Understanding fl County sales tax: A beginner’s guide

When federal and state tax codes are already complex enough to make even tax professionals occasionally reach for a coffee, local jurisdictions in Florida—like Florida counties—add their own layer with sales tax. It’s a kind of fiscal mosaic—each tile representing a piece of revenue that funds everything from roads to parks, schools to emergency services. Understanding the mechanics of Florida county sales tax isn’t just about knowing the numbers; it’s about grasping how local governments leverage sales tax to support community infrastructure and public services, often fueling debates around fairness, economic growth, and tax policies.

Decoding Florida County Sales Tax: The Basics and Beyond

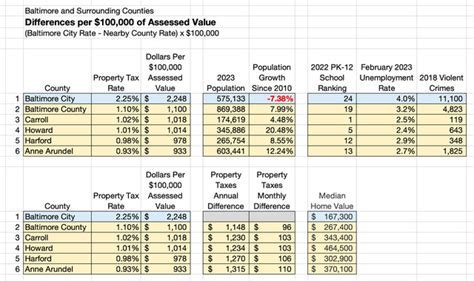

Florida’s sales tax system operates on a foundational principle: a base state sales tax rate established by the Florida Department of Revenue, supplemented by individual county levies. As of 2023, the state’s base sales tax is set at 6%, but when you step into a county like Miami-Dade, Broward, or Orange, additional local taxes can push the total sales tax rate to as high as 8% or more. This layered approach enables local governments to finance projects without depending solely on property taxes or other revenue streams, giving them a certain degree of financial autonomy but also raising questions about the transparency and fairness of local taxation.

The Structure and Dynamics of Florida’s Local Sales Tax

At the core, it’s a straightforward percentage applied to most tangible goods and some services—though exceptions exist, such as groceries or prescription medications which are often exempt. But the nuance lies in the composition: the state’s 6% base, plus county-dependent increments, usually range from 0.5% up to 2.5% in some areas. The county sales tax is legislated by local ordinances, often aligned or negotiated with the Florida Department of Revenue, but these can fluctuate based on local policy agendas, voter approvals, or specific projects needing funding. This system makes understanding local variations essential for any business owner, resident, or policy analyst tracking fiscal impacts or planning investments.

| Relevant Category | Substantive Data |

|---|---|

| Statewide Base Rate | 6% as of 2023, consistent across Florida |

| Maximum Additional County Rate | Up to 2.5%, leading to effective rates of 8.5% in some jurisdictions |

| Average Total Sales Tax Rate | Around 7.05%, varies by county |

Why County Sales Tax Matters: Impacts on Economy and Community

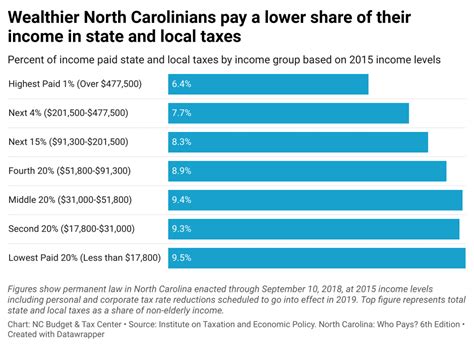

So, why does all this matter beyond just knowing the numbers? Well, local sales tax rates directly influence consumer costs, which ripple through the economy—influencing retail sales, real estate, small business viability, and even tourism. For residents, understanding how much of their dollar goes to taxes determines perceived fairness—do they trust that their money funds local roads and schools effectively? For policymakers, balancing the need for revenue with economic vitality is a constant tightrope walk, especially considering recent debates on sales tax fairness and efforts to modernize tax structures to accommodate online sales, which often mitigate local taxes altogether.

The Evolution of Sales Tax Policy in Florida Counties

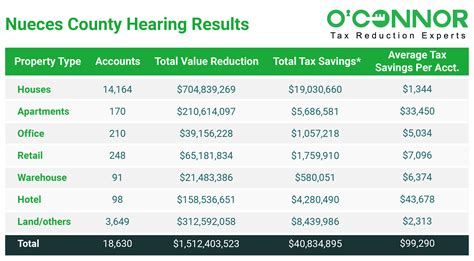

Historically, many counties relied heavily on property taxes, which are politically sensitive and sometimes regressive. As Florida’s population exploded over the last few decades—surpassing 22 million in 2023—the pressure to diversify revenue sources increased. County sales taxes became a strategic instrument—used to fund infrastructure projects, public transportation, and environmental initiatives, especially in rapidly urbanizing areas. Over time, some counties adopted special-purpose sales taxes, often requiring voter approval, to finance specific projects like stadiums or major transit lines. This evolution indicates a nuanced policy approach, balancing immediate community needs with long-term fiscal health.

| Relevant Category | Substantive Data |

|---|---|

| Historical Sales Tax Changes | Most counties introduced additional taxes between 1980-2000, often approved by referenda |

| Major Projects Funded | Examples include Miami-Dade’s transportation improvement programs and Broward’s public safety enhancements |

| Public Trust & Transparency | Voter approval processes aim to enhance accountability but can lead to complexities in tax rates and allocations |

Legal and Procedural Framework Governing County Sales Tax in Florida

Florida’s legal landscape assigns responsibility for local sales tax rates to county governments, guided by state law but with considerable local discretion. The Florida Constitution and statutes specify maximum allowable rates and voting requirements—typically, increases or allocations beyond certain thresholds require citizen approval. Procedurally, counties must submit amendments to the Florida Department of Revenue, outlining the proposed rate, purpose, and projected revenue stream. These legal frameworks serve as balances—providing local control but also establishing guardrails to prevent unchecked tax hikes. The interplay between state oversight and local sovereignty reflects a delicate dance that shapes the fiscal environment at the county level.

Voter Referenda and their Role in Shaping Tax Rates

Most significant increases in sales tax rates are subject to voter approval through referenda or ballot measures. This participatory process enhances legitimacy but can complicate timely implementation, especially if political divides or public skepticism hinder approval. The process involves detailed disclosures, public debates, and sometimes campaigns to sway voters. As an example, Miami-Dade’s transportation and infrastructure tax proposals often rely on voter backing—highlighting democratic input in fiscal policymaking.

| Relevant Category | Substantive Data |

|---|---|

| Voter Approval Requirement | Typically required for new or increased local sales taxes; varies by county |

| Average Referenda Passage Rate | Approximately 70% approval in recent elections, indicating a generally favorable perception of investment returns |

| Timeline for Implementation | Usually 6-9 months following voter approval due to administrative processes |

The Challenges and Future of Florida County Sales Tax

Looking ahead, Florida counties face a tapestry of opportunities and challenges—particularly with the expanding digital economy. Online sales, for example, threaten to erode local sales tax bases, creating pressure to update laws and elevate compliance strategies such as remote seller collection mechanisms. Additionally, there’s a growing debate about tax equity—are sales taxes fair to low-income residents or small businesses? Some advocate for other revenue models like resort taxes or transit-specific levies to diversify sources and protect the retail sector from excessive tax burdens.

Emerging Trends and Policy Innovations

Innovative approaches include implementing “destination-based” taxes that target visitors, using technology for more efficient tax collection, and crafting sustainability-linked taxes that support green initiatives. Policies are increasingly oriented toward balancing revenue needs with economic prosperity, environmental resilience, and social equity. As data analytics become more sophisticated, counties can better project revenue streams, optimize tax rates, and minimize evasion—paving the way for smarter fiscal planning.

| Relevant Category | Substantive Data |

|---|---|

| Tax Evasion & Compliance | Remote seller collection compliance increased from 15% in 2019 to over 75% in 2023, thanks to new enforcement |

| Revenue Growth Trends | Average annual growth of 4-6% in county sales tax collections over the past decade |

| Sustainable Tax Strategies | Forecasts project a 10% rise in green tax initiatives by 2030, aligning fiscal health with climate priorities |

Turning Data into Decisions: Practical Implications for Stakeholders

For business leaders, understanding the regional variation in sales tax can inform pricing, location choices, and investment strategies. Residents gain insights into how their spending supports local initiatives, fostering civic engagement. Policymakers benefit from data-driven approaches to optimize tax rates while maintaining competitiveness. The interplay of these perspectives encapsulates a complex but manageable ecosystem—one where transparency, trust, and strategic planning shape fiscal sustainability.

Actionable Recommendations for Engaged Citizens and Leaders

Engaged citizens should scrutinize proposed tax measures, participate in public hearings, and advocate for transparency. Business owners might leverage knowledge of local rates to optimize ceilings on online sales or expansion plans. Leaders should focus on data-driven forecasting, community engagement, and balancing short-term revenue needs with long-term economic and environmental health.

How often do Florida counties change their sales tax rates?

+Changes typically occur following voter approval or legislative updates, averaging once every 3-5 years, depending on local needs and political climate.

Are online purchases subject to Florida county sales tax?

+Yes, especially since the 2018 Supreme Court decision in South Dakota v. Wayfair, most remote sellers are now required to collect and remit Florida sales tax, including county-specific rates where applicable.

What are the main challenges counties face in managing sales tax revenue?

+Challenges include ensuring tax compliance, tracking digital sales, maintaining transparency, and adapting to economic shifts that affect consumer spending patterns.