State Of Michigan Income Tax Forms

Welcome to our comprehensive guide on navigating the State of Michigan's income tax forms and understanding the essential aspects of filing your taxes in the Great Lakes State. As a resident of Michigan, it's crucial to familiarize yourself with the tax landscape to ensure you meet your obligations and maximize any potential benefits.

Understanding Michigan’s Income Tax Structure

Michigan operates on a progressive income tax system, which means the more you earn, the higher your tax rate. This approach ensures fairness and adaptability to various income levels. The state’s income tax is calculated based on your federal adjusted gross income (AGI), and specific deductions and credits can further reduce your taxable income.

Tax Rates and Brackets

For the 2023 tax year, Michigan has six income tax brackets, ranging from 4.25% to 4.60%. The tax rates apply progressively as your income increases, ensuring a balanced approach to taxation. Here’s a breakdown of the brackets and their corresponding tax rates:

| Income Bracket | Tax Rate |

|---|---|

| $0 - $3,350 | 4.25% |

| $3,351 - $13,400 | 4.275% |

| $13,401 - $50,000 | 4.35% |

| $50,001 - $90,000 | 4.40% |

| $90,001 - $250,000 | 4.475% |

| Over $250,000 | 4.60% |

These tax rates are subject to change annually, so it's essential to refer to the Michigan Department of Treasury's official guidelines for the most current information.

Filing Status and Deductions

When filing your Michigan income tax return, you’ll choose a filing status based on your marital status and living arrangements. The options include single, married filing jointly, married filing separately, head of household, and qualifying widow(er) with dependent child. Each status has its implications for deductions and credits.

Michigan offers several deductions to reduce your taxable income. These include standard deductions, which vary based on your filing status, and itemized deductions for expenses like medical costs, state and local taxes, and charitable contributions. Additionally, you can claim personal exemptions for yourself and your dependents.

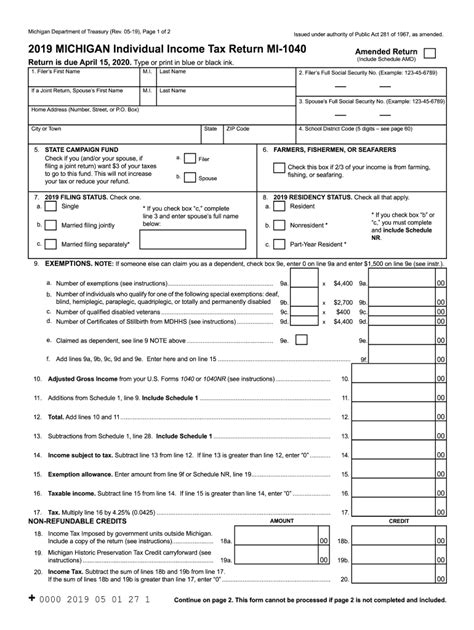

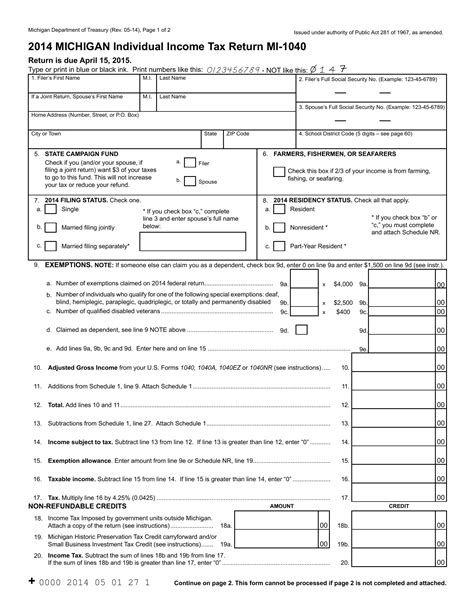

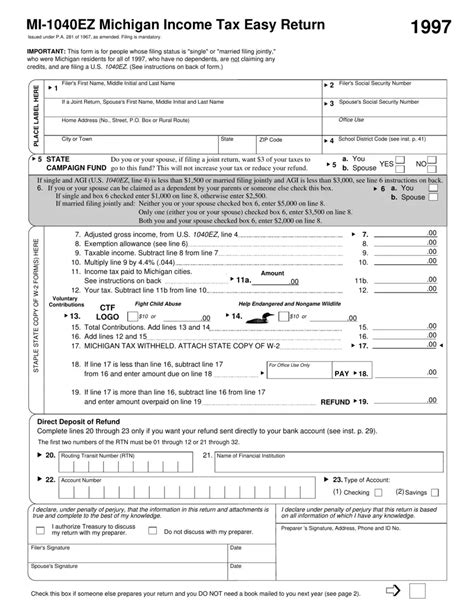

Navigating Michigan’s Tax Forms

The Michigan Department of Treasury provides a range of tax forms and instructions to guide you through the filing process. Here’s a breakdown of the essential forms you’ll encounter:

Form 1040ME

This is the primary Michigan Individual Income Tax Return form. It’s used to report your federal adjusted gross income (AGI), calculate your Michigan taxable income, and determine your tax liability. Form 1040ME includes spaces for various deductions, credits, and adjustments, allowing you to optimize your tax position.

