Nueces Property Tax

When it comes to managing property taxes, it's essential to stay informed about the various aspects that can impact your financial obligations. In this comprehensive guide, we will delve into the world of Nueces County property taxes, providing you with an in-depth understanding of the assessment process, tax rates, payment options, and strategies to optimize your tax liabilities. Whether you're a homeowner, a business owner, or simply curious about the property tax landscape in Nueces County, Texas, this article will equip you with the knowledge you need to navigate the complexities of local taxation.

Understanding the Nueces County Property Tax System

The property tax system in Nueces County operates as a fundamental source of revenue for local governments, schools, and special districts. It is a critical component of the county’s financial infrastructure, enabling the provision of essential services and infrastructure development. Property taxes in Nueces County are assessed based on the value of real estate properties, including residential homes, commercial establishments, and land parcels.

Assessment Process

The Nueces Central Appraisal District plays a pivotal role in the property tax assessment process. Each year, the appraisal district determines the market value of properties within the county. This value serves as the basis for calculating the property taxes owed by landowners.

The assessment process involves the following key steps:

- Property Identification: The appraisal district identifies all taxable properties within Nueces County, assigning unique identification numbers to each property.

- Data Collection: Appraisers visit properties or rely on recent sales data to gather information about the characteristics of each property, such as size, improvements, and recent renovations.

- Market Value Estimation: Using sales data and other market indicators, the appraisal district estimates the market value of each property. This value is crucial for determining the property’s taxable value.

- Notice of Appraised Value: Property owners receive a notice of appraised value, detailing the estimated market value of their property. This notice serves as a starting point for property owners to review and potentially protest the assessed value.

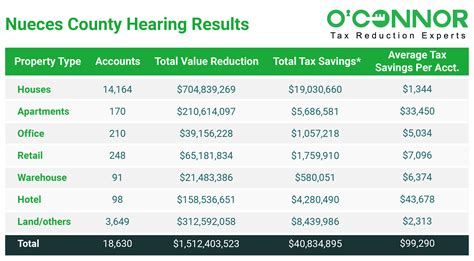

- Protest and Appeals: Property owners have the right to protest the appraised value if they believe it is inaccurate or excessive. The protest process involves submitting documentation and evidence to support the protest. The Nueces Central Appraisal District reviews protests and makes final decisions on value adjustments.

Tax Rates and Calculations

Property taxes in Nueces County are determined by applying tax rates set by various taxing entities, including the county government, school districts, cities, and special districts. These entities use property taxes to fund their operations and provide essential services to residents.

The tax rate, often referred to as the tax levy, is expressed as a percentage of the property’s taxable value. The taxable value is typically a fraction of the appraised market value, known as the taxable rate ceiling or taxable value cap. For instance, in Nueces County, the taxable rate ceiling is commonly set at 10% of the appraised value.

To calculate the property tax liability, the taxable value is multiplied by the tax rate. The tax rate is a combination of rates set by different taxing entities, resulting in a total effective tax rate. The total effective tax rate is the sum of the rates for the county, school districts, cities, and special districts.

For example, if the taxable value of a property is 200,000 and the total effective tax rate is 2%, the property tax liability would be calculated as follows:</p> <p>Property Tax Liability = Taxable Value (200,000) x Total Effective Tax Rate (0.02) = $4,000

This calculation provides an estimate of the annual property tax obligation for the property owner.

Property Tax Rates in Nueces County

The property tax rates in Nueces County vary depending on the taxing entity and the type of property. Understanding these rates is crucial for property owners to assess their potential tax liabilities accurately.

County Tax Rates

The Nueces County Commissioners Court sets the tax rate for the county. The county tax rate is a significant component of the overall tax burden, as it funds county operations, infrastructure projects, and various county services.

As of the latest available data, the county tax rate in Nueces County is set at 0.3997 per $100 of assessed value. This rate is subject to change annually based on budgetary requirements and local economic conditions.

School District Tax Rates

School districts in Nueces County play a vital role in providing quality education to the county’s residents. Property taxes are a primary source of funding for school districts, enabling them to maintain schools, hire teachers, and offer a range of educational programs.

Each school district within the county sets its own tax rate, taking into account the district’s financial needs and the local community’s support for education. The school district tax rates vary across the county, with some districts having higher rates to address specific educational requirements.

For instance, the Corpus Christi Independent School District, one of the largest school districts in Nueces County, had a tax rate of 1.4947 per $100 of assessed value as of the most recent data. This rate is subject to change based on the district’s budget and the community’s feedback.

City Tax Rates

Cities within Nueces County also levy property taxes to fund their operations and provide municipal services. The tax rates set by cities contribute to the overall tax burden on property owners within their jurisdictions.

The city tax rates vary depending on the city’s size, budget, and the services it offers to its residents. Some cities have lower tax rates, while others may have higher rates to support specific initiatives or infrastructure projects.

For example, the City of Corpus Christi, the largest city in Nueces County, had a tax rate of 0.6094 per $100 of assessed value as of the most recent data. This rate enables the city to fund essential services such as public safety, infrastructure maintenance, and community development.

Special District Tax Rates

In addition to county, school district, and city taxes, property owners in Nueces County may also be subject to taxes levied by special districts. Special districts are created to address specific needs or provide specialized services within a defined geographic area.

