Sales Tax Los Angeles County

Sales tax in Los Angeles County, California, is an essential aspect of understanding the local economy and its impact on businesses and consumers alike. The tax rates and regulations can vary within the county, affecting the overall business climate and consumer spending. This article aims to delve into the intricacies of sales tax in Los Angeles County, exploring the current rates, their historical context, and the implications for businesses and residents.

Understanding Sales Tax in Los Angeles County

Sales tax in Los Angeles County is a crucial revenue source for the local government, funding various public services and infrastructure projects. The tax is imposed on the sale or lease of most tangible personal property and certain services within the county’s boundaries. It is a percentage added to the purchase price, with rates varying depending on the specific jurisdiction within the county.

As of [Current Date], the combined sales tax rate in Los Angeles County ranges from 7.25% to 10.25%, depending on the city or unincorporated area. This rate is made up of several components, including the state sales tax, county tax, and local municipal tax. The state sales tax rate is a uniform 7.25% across California, while the county and municipal tax rates can vary, resulting in the different combined rates throughout the county.

| Jurisdiction | Combined Sales Tax Rate |

|---|---|

| Los Angeles City | 9.50% |

| Santa Monica | 10.25% |

| Long Beach | 9.75% |

| Burbank | 9.25% |

| Unincorporated Los Angeles County | 7.25% |

Historical Context and Rate Changes

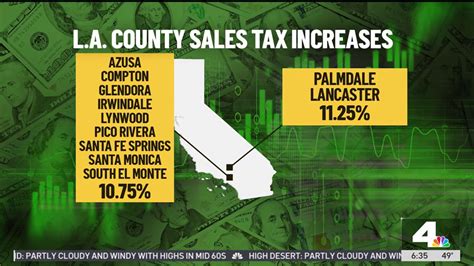

The sales tax rates in Los Angeles County have evolved over time, with various initiatives and economic factors influencing the changes. In recent years, there have been several notable rate adjustments:

- 2017: The state of California passed a law allowing local jurisdictions to increase their sales tax rates to fund transportation projects. This led to several cities in Los Angeles County implementing additional local taxes, resulting in higher combined rates.

- 2018: Los Angeles City approved a temporary sales tax increase to fund infrastructure improvements. This added 0.5% to the existing rate, bringing the total to 9.5% within city limits.

- 2021: Santa Monica and Beverly Hills both implemented additional sales taxes to support local initiatives, resulting in some of the highest rates in the county.

Impact on Businesses and Consumers

The varying sales tax rates across Los Angeles County can have significant implications for both businesses and consumers. Here’s a deeper look at these impacts:

Businesses

For businesses operating in Los Angeles County, understanding the sales tax landscape is crucial for effective financial planning and strategic decision-making. Here are some key considerations:

- Compliance: Businesses must accurately calculate and collect the appropriate sales tax based on their location and the goods or services they provide. Failure to comply can result in penalties and legal consequences.

- Pricing Strategies: Sales tax rates can influence pricing strategies. Businesses may need to adjust their pricing to remain competitive within their specific jurisdiction or consider the impact of varying rates on cross-border sales.

- Online Sales: With the rise of e-commerce, businesses selling online must navigate the complexities of sales tax collection, especially when shipping goods to different areas within the county with varying rates.

- Economic Incentives: Some areas with lower sales tax rates may attract businesses looking to reduce their tax burden. This can lead to economic development incentives and competition between jurisdictions.

Consumers

Consumers in Los Angeles County are directly impacted by sales tax rates, influencing their purchasing decisions and overall spending habits. Here are some key points to consider:

- Price Transparency: Consumers should be aware of the sales tax rates in their specific areas to make informed purchasing decisions. Clear price transparency is essential for understanding the true cost of goods and services.

- Comparison Shopping: With varying rates across the county, consumers may engage in comparison shopping, seeking out lower-tax areas for certain purchases. This can impact local businesses and create a competitive environment.

- Tax Burdens: Higher sales tax rates can result in a heavier tax burden for consumers, especially for essential items or large purchases. This may influence consumer behavior and spending patterns.

- Tourism and Visitor Taxes: Some areas with higher sales tax rates may rely on tourism to generate revenue. Visitors should be aware of these additional taxes when making purchases during their stay.

Sales Tax Collection and Administration

The collection and administration of sales tax in Los Angeles County involve a complex system of regulations and processes. Here’s an overview of the key aspects:

Registration and Reporting

Businesses operating in Los Angeles County must register with the California Department of Tax and Fee Administration (CDTFA) to obtain a Seller’s Permit. This permit allows them to collect and remit sales tax to the state. Businesses are then required to file periodic sales tax returns, reporting their taxable sales and remitting the collected tax to the CDTFA.

Taxable Items and Exemptions

Not all goods and services are subject to sales tax. Certain items, such as prescription medications, groceries, and some manufacturing equipment, are exempt from sales tax in California. Understanding the taxable and exempt items is crucial for businesses to ensure accurate tax collection.

Audit and Enforcement

The CDTFA conducts audits to ensure compliance with sales tax regulations. Businesses may be subject to audits to verify their tax filings and collection practices. Failure to comply with sales tax laws can result in penalties, interest, and even criminal charges in severe cases.

Future Implications and Potential Changes

The sales tax landscape in Los Angeles County is subject to ongoing changes and potential future adjustments. Here are some factors to consider:

- Economic Factors: Economic conditions, such as inflation, can influence the need for tax adjustments to maintain revenue streams.

- Political Climate: Local and state politics play a role in tax policy decisions. Changes in leadership or initiatives can lead to new tax proposals or rate adjustments.

- Infrastructure Funding: Sales tax increases are often proposed to fund specific infrastructure projects or address budgetary concerns. Future projects may drive the need for additional tax revenue.

- E-commerce Evolution: The growth of online sales and the challenges of taxing e-commerce could lead to new regulations and tax collection methods.

Conclusion

Sales tax in Los Angeles County is a multifaceted topic, impacting the county’s economy, businesses, and residents. Understanding the current rates, their historical context, and potential future changes is essential for navigating the local business environment. As the county continues to evolve, so too will its sales tax landscape, shaping the economic climate and consumer experiences.

How often are sales tax rates updated in Los Angeles County?

+Sales tax rates can change periodically, often in response to local initiatives or state-level legislation. It’s important for businesses and consumers to stay updated with the latest rates to ensure compliance and make informed decisions.

Are there any sales tax holidays in Los Angeles County?

+Sales tax holidays are temporary periods when certain items are exempt from sales tax. These holidays are typically declared at the state level and may include back-to-school shopping or energy-efficient appliance purchases. Check with the CDTFA for the latest information on sales tax holidays.

How can businesses register for a Seller’s Permit in Los Angeles County?

+Businesses can register for a Seller’s Permit through the California Department of Tax and Fee Administration’s website. The process involves completing an application, providing business information, and obtaining the permit number. It’s a crucial step for businesses to collect and remit sales tax legally.