Schedule 1

Schedule 1 is an attachment to Form 1040ME, where you itemize your deductions. Here, you’ll list eligible expenses such as medical costs, state and local taxes, and charitable donations. By itemizing, you may be able to reduce your taxable income and lower your overall tax burden.

Schedule 2

Schedule 2 is used to calculate additional adjustments to your income. This schedule accounts for various factors like education credits, retirement plan contributions, and certain business expenses. These adjustments can further reduce your taxable income and potentially increase your refund.

Schedule 3

Schedule 3 is dedicated to credits that can offset your tax liability. Michigan offers several credits, including the Michigan Homestead Property Tax Credit, the Michigan Education Credit, and the Michigan Earned Income Tax Credit. By claiming eligible credits, you may be able to reduce your tax bill or increase your refund.

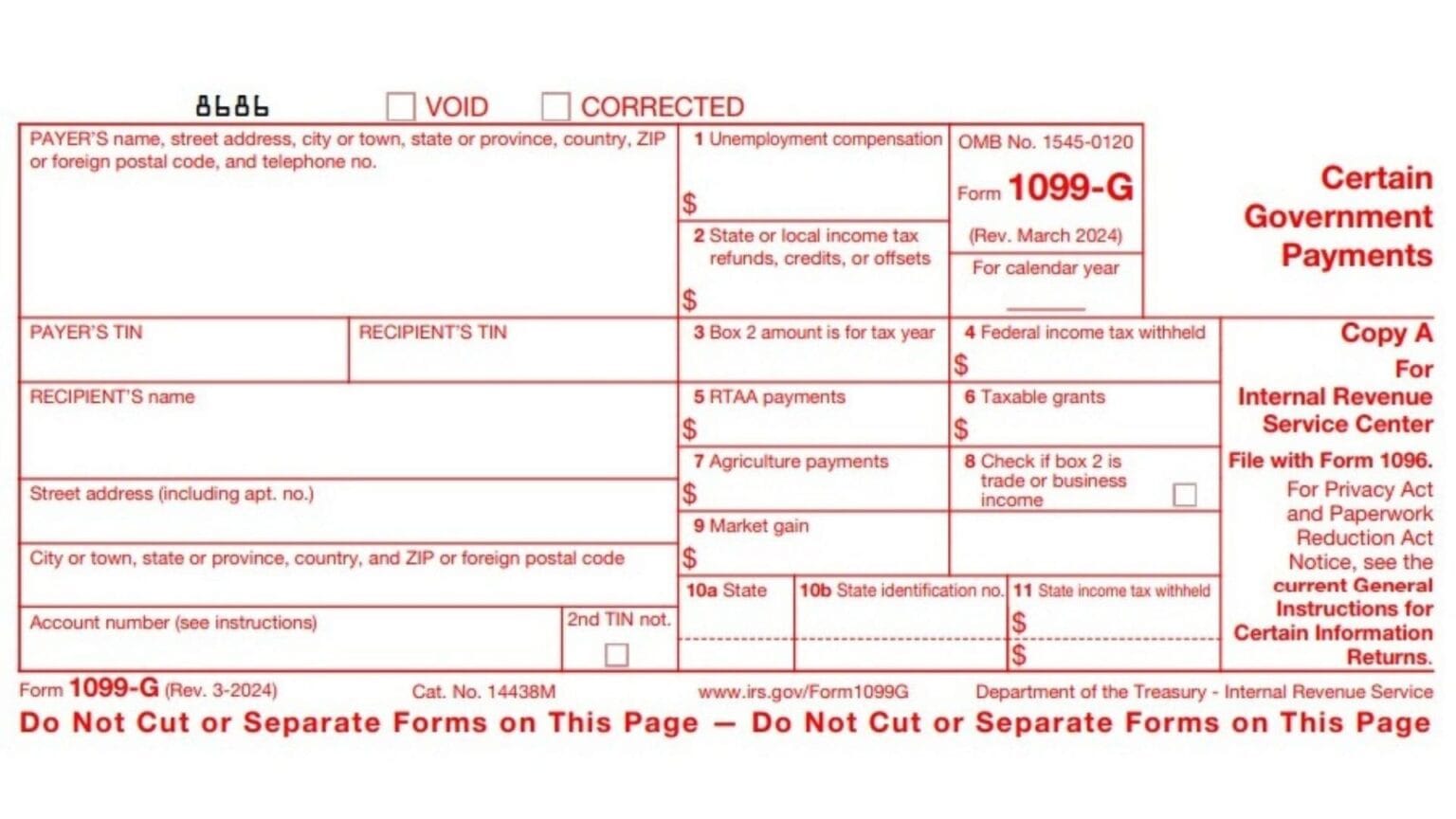

Form 4847

Form 4847, the Michigan Income Tax Withholding Certificate, is crucial for employees and employers. This form ensures that the correct amount of Michigan income tax is withheld from your paycheck throughout the year. By completing and submitting Form 4847, you help avoid underpayment penalties and ensure an accurate tax liability when you file your return.

