individuals with higher incomes contribute a larger proportion of their income to the tax system.

Provincial and Territorial Income Tax Rates

In addition to federal income taxes, Canadians are also subject to provincial or territorial income taxes. These rates vary across the country, with each province and territory setting its own tax structure. For instance, in the province of Ontario, the income tax rates for [current year] are:

| Income Bracket (in CAD) | Tax Rate |

|---|---|

| Up to $45,479 | 5.05% |

| $45,480 - $90,958 | 9.15% |

| $90,959 - $151,932 | 11.16% |

| $151,933 - $220,000 | 12.16% |

| Over $220,000 | 13.16% |

These provincial rates are applied on top of the federal income tax rates, resulting in a combined federal and provincial tax liability for individuals. The variations in provincial tax rates can lead to significant differences in the overall tax burden for individuals residing in different parts of the country.

Calculating Income Tax Liability

Determining one's income tax liability in Canada involves a multi-step process. First, individuals must calculate their taxable income by subtracting eligible deductions and credits from their total income. This taxable income is then divided into the applicable tax brackets to determine the tax payable at each rate. The taxes calculated for each bracket are summed to arrive at the total federal income tax liability.

For instance, consider an individual with a taxable income of $75,000 in [current year]. This income falls within the second federal tax bracket, which applies a tax rate of 20.5%. The tax payable on this income would be calculated as follows:

| Tax Bracket | Income Range | Tax Rate | Tax Payable |

|---|---|---|---|

| First Bracket | Up to $49,020 | 15% | $7,353 |

| Second Bracket | $49,021 - $98,040 | 20.5% | $5,175 |

| Total Federal Tax Payable | $12,528 |

In this example, the individual's total federal tax liability is $12,528. However, this is just the federal component of their tax obligation. The individual would also need to calculate their provincial or territorial tax liability using the applicable rates for their province or territory.

Tax Credits and Deductions

Canada's tax system allows individuals to reduce their taxable income through various tax credits and deductions. These incentives are designed to encourage certain behaviors or support specific groups within society. Common tax credits include those for childcare expenses, public transit costs, and education-related expenses. Deductions, on the other hand, reduce the amount of income subject to tax and can include contributions to registered retirement savings plans (RRSPs) and certain business expenses.

Implications for Taxpayers

Understanding the income tax rates in Canada is crucial for effective financial planning. Taxpayers can use this knowledge to estimate their tax liabilities, plan their finances accordingly, and take advantage of available tax credits and deductions. For businesses, the income tax rates can impact investment decisions, cash flow management, and overall financial strategies.

Additionally, the progressive nature of Canada's tax system means that individuals with higher incomes contribute a larger share of their income to taxes. This structure aims to promote social and economic equality while ensuring the government has sufficient revenue to fund public services and infrastructure.

Frequently Asked Questions

What is the difference between federal and provincial income tax rates in Canada?

+

Federal income tax rates are set by the Canadian federal government and apply to all provinces and territories. On the other hand, provincial and territorial income tax rates are set by each individual province or territory, resulting in variations across the country.

How often do income tax rates change in Canada?

+

Income tax rates in Canada can change annually. The federal government typically announces any changes to the tax system in its annual budget, while provincial governments may also make adjustments to their tax rates from time to time.

Are there any tax-free income thresholds in Canada?

+

Yes, Canada has a basic personal amount, which is a tax-free threshold. In [current year], the basic personal amount is [value in CAD], meaning that individuals can earn up to this amount without paying federal income tax. However, provincial tax rates may still apply.

How do tax credits and deductions affect my income tax liability in Canada?

+

Tax credits and deductions reduce your taxable income, which can lower your overall tax liability. Tax credits directly reduce the amount of tax you owe, while deductions reduce your taxable income before calculating your tax. Both can significantly impact your tax bill.

Are there any special tax considerations for businesses in Canada?

+

Yes, businesses in Canada are subject to a corporate income tax, which is separate from personal income tax. Additionally, there are various tax incentives and programs available for businesses, such as the Small Business Deduction and the Scientific Research and Experimental Development (SR&ED) tax credit.