Inheritance Tax Washington

Inheritance tax is a topic that often sparks curiosity and concern among individuals, especially when it comes to understanding the specific regulations of different states. In the case of Washington, the inheritance tax landscape is unique and offers some interesting insights. Let's delve into the intricacies of inheritance tax in Washington and explore the key aspects that make it an important topic for residents and their estate planning.

Inheritance Tax in Washington: A Comprehensive Overview

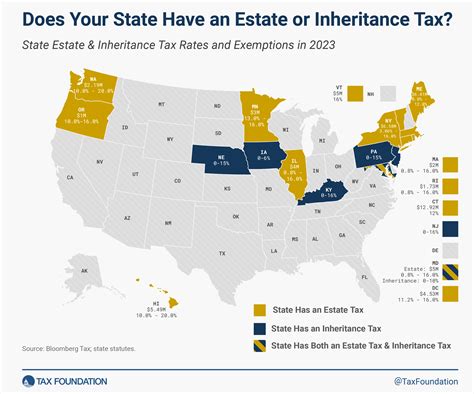

Washington is one of the few states in the United States that has retained its inheritance tax, also known as the estate tax, which is levied on the transfer of a decedent's estate to their beneficiaries. This tax is distinct from the federal estate tax, and it is important to understand its implications for Washington residents.

The inheritance tax in Washington applies to the transfer of assets from a deceased individual's estate to their heirs, whether they are family members, friends, or charitable organizations. It is a progressive tax, meaning the tax rate increases as the value of the estate grows. This tax aims to ensure that wealthier individuals contribute a fair share to the state's revenue while also providing a mechanism for equitable distribution of assets.

Taxable Estates and Exclusions

Not all estates in Washington are subject to inheritance tax. The state has established an exemption threshold, which means that estates below a certain value are exempt from this tax. As of the latest regulations, estates valued at or below $2.25 million are exempt from the inheritance tax. This exemption is beneficial for many Washington residents, as it covers a significant portion of estates, especially those of modest value.

However, it is crucial to note that this exemption does not apply to all transfers. Certain transfers, such as those to a surviving spouse, domestic partner, or certain charitable organizations, are exempt from inheritance tax regardless of the estate's value. This exclusion is designed to encourage wealth transfer within families and support charitable causes.

| Transfer Type | Inheritance Tax Exemption |

|---|---|

| To a Surviving Spouse | Unlimited |

| To a Domestic Partner | Unlimited |

| To a Charitable Organization | Unlimited |

Additionally, Washington offers an exclusion for family-owned farms and businesses. Estates that include these types of assets may qualify for a higher exemption threshold, ensuring that family businesses can continue to thrive without being burdened by excessive taxes.

Inheritance Tax Rates and Calculations

For estates that exceed the exemption threshold, Washington applies a progressive tax rate. The tax rate ranges from 10% to 20%, with the highest rate applying to estates valued at $11.7 million or more. This progressive structure ensures that larger estates contribute a larger proportion of their value to the state's revenue.

| Estate Value Range | Inheritance Tax Rate |

|---|---|

| $2.25 million to $5.75 million | 10% |

| $5.75 million to $11.7 million | 12% |

| $11.7 million and above | 20% |

The calculation of the inheritance tax involves determining the value of the taxable estate, which includes all assets owned by the decedent at the time of their death. This value is then subject to the applicable tax rate based on the estate's size. It is essential for individuals to accurately assess their estates to ensure compliance with the state's regulations.

Impact on Estate Planning

Inheritance tax in Washington significantly influences how individuals approach their estate planning. It encourages thoughtful consideration of asset distribution and the use of various estate planning tools to minimize tax liabilities. Residents often employ strategies such as gifting, establishing trusts, and utilizing life insurance to pass on assets efficiently while reducing the tax burden on their heirs.

Gifting, for instance, can be an effective strategy to reduce the value of an estate below the exemption threshold. By gifting assets during their lifetime, individuals can ensure that their heirs receive the full benefit of these assets without incurring inheritance tax. Trusts, on the other hand, offer a way to manage and distribute assets while potentially reducing tax liabilities and providing greater control over the estate.

Future Implications and Legislative Updates

The inheritance tax landscape in Washington is subject to ongoing legislative review and potential changes. While the state has maintained its inheritance tax system, there have been discussions and proposals for reforms. Some of these proposals aim to simplify the tax structure, adjust exemption thresholds, or introduce additional exemptions to support certain types of transfers.

Staying informed about any legislative updates is crucial for Washington residents and their estate planning. Any changes to the inheritance tax regulations can have a significant impact on the distribution of assets and the financial well-being of beneficiaries. It is advisable to consult with legal and financial professionals to understand the latest developments and ensure compliance with evolving tax laws.

Frequently Asked Questions

How does Washington’s inheritance tax compare to other states?

+

Washington is among a minority of states that still impose an inheritance tax. Many states have either repealed their inheritance tax or merged it with the federal estate tax. Washington’s inheritance tax is progressive, similar to some other states, but it offers a higher exemption threshold compared to certain states, making it more favorable for smaller estates.

Are there any exemptions for family farms and businesses in Washington’s inheritance tax?

+

Yes, Washington provides an exemption for family-owned farms and businesses. Estates that include these assets may qualify for a higher exemption threshold, allowing them to transfer a larger portion of their assets tax-free.

How often does Washington update its inheritance tax regulations?

+

Washington’s inheritance tax regulations are subject to periodic reviews and potential updates. While the state has maintained its inheritance tax system, there have been proposals for reforms. It is important for individuals to stay informed about any legislative changes that may impact their estate planning.