Renters Tax Credit Versus Housing Voucher: Which Offers Better Savings?

As someone who has navigated the complicated terrains of housing affordability for years—both as a renter and as a policy enthusiast—I’ve come to see firsthand how economic tools like renters’ tax credits and housing vouchers shape individuals' financial realities. These support mechanisms are more than just policy jargon; they’re lifelines that influence not only the bottom line but also the quality of life, stability, and future prospects for millions of Americans. My own journey of understanding these programs—bolstered by empirical data and policy analysis—has revealed nuanced insights into which option offers more substantial savings, depending on various personal circumstances and broader economic contexts.

Understanding Renters’ Tax Credit and Housing Vouchers: Foundations and Functionality

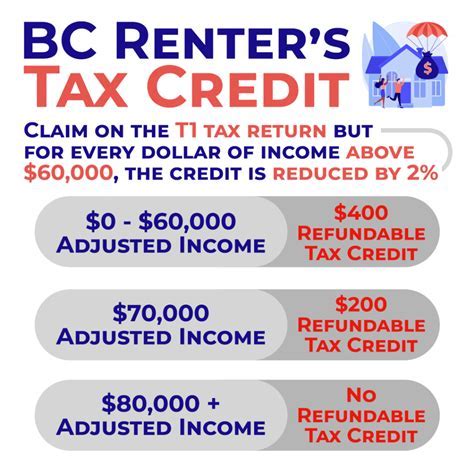

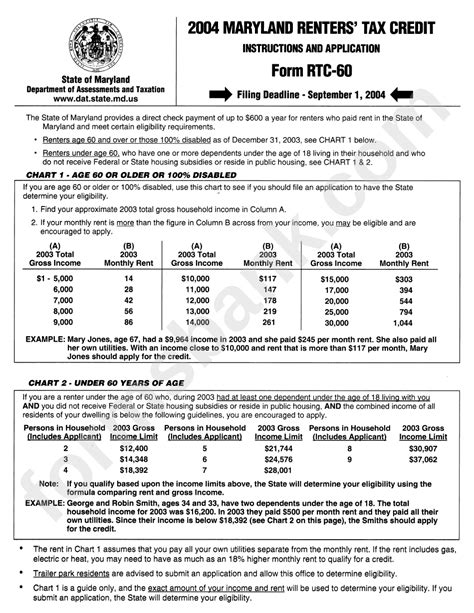

Digging into the core functions of renters’ tax credits and housing vouchers unravels a tapestry of policy design aimed at alleviating housing cost burdens. The renters’ tax credit, often considered a tax relief measure, allows eligible renters to reduce their tax liability based on their rent payments and income levels. Unlike direct payments, this reduces tax owed, effectively increasing disposable income during tax season—much like a rebate that compensates for rent expenses but only after filing taxes.

Housing vouchers, conversely, operate as direct subsidies that help renters pay their landlords. The most prominent federal example, the Housing Choice Voucher Program (Section 8), provides recipients with a fixed subsidy or a percentage of rent based on income and local rent standards. Vouchers are sent directly to landlords—removing the cash flow barrier between tenants and property owners—and are designed to ensure that rent costs do not exceed a certain percentage of household income.

Both tools aim to address housing affordability issues but approach the problem from different angles—tax relief versus direct subsidy—and their efficacy varies based on personal finances, regional housing markets, and administrative factors.

Comparative Analysis: Immediate Savings and Long-Term Impacts

Understanding which offers better savings hinges on a nuanced assessment of timing, scale, and accessibility. From a personal finance standpoint, tax credits often provide delayed benefits—realized during tax season—requiring users to have sufficient income, knowledge, and filing capabilities to claim the credits effectively. Housing vouchers, on the other hand, deliver immediate relief—monthly rent reductions—that can significantly ease cash flow constraints.

My own experience with vouchers is that they are particularly powerful in high-cost housing markets like San Francisco or New York, where rent burdens often exceed 40% of household income. A voucher that covers even 30-50% of rent can translate into hundreds of dollars saved monthly, freeing up income for savings, investment, or other essentials.

In contrast, the tax credit’s value depends heavily on one’s tax situation. For low- to moderate-income renters unable to owe significant taxes, the credit offers limited or no benefit. Conversely, higher-income renters who itemize deductions can leverage these credits to reduce their tax liabilities and effectively recoup rent expenses post-facto. The crux: tax credits are less flexible but potentially more impactful for those who can claim them meaningfully.

| Category | Impact & Data Points |

|---|---|

| Average Rent Burden | In major urban centers, rent can reach 2,500–4,000/month, with a typical voucher covering up to 1,500–2,000, significantly reducing personal expense load. |

| Tax Credit Value | The federal Low-Income Housing Tax Credit (LIHTC) subsidizes housing development indirectly, but renters’ tax credits, such as the Working Families Tax Credit, can range from a few hundred to over $2,000 annually depending on income and filing status. |

| Administrative Complexity | Tax credits require proper filing, documentation, and understanding of tax law—barriers for some—whereas vouchers involve straightforward application processes often managed through local housing authorities. |

Regional Variations and Policy Implications

The effectiveness of each program varies dramatically depending on local housing markets. In dense urban environments with sky-high rents, vouchers are often the difference between financial stability and hardship. For instance, in New York City, vouchers can reduce rent burdens below 30%, often translating into hundreds of dollars saved each month—a figure that might otherwise require a significant income increase.

In contrast, in regions with more affordable housing—say, in Midwestern cities or suburban areas—the relative benefit of vouchers diminishes since rent costs are lower. Here, tax credits, especially state-level programs, can boost savings by lowering overall tax liabilities, plus they often come with fewer eligibility restrictions.

It’s also worth noting that policy shifts, such as the Biden administration’s increased funding for vouchers and state-level tax credit expansions, create dynamic landscapes. These developments can shift the balance of relative savings and access, making real-time data and regional analysis critical for households making housing decisions.

Impact of Eligibility and Administrative Barriers

While vouchers are generally straightforward, eligibility is often constrained by income thresholds, and shortage of available vouchers can delay access for many households—sometimes waiting years. The bureaucratic process can be prohibitive, especially for those unfamiliar with government programs or without advocacy support.

Tax credits, meanwhile, demand proactive engagement—filing accurate returns, understanding complex tax code, and sometimes relying on professional assistance. For those unfamiliar or uncomfortable with taxes, these credits can be underutilized, and their benefit reduced by procedural hurdles.

| Barrier/Advantage | Implication |

|---|---|

| Voucher Availability | Limited supply creates waitlists, delaying real savings. |

| Tax Credit Accessibility | Requires tax literacy, but no waiting periods once qualified. |

Strategic Recommendations for Renters: Maximizing Savings

When weighing whether a renters’ tax credit or a housing voucher provides better savings, an individual’s specific financial landscape must be the guiding star. Here are some distilled insights:

- Evaluate regional rent levels and voucher availability: High-cost urban areas lean heavily on vouchers for immediate relief. If waiting lists are long, consider alternative subsidy programs or state-level tax credits.

- Assess income stability and tax liabilities: For those with steady incomes who owe taxes, maximizing tax credits can provide significant post-tax savings, especially if federal or state programs are accessible.

- Factor in administrative capacity: Simple, straightforward programs like vouchers may be more suitable for those with limited time or support for navigating tax law complexities.

- Combine both tools when possible: For eligible households, leveraging both vouchers for immediate monthly savings and tax credits for annual tax relief maximizes overall benefits.

From my perspective, the best approach often involves a pragmatic combination—using vouchers to reduce immediate rent burdens and tax credits to buffer annual fiscal liabilities. This hybrid strategy can optimize both short- and long-term savings, especially when regional program accessibility is considered.

Can renters qualify for both vouchers and tax credits simultaneously?

+Yes, in many cases, renters can qualify for both. Vouchers provide immediate rent relief, while tax credits can reduce tax bills. Eligibility depends on income, residency, and local program rules. Combining both often yields the best overall savings.

What are some common pitfalls in claiming renters’ tax credits?

+Common pitfalls include missing filing deadlines, misunderstanding eligibility requirements, or failing to document rent payments correctly. Working with experienced tax professionals or using reputable tax software can mitigate these issues.

How does regional housing market health influence these programs’ effectiveness?

+In overheated markets, vouchers are more critical because rent prices can be insurmountably high for many. In markets with stable or declining rents, tax credits and other forms of support might provide more substantial savings relative to cost.