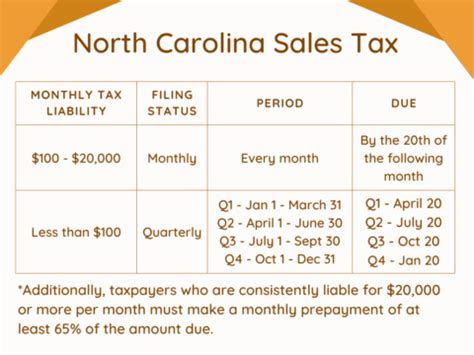

Sales Tax In North Carolina On Cars

North Carolina's sales tax regulations are designed to generate revenue for the state while ensuring a fair and consistent approach to taxation. When it comes to purchasing a car, understanding the sales tax process and rates is crucial for both buyers and sellers. In this comprehensive guide, we will delve into the specifics of sales tax on cars in North Carolina, providing an in-depth analysis of the rules, rates, and real-world examples to help you navigate this aspect of car ownership.

Understanding North Carolina’s Sales Tax Structure

North Carolina imposes a state sales and use tax on various transactions, including the purchase of vehicles. This tax is applied to the purchase price or the fair market value of the vehicle, whichever is higher. It’s important to note that North Carolina operates under a multistate tax compact, which means the state adheres to a set of uniform tax rules and regulations agreed upon by multiple states.

The state sales tax rate in North Carolina is 4.75%, but this is just the starting point. In addition to the state tax, there are local sales taxes that vary by county. These local taxes can significantly impact the overall tax burden, as they are added to the state tax rate.

Local Sales Tax Rates in North Carolina

Local sales tax rates in North Carolina can range from 2% to 3%, depending on the county in which the vehicle is purchased. This means that the total sales tax rate on a car purchase can vary from 6.75% to 7.75%, depending on the location.

| County | Local Sales Tax Rate | Total Sales Tax Rate |

|---|---|---|

| Alamance | 2% | 6.75% |

| Buncombe | 2.25% | 7% |

| Forsyth | 3% | 7.75% |

| Guilford | 2% | 6.75% |

| Mecklenburg | 2% | 6.75% |

These rates are subject to change, so it's essential to check the official North Carolina Department of Revenue website for the most up-to-date information. Additionally, certain counties may have additional local option taxes, which can further impact the total sales tax rate.

Sales Tax on New and Used Cars

The sales tax in North Carolina applies to both new and used vehicles. However, the calculation and application process differs slightly between these categories.

New Car Sales Tax

When purchasing a new car from a dealership, the sales tax is typically calculated as a percentage of the purchase price of the vehicle. This includes any additional fees, such as dealer preparation fees and transportation costs, but excludes sales tax itself. The dealership will calculate the tax and add it to the total purchase price.

For example, if you buy a new car with a purchase price of $30,000 in a county with a local sales tax rate of 2%, the sales tax would be calculated as follows:

- State sales tax: $30,000 x 4.75% = $1,425

- Local sales tax: $30,000 x 2% = $600

- Total sales tax: $1,425 + $600 = $2,025

- Total purchase price with tax: $30,000 + $2,025 = $32,025

Used Car Sales Tax

The sales tax on used cars in North Carolina is based on the fair market value of the vehicle. The fair market value is determined by factors such as the age, condition, and mileage of the car. This value is often agreed upon by the buyer and seller, and it must be reported to the North Carolina Division of Motor Vehicles (DMV) for registration and titling purposes.

The sales tax on a used car purchase is calculated as a percentage of the fair market value, just like with new cars. However, used car sales may also be subject to additional fees, such as title fees and registration fees, which can vary depending on the county.

Let's consider an example of a used car purchase. If you buy a used car with a fair market value of $15,000 in a county with a local sales tax rate of 2.5%, the sales tax calculation would be as follows:

- State sales tax: $15,000 x 4.75% = $712.50

- Local sales tax: $15,000 x 2.5% = $375

- Total sales tax: $712.50 + $375 = $1,087.50

- Total purchase price with tax: $15,000 + $1,087.50 = $16,087.50

Exemptions and Special Cases

While the sales tax on cars is a standard process in North Carolina, there are certain exemptions and special cases to be aware of.

Vehicle Trade-Ins

If you trade in your old vehicle when purchasing a new or used car, the sales tax calculation may change. In North Carolina, the trade-in value is typically deducted from the purchase price of the new vehicle before calculating the sales tax. This can result in a lower tax liability.

Out-of-State Purchases

If you purchase a car from another state and bring it into North Carolina, you may be subject to the use tax. This tax is applied to vehicles purchased out of state to ensure that North Carolina residents pay the appropriate tax on their vehicle acquisitions. The use tax is calculated in the same way as the sales tax and is payable to the North Carolina Department of Revenue.

Military Personnel and Residents

Military personnel stationed in North Carolina are exempt from paying sales tax on vehicles purchased in the state. However, they must provide proof of their military status and follow the necessary procedures to claim this exemption.

Similarly, North Carolina residents who are temporarily out of the state for military duty, employment, or education are exempt from paying sales tax on vehicles purchased in another state and brought back to North Carolina. They must meet certain criteria and provide the necessary documentation to qualify for this exemption.

Sales Tax Payment and Registration

After purchasing a car in North Carolina, you must pay the sales tax and register the vehicle with the North Carolina DMV. The sales tax payment is typically included in the overall transaction, and the dealership will handle the necessary paperwork. However, if you purchase a vehicle privately or out of state, you will need to calculate and pay the sales tax yourself and then register the vehicle.

The registration process involves providing proof of insurance, a valid title, and the necessary fees. The sales tax payment is a crucial part of this process, as it ensures that you are in compliance with North Carolina's tax laws.

Conclusion

Understanding the sales tax process on cars in North Carolina is vital for both buyers and sellers. The state’s sales tax structure, which includes a state tax and varying local taxes, can significantly impact the overall cost of a vehicle purchase. By being aware of the rates, exemptions, and special cases, you can navigate the sales tax landscape with confidence and ensure a smooth car-buying experience.

Frequently Asked Questions

What happens if I don’t pay the sales tax on my car purchase in North Carolina?

+

Failing to pay the sales tax on a car purchase in North Carolina can result in significant penalties and interest charges. You may also be unable to register your vehicle, which is a legal requirement for operating a motor vehicle in the state. It’s important to pay the sales tax in a timely manner to avoid these consequences.

Can I negotiate the sales tax rate when buying a car in North Carolina?

+

The sales tax rate in North Carolina is set by law and cannot be negotiated. However, you can try to negotiate the purchase price of the vehicle, which may indirectly affect the overall sales tax amount. It’s important to understand the market value of the car you’re buying to ensure you’re getting a fair deal.

Are there any special tax incentives for buying electric or hybrid vehicles in North Carolina?

+

North Carolina does offer certain tax incentives for the purchase of electric and hybrid vehicles. These incentives can include a tax credit or a reduced sales tax rate. However, the specifics of these incentives can change over time, so it’s important to check with the North Carolina Department of Revenue or a tax professional for the most current information.