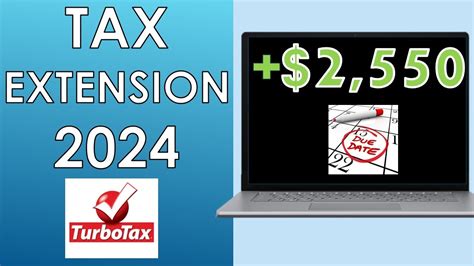

File Tax Extension With Turbotax

Filing your taxes can be a daunting task, especially if you find yourself short on time or unsure about certain aspects of your tax situation. In such cases, filing for a tax extension can provide much-needed breathing room. Fortunately, with TurboTax, you can easily navigate the process of extending your tax deadline and ensure compliance with the IRS.

A tax extension offers a valuable opportunity to gather the necessary information, organize your records, and seek professional advice if needed. By understanding the benefits and limitations of a tax extension, you can make an informed decision about whether it's the right choice for your specific circumstances.

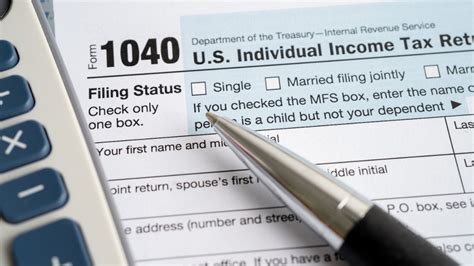

Understanding the Tax Extension Process

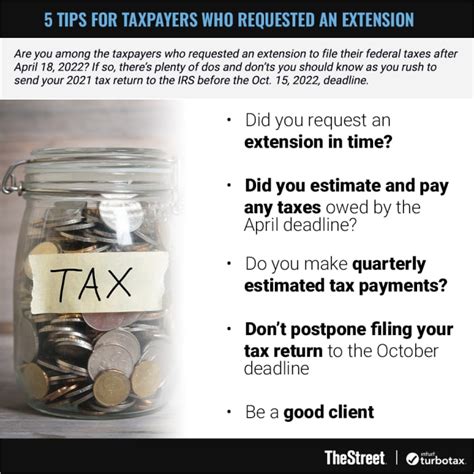

A tax extension, officially known as Form 4868, is a request to the IRS to extend the deadline for filing your federal income tax return. It's important to note that an extension does not provide additional time to pay your taxes; it only extends the deadline for submitting your tax return. However, if you owe taxes, it's crucial to estimate and pay at least 90% of your total tax liability by the original due date to avoid penalties and interest.

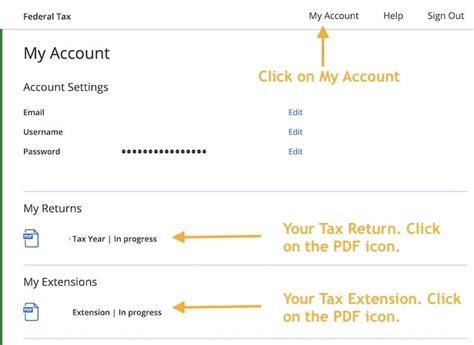

Filing for an extension is a relatively straightforward process, especially when using a trusted tax preparation software like TurboTax. Here's a step-by-step guide to help you through the process:

- Gather your tax documents: Before starting, ensure you have all the necessary tax documents, such as W-2s, 1099s, and any other relevant income and expense records. TurboTax provides a convenient checklist to help you gather all the required information.

- Estimate your tax liability: Use TurboTax's intuitive interface to estimate your tax liability for the year. This will help you determine the amount you need to pay by the original due date to avoid penalties.

- Complete Form 4868: With TurboTax, you can easily complete and e-file Form 4868. The software guides you through the process, ensuring accuracy and completeness. It automatically transfers the necessary information from your tax return to the extension form, saving you time and effort.

- E-file your extension: Once you've completed Form 4868, you can e-file it directly through TurboTax. This ensures a faster processing time compared to mailing the form to the IRS.

- Pay any taxes owed: If you owe taxes, remember to pay at least 90% of your estimated tax liability by the original due date. You can make this payment when you e-file your extension or set up a payment plan with the IRS.

By following these steps, you can efficiently file for a tax extension using TurboTax. It's a simple and stress-free process that provides you with the extra time needed to accurately complete your tax return.

Benefits of Filing a Tax Extension

Filing for a tax extension can offer several advantages, especially for taxpayers who require additional time to gather information, resolve complex tax issues, or seek professional assistance. Here are some key benefits:

- Time to Organize and Plan: An extension provides you with an extra six months (until October 15th) to organize your tax documents, review your financial records, and make informed decisions about your tax strategy. This can be particularly beneficial if you have a complex tax situation or multiple sources of income.

- Avoid Penalties and Interest: Filing for an extension ensures you meet the IRS deadline and avoid late filing penalties. However, it's important to note that an extension does not relieve you of the obligation to pay any taxes owed by the original due date. By paying at least 90% of your estimated tax liability, you can avoid interest and penalty charges.

- Access to Professional Guidance: With more time, you can consult with tax professionals or CPAs to address complex tax issues, maximize deductions, and ensure compliance with IRS regulations. TurboTax also offers access to tax experts who can provide guidance and support throughout the extension process.