Filing Options and Deadlines

Michigan offers several options for filing your income tax return. You can choose to file electronically through the Michigan eFile system, which is secure, convenient, and often the fastest way to receive your refund. Alternatively, you can opt for paper filing by mailing your completed forms to the Michigan Department of Treasury.

The deadline for filing your Michigan income tax return typically aligns with the federal tax deadline, which is usually April 15th. However, it's essential to note that the deadline may be extended in certain circumstances, such as during a state of emergency. Stay informed by monitoring official sources for any updates on filing deadlines.

Maximizing Deductions and Credits

Understanding the deductions and credits available to Michigan taxpayers is key to minimizing your tax liability. Here are some essential deductions and credits to consider:

Standard Deduction

Michigan offers a standard deduction based on your filing status. This deduction reduces your taxable income without requiring itemized records of specific expenses. The standard deduction amounts are subject to change annually, so refer to the Michigan tax guidelines for the most current information.

Itemized Deductions

If your eligible expenses exceed the standard deduction, you may benefit from itemizing your deductions. Common itemized deductions include medical and dental expenses, state and local taxes, mortgage interest, and charitable contributions. By itemizing, you can potentially reduce your taxable income significantly.

Michigan Homestead Property Tax Credit

This credit is designed to provide relief to Michigan homeowners. It offers a credit based on the property taxes paid on your primary residence. The credit amount varies depending on your income and property tax liability. Claiming this credit can help offset the cost of owning a home in Michigan.

Michigan Education Credit

Michigan residents who incur eligible education expenses may qualify for the Michigan Education Credit. This credit is available for expenses related to higher education, such as tuition, fees, and books. By claiming this credit, you can reduce your tax liability and make education more affordable.

Michigan Earned Income Tax Credit

Similar to the federal Earned Income Tax Credit, Michigan offers its own version to provide financial support to low- and moderate-income earners. This credit can reduce your tax liability or increase your refund, making it an essential consideration for eligible taxpayers.

Future Implications and Tax Planning

Staying informed about potential changes to Michigan’s tax laws and regulations is crucial for effective tax planning. Here are some key considerations for the future:

Tax Reform and Legislative Changes

Michigan’s tax landscape is subject to change, and proposed reforms or legislative amendments can impact your tax obligations. Stay updated on any proposed or enacted changes to ensure you’re aware of new requirements, deductions, or credits that may benefit you.

Retirement Planning and Tax-Advantaged Accounts

When planning for retirement, consider the tax implications of your savings and investment strategies. Michigan offers tax advantages for contributions to retirement accounts like IRAs and 401(k)s. By maximizing these contributions, you can reduce your taxable income and potentially lower your tax burden over time.

Business and Investment Strategies

If you own a business or have investment income, explore the tax benefits available to you. Michigan offers various incentives and deductions for business owners, including those related to research and development, job creation, and certain capital investments. Consult with a tax professional to ensure you’re taking full advantage of these opportunities.

Frequently Asked Questions

How do I calculate my Michigan income tax liability?

+

To calculate your Michigan income tax liability, start by determining your federal adjusted gross income (AGI) and applicable deductions and credits. Use the Michigan tax brackets to calculate your tax rate based on your income level. Apply the tax rate to your taxable income to determine your liability. You can use online calculators or tax preparation software for a more precise calculation.

When is the deadline for filing Michigan income taxes?

+

The deadline for filing Michigan income taxes typically aligns with the federal tax deadline, which is usually April 15th. However, it’s crucial to monitor official sources for any updates or extensions due to special circumstances, such as a state of emergency. Stay informed to ensure you meet the filing deadline.

Can I file my Michigan income taxes electronically?

+

Yes, Michigan offers an electronic filing system called Michigan eFile. This secure and convenient option allows you to file your tax return online, often resulting in faster processing and refund issuance. However, you can also choose to file a paper return by mailing your completed forms to the Michigan Department of Treasury.

What deductions and credits are available to Michigan taxpayers?

+

Michigan taxpayers can benefit from various deductions and credits, including the standard deduction, itemized deductions for eligible expenses, the Michigan Homestead Property Tax Credit, the Michigan Education Credit, and the Michigan Earned Income Tax Credit. These deductions and credits can reduce your taxable income and potentially increase your refund.

How can I ensure I’m withholding the correct amount of Michigan income tax from my paycheck?

+

To ensure accurate withholding of Michigan income tax, complete and submit Form 4847, the Michigan Income Tax Withholding Certificate. This form helps your employer calculate the correct amount to withhold from your paycheck based on your filing status and allowances. By keeping your withholding accurate, you can avoid underpayment penalties and ensure a smooth filing process.

Understanding Michigan’s income tax system and utilizing the available forms and deductions can make filing your taxes a more manageable process. Stay informed, seek professional advice when needed, and take advantage of the opportunities to optimize your tax position. For more detailed information and the latest tax guidelines, visit the Michigan Department of Treasury’s official website.