Special district tax rates can vary widely depending on the nature of the district and its funding requirements. These districts may include water districts, hospital districts, or utility districts, each with its own unique tax rate structure.

For instance, the Nueces County Hospital District, which provides healthcare services to the county’s residents, had a tax rate of 0.1250 per $100 of assessed value as of the latest data. This rate ensures the district can continue to offer essential healthcare services to the community.

Property Tax Payment Options and Due Dates

Understanding the property tax payment options and due dates is crucial for property owners to avoid late fees and penalties. Nueces County offers various payment methods and deadlines to accommodate the diverse needs of taxpayers.

Payment Methods

Nueces County provides property owners with multiple payment options to facilitate convenient and secure tax payments. The following are the primary payment methods available:

- Online Payment: Property owners can make tax payments online through the Nueces County Tax Office’s official website. This method offers a convenient and secure way to pay taxes using a credit or debit card, electronic check, or direct bank transfer.

- Mail-in Payment: Property owners can mail their tax payments to the Nueces County Tax Office. This option allows for payment by check or money order. The payment should be accompanied by the appropriate tax statement and mailed to the address provided by the tax office.

- In-Person Payment: Property owners can visit the Nueces County Tax Office during regular business hours to make tax payments in person. This option allows for payment by cash, check, money order, or credit/debit card. The tax office staff can assist taxpayers with any payment-related inquiries.

- Automatic Payment Plans: Nueces County offers automatic payment plans, allowing property owners to have their tax payments automatically deducted from their bank accounts on specified dates. This option provides convenience and ensures timely payments without the need for manual reminders.

Payment Due Dates

The payment due dates for property taxes in Nueces County are typically divided into two installments. The tax year runs from January 1 to December 31, with the first installment due on or before January 31, and the second installment due on or before July 31. However, it’s important to note that these due dates may be subject to change based on local regulations and tax office policies.

Property owners should receive a tax statement from the Nueces County Tax Office detailing the amount due for each installment. It’s crucial to pay attention to these statements and make payments on time to avoid late fees and penalties.

In the event of a missed payment, property owners should contact the Nueces County Tax Office promptly to discuss potential payment arrangements or seek assistance with understanding the late payment penalties and options for resolving any outstanding tax liabilities.

Strategies to Optimize Property Tax Liabilities

Optimizing property tax liabilities is a strategic approach that can help property owners manage their financial obligations effectively. By understanding the assessment process, staying informed about tax rates, and employing proactive strategies, property owners can potentially reduce their tax burdens and make more informed financial decisions.

Reviewing Property Assessments

Property owners should carefully review their property assessments to ensure accuracy. The Nueces Central Appraisal District provides property owners with the opportunity to protest their appraised values if they believe they are excessive or inaccurate. By gathering evidence and supporting documentation, property owners can present their case for a potential reduction in their property’s appraised value.

Exploring Tax Exemptions

Nueces County offers various tax exemptions that can reduce the taxable value of a property, thereby lowering the property tax liability. Property owners should explore the different exemption options available, such as the Homestead Exemption, which reduces the taxable value of a property for homeowners who use it as their primary residence. Other exemptions, such as the Over-65 Exemption and the Disability Exemption, provide relief for eligible individuals.

Utilizing Tax Abatement Programs

Nueces County and its cities may offer tax abatement programs to encourage economic development and attract businesses. These programs provide temporary reductions in property taxes for eligible businesses, making it an attractive incentive for companies considering relocating or expanding in the county. Property owners should stay informed about these programs and explore their eligibility to potentially benefit from tax abatements.

Staying Informed about Tax Rate Changes

Property owners should stay updated on any changes to tax rates within Nueces County. Taxing entities, such as the county government, school districts, and cities, may adjust their tax rates annually to meet budgetary needs. By monitoring these changes, property owners can anticipate potential increases in their tax liabilities and plan their financial strategies accordingly.

Conclusion

Understanding the intricacies of the Nueces County property tax system is essential for property owners to manage their financial obligations effectively. By comprehending the assessment process, tax rates, payment options, and optimization strategies, property owners can navigate the local taxation landscape with confidence. Staying informed and proactive allows property owners to make informed decisions, explore potential tax savings, and contribute to the economic vitality of the community.

How often are property values assessed in Nueces County?

+Property values in Nueces County are typically assessed annually by the Nueces Central Appraisal District. This assessment determines the market value of properties and serves as the basis for calculating property taxes.

Can property owners appeal their property tax assessments in Nueces County?

+Yes, property owners have the right to appeal their property tax assessments if they believe the appraised value is excessive or inaccurate. The protest process involves submitting evidence and documentation to support the appeal.

What are the consequences of not paying property taxes on time in Nueces County?

+Late payment of property taxes in Nueces County may result in penalties and interest charges. Additionally, if taxes remain unpaid, the property may be subject to a tax lien or, in extreme cases, a tax foreclosure sale.

Are there any tax relief programs available for senior citizens in Nueces County?

+Yes, Nueces County offers the Over-65 Exemption, which provides tax relief for homeowners who are 65 years of age or older and meet certain income and residency requirements. This exemption reduces the taxable value of the property, resulting in lower property taxes.

Can property owners pay their taxes in installments in Nueces County?

+Yes, property owners in Nueces County have the option to pay their taxes in two installments. The first installment is due on or before January 31, and the second installment is due on or before July 31. This allows property owners to manage their tax payments more effectively.