Does New Mexico Have State Tax

In the United States, the taxation landscape varies significantly from state to state, with each state having its own set of tax laws and regulations. New Mexico, like many other states, imposes a state tax, which contributes to the state's revenue and funds various public services and infrastructure projects.

The State Tax Structure in New Mexico

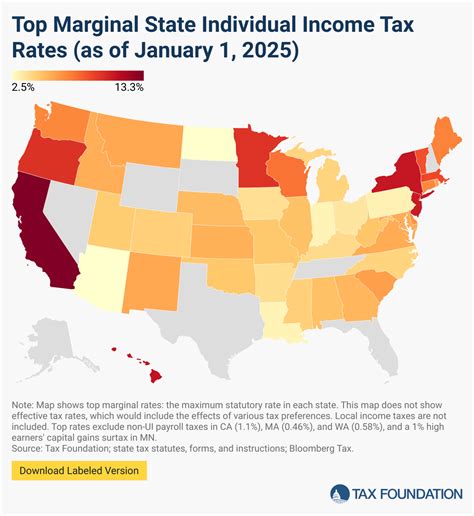

New Mexico operates on a comprehensive tax system, encompassing various types of taxes to generate revenue. One of the primary sources of state tax revenue is the personal income tax, which is levied on individuals and businesses based on their taxable income. The state’s income tax structure is progressive, meaning that higher income earners are subjected to higher tax rates.

New Mexico's income tax rates range from 1.7% to 4.9%, depending on the taxpayer's income bracket. The state tax is calculated based on federal adjusted gross income (AGI) and is adjusted annually to account for inflation. This means that individuals and businesses with higher incomes contribute a larger proportion of their earnings to the state's coffers.

Sales and Use Tax

In addition to income tax, New Mexico also imposes a sales and use tax, which is applicable to the purchase of goods and certain services within the state. The sales tax rate in New Mexico is 5.125%, which is then combined with local taxes, resulting in varying effective tax rates across different jurisdictions within the state. These local taxes, often referred to as gross receipts taxes, are collected by the state and then distributed to the respective municipalities.

| Tax Type | Rate |

|---|---|

| State Sales Tax | 5.125% |

| Average Local Tax | Varies by Jurisdiction |

It's important to note that certain items, such as groceries, prescription drugs, and certain medical devices, are exempt from the sales tax in New Mexico. This is a measure to alleviate the tax burden on essential items and to provide some relief to lower-income households.

Property Tax

Property tax is another significant source of revenue for New Mexico. The state’s property tax system is administered at the county level, with each county setting its own tax rates. This means that property tax rates can vary significantly across the state.

Property taxes in New Mexico are based on the assessed value of the property. The assessment process involves evaluating the property's worth and then applying a tax rate to that value. The tax rate is typically expressed as a mill levy, which represents the amount of tax owed per $1,000 of assessed value. For instance, a mill levy of 50 would result in a tax of $50 for every $1,000 of assessed property value.

To provide some relief to homeowners, New Mexico offers a homestead exemption, which reduces the taxable value of a primary residence. This exemption varies by county and can significantly reduce the property tax burden for eligible homeowners.

Other State Taxes

Beyond the income, sales, and property taxes, New Mexico also imposes various other taxes to generate revenue. These include:

- Motor Vehicle Excise Tax: This tax is levied on the purchase or transfer of motor vehicles within the state.

- Severance Tax: Applicable to the extraction of natural resources, such as oil, gas, and minerals.

- Inheritance Tax: Imposed on certain transfers of property upon the death of a resident.

- Corporate Income Tax: Businesses operating in New Mexico are subject to corporate income tax, with rates varying based on the entity's structure and income.

Impact of State Taxes on Residents and Businesses

The state tax structure in New Mexico, like in any state, has a significant impact on both residents and businesses. For individuals, the progressive income tax system means that higher earners contribute a larger share of their income to the state’s revenue. This can be a source of contention, as it may lead to discussions about tax fairness and the distribution of wealth.

From a business perspective, the state's tax environment can influence investment decisions and the overall economic climate. New Mexico's sales tax, for instance, can affect the competitiveness of local businesses compared to online retailers, which may not be subject to the same tax obligations. However, the state also offers various tax incentives and credits to attract businesses and promote economic development.

Future Implications and Tax Policy Considerations

As with any state’s tax system, New Mexico’s tax policies are subject to ongoing evaluation and potential reform. The state’s tax landscape is influenced by various factors, including economic conditions, political ideologies, and the evolving needs of its residents.

In recent years, there has been a growing focus on tax fairness and simplification. This has led to discussions about tax reform, with some advocating for a flatter tax system that reduces the complexity of the current progressive structure. Such reforms could impact the tax burden on individuals and businesses, potentially shifting the balance of state revenue generation.

Additionally, the rise of e-commerce and remote work has prompted discussions about the fair taxation of online sales and the digital economy. New Mexico, like many other states, is navigating these challenges and exploring ways to adapt its tax system to the evolving economic landscape.

In conclusion, New Mexico, like other states, imposes a range of taxes to fund public services and infrastructure. The state's tax structure, including income, sales, and property taxes, has a direct impact on residents and businesses. As the state continues to evolve, its tax policies will remain a key area of focus, shaping the economic environment and the overall well-being of its residents.

What is the average effective tax rate in New Mexico for residents?

+The average effective tax rate for residents in New Mexico varies depending on their income level and local tax rates. On average, residents can expect to pay between 5% and 7% of their income in state and local taxes.

Are there any tax incentives for businesses in New Mexico?

+Yes, New Mexico offers various tax incentives to attract and support businesses. These include tax credits for job creation, research and development, and investments in renewable energy. Additionally, the state provides tax exemptions for certain industries, such as manufacturing and film production.

How does New Mexico’s tax structure compare to other states?

+New Mexico’s tax structure, particularly its income tax rates, is relatively competitive compared to other states. However, the state’s sales tax rate is slightly higher than the national average. Overall, New Mexico’s tax environment is designed to support economic growth while funding essential public services.