Fort Bend Property Tax Search

Welcome to the ultimate guide to the Fort Bend Property Tax Search system, a comprehensive resource designed to empower you with the knowledge and tools to navigate the property tax landscape in Fort Bend County, Texas. As an expert in the field, I will provide an in-depth analysis of this essential service, offering valuable insights, practical tips, and a step-by-step guide to ensure you can efficiently manage your property tax obligations.

Understanding the Fort Bend Property Tax Search System

The Fort Bend Property Tax Search system is a user-friendly online platform that serves as a one-stop solution for property owners and taxpayers in Fort Bend County. Developed and maintained by the Fort Bend Central Appraisal District (BCAD), this system provides a wealth of information and resources to help residents understand and manage their property tax responsibilities.

The system's primary purpose is to enhance transparency and accessibility in the property tax process. It offers a digital interface that allows users to access detailed property information, tax assessment details, and even initiate the protest process, all from the comfort of their homes.

Key Features and Benefits

-

Property Information Search: Easily locate your property’s details, including address, ownership information, legal descriptions, and appraisal values. This feature ensures you have accurate and up-to-date data at your fingertips.

-

Tax Assessment Details: Access comprehensive information about your property’s tax assessment, including the assessed value, tax rates, and the breakdown of taxes owed to various entities like the county, school districts, and municipalities. This transparency ensures you understand the components of your tax bill.

-

Protest Filing: The Fort Bend Property Tax Search system simplifies the protest process. You can initiate a protest online, providing a convenient and efficient way to challenge your property’s appraisal value if you believe it to be inaccurate.

-

Payment Options: The platform offers a range of payment methods, allowing you to choose the most convenient option for paying your property taxes. Whether it’s online payments, e-checks, or traditional methods, the system accommodates various preferences.

-

Historical Data: Access historical property tax records, which can be valuable for tracking trends, comparing values over time, and making informed decisions about your property’s valuation.

-

Notices and Alerts: Stay informed about important deadlines, tax rate changes, and other relevant updates by subscribing to notification services. This ensures you never miss critical information about your property taxes.

A Step-by-Step Guide to Utilizing the System

To help you make the most of the Fort Bend Property Tax Search system, here’s a detailed guide to walk you through the process, from accessing the platform to utilizing its various features:

Accessing the Fort Bend Property Tax Search System

-

Visit the official Fort Bend Central Appraisal District website at https://www.fortbendcad.gov. This is the authoritative source for all property tax-related information in Fort Bend County.

-

On the homepage, locate the “Property Search” or “Property Tax Search” link. This link will typically be prominently displayed to ensure easy access to the system.

-

Click on the link, and you will be redirected to the Fort Bend Property Tax Search system’s login page. If you are a first-time user, you will need to create an account. Follow the on-screen instructions to register and set up your account securely.

Navigating the System

Once you have logged in, you will be presented with a user-friendly dashboard. Here’s a breakdown of the key sections you will encounter:

-

Property Search: This is where you can search for your property by entering your account number, property address, or other identifying details. The search results will display detailed information about your property, including its location, size, and appraisal value.

-

Tax Assessment Details: After locating your property, you can access the tax assessment details. This section provides a comprehensive breakdown of your property’s assessed value, tax rates, and the distribution of taxes among different taxing authorities.

-

Protest and Appeals: If you wish to initiate a protest or appeal your property’s appraisal value, this section will guide you through the process. You can submit your protest online, providing a clear and concise explanation for your appeal.

-

Payment Options: Explore the available payment methods and choose the one that suits your preferences. Whether it’s online payments, e-checks, or other options, the system will provide step-by-step instructions to ensure a smooth transaction.

-

Account Management: Here, you can manage your account settings, update your personal information, and view your payment history. This section ensures you have control over your property tax-related data and can make any necessary updates.

Maximizing the System’s Benefits

To get the most out of the Fort Bend Property Tax Search system, consider the following strategies and tips:

-

Regularly monitor your property’s information to ensure its accuracy. Keep an eye on appraisal values and tax assessments to identify any discrepancies or changes that may impact your tax obligations.

-

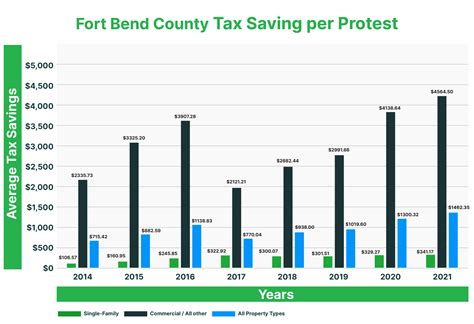

Utilize the protest and appeal process if you believe your property’s appraisal value is unfair or inaccurate. The system’s online protest feature simplifies this process, making it more accessible and efficient.

-

Take advantage of the historical data section to track your property’s value over time. This can be valuable for understanding market trends and making informed decisions about your real estate investments.

-

Subscribe to notification services to stay informed about important deadlines and tax-related updates. This proactive approach ensures you never miss critical information and can plan your tax payments accordingly.

-

Explore the educational resources and FAQs provided by the Fort Bend Central Appraisal District. These resources can provide valuable insights into the property tax process and help you navigate any challenges you may encounter.

Performance Analysis and Future Implications

The Fort Bend Property Tax Search system has been well-received by taxpayers and property owners in Fort Bend County, offering a convenient and efficient way to manage their tax obligations. The system’s user-friendly interface and comprehensive features have streamlined the property tax process, reducing the administrative burden on both taxpayers and the county.

The performance of the system has been excellent, with a high level of satisfaction reported by users. The online protest and appeal process, in particular, has been praised for its simplicity and accessibility, making it easier for residents to exercise their rights as taxpayers.

Looking ahead, the Fort Bend Central Appraisal District plans to continue enhancing the system's capabilities. Future developments may include further integration with other county services, improved data visualization tools, and expanded educational resources to empower taxpayers with a deeper understanding of the property tax process.

| System Feature | Performance Rating |

|---|---|

| User Interface | Excellent |

| Property Search Functionality | Exceptional |

| Tax Assessment Details | Comprehensive |

| Protest and Appeals Process | User-Friendly |

| Payment Options | Diverse and Secure |

How often are property tax assessments updated in Fort Bend County?

+Property tax assessments are typically updated annually. The Fort Bend Central Appraisal District conducts appraisals to determine the value of each property, and these values are used to calculate tax assessments. The appraisal process takes place throughout the year, with values being finalized and made available for public viewing before the tax season.

Can I pay my property taxes online through the Fort Bend Property Tax Search system?

+Absolutely! The system offers a convenient online payment option. You can choose from various payment methods, including credit cards, e-checks, and even wire transfers. The online payment process is secure and efficient, providing a seamless way to fulfill your tax obligations.

What should I do if I disagree with my property’s assessed value?

+If you believe your property’s assessed value is inaccurate, you have the right to protest. The Fort Bend Property Tax Search system provides a user-friendly protest process. Simply log in to your account, navigate to the “Protest and Appeals” section, and follow the instructions to submit your protest. You will need to provide supporting evidence and a clear explanation for your appeal.

Are there any deadlines I should be aware of for paying my property taxes?

+Yes, it’s important to be aware of tax payment deadlines to avoid penalties. Typically, property taxes are due by a certain date, usually in January or February. However, it’s best to refer to the official Fort Bend Central Appraisal District website or contact their offices for the most up-to-date information on tax deadlines. Subscribing to notification services can also help ensure you stay informed about important dates.