- Flexibility for Amended Returns: If you discover errors or omissions in your original tax return after filing, an extension provides the flexibility to file an amended return without incurring penalties. This is especially useful if you need to correct mistakes or take advantage of additional deductions or credits.

While a tax extension can be beneficial, it's important to carefully consider your specific circumstances and tax obligations. An extension may not be necessary if you have all the required information and can accurately complete your tax return by the original due date.

TurboTax: Your Trusted Tax Extension Partner

TurboTax is a leading tax preparation software that offers a seamless and user-friendly experience when filing for a tax extension. With its intuitive interface and step-by-step guidance, you can navigate the extension process with confidence. Here's how TurboTax simplifies the process:

- Easy Form Completion: TurboTax guides you through Form 4868, ensuring you provide all the necessary information accurately. The software automatically populates fields based on your tax return, saving you time and reducing the risk of errors.

- Estimating Tax Liability: TurboTax's advanced tax calculation engine helps you estimate your tax liability with precision. This ensures you pay the correct amount by the original due date, avoiding unnecessary penalties and interest.

- Secure E-Filing: With TurboTax, you can e-file your extension form directly to the IRS. This method is faster and more secure than mailing the form, reducing the risk of delays and errors.

- Payment Options: TurboTax offers various payment options, including direct debit, credit card, or payment plan arrangements with the IRS. This flexibility allows you to manage your tax obligations in a way that suits your financial situation.

- Expert Support: TurboTax provides access to a team of tax experts who can answer your questions and provide guidance throughout the extension process. Whether you have complex tax issues or need assistance with specific deductions, their expertise ensures you make informed decisions.

By choosing TurboTax, you can have peace of mind knowing that your tax extension is being handled accurately and efficiently. The software's user-friendly interface and expert support make the process less stressful and more manageable.

Tips for a Successful Tax Extension

To ensure a smooth and successful tax extension process, consider the following tips:

- Start Early: Begin the extension process well in advance of the original tax deadline. This allows you to gather all the necessary documents, estimate your tax liability accurately, and make any required payments on time.

- Pay Your Taxes: Remember, an extension only provides additional time to file your tax return. You still need to pay any taxes owed by the original due date to avoid penalties and interest. Use TurboTax's payment options to make this process convenient and secure.

- Review Your Extension Form: Carefully review Form 4868 before submitting it. Ensure all the information is accurate and complete. TurboTax's built-in error checks and automatic data transfer help minimize the risk of errors, but it's always a good practice to double-check.

- Seek Professional Help: If you have complex tax issues or are unsure about certain aspects of your tax situation, consider seeking the advice of a tax professional or CPA. They can provide expert guidance and ensure you're maximizing your deductions and credits.

- Stay Organized: Maintain a well-organized system for your tax documents and records. This will make it easier to find information when preparing your tax return during the extended filing period. TurboTax's document checklist can assist you in gathering all the necessary items.

By following these tips and utilizing the capabilities of TurboTax, you can successfully navigate the tax extension process and ensure compliance with IRS regulations.

Conclusion

Filing for a tax extension with TurboTax is a straightforward and efficient way to gain additional time to complete your tax return. By understanding the benefits and limitations of an extension, you can make an informed decision about whether it's the right choice for your circumstances. TurboTax's user-friendly interface, expert support, and secure e-filing capabilities make the extension process seamless and stress-free.

Remember, while an extension provides valuable time, it's crucial to remain proactive and meet your tax obligations. By starting early, paying your taxes on time, and seeking professional guidance when needed, you can ensure a successful tax extension experience. With TurboTax by your side, you can navigate the tax landscape with confidence and peace of mind.

Can I file for a tax extension if I’m expecting a refund?

+Yes, you can still file for a tax extension even if you’re expecting a refund. An extension only extends the deadline for filing your tax return, not for receiving your refund. By filing for an extension, you ensure you have more time to accurately complete your return and claim any eligible deductions or credits.

How much does it cost to file a tax extension with TurboTax?

+The cost of filing a tax extension with TurboTax depends on the version of the software you choose. The basic version, which includes Form 4868, is typically free to use. However, if you require additional forms or have a more complex tax situation, you may need to upgrade to a premium version, which comes with a fee. TurboTax offers various pricing plans to cater to different tax needs.

Can I file an extension for state taxes as well?

+Yes, TurboTax allows you to file extensions for both federal and state taxes. However, it’s important to note that each state has its own rules and deadlines for filing extensions. Ensure you familiarize yourself with your state’s specific requirements and deadlines to avoid penalties or late filing issues.

What happens if I don’t pay enough taxes by the original due date when filing an extension?

+If you don’t pay at least 90% of your estimated tax liability by the original due date when filing an extension, you may be subject to penalties and interest. The IRS imposes a late payment penalty, which is typically 0.5% of the unpaid tax for each month or part of a month the tax remains unpaid, up to a maximum of 25%. Additionally, interest accrues on the unpaid tax from the original due date until the tax is paid in full.

Can I file an extension if I’m a sole proprietor or business owner?

+Yes, sole proprietors and business owners can also file for tax extensions. However, it’s important to note that the extension applies only to your personal income tax return. If you have business tax obligations, such as payroll taxes or estimated quarterly payments, you may need to file separate extensions for those. Consult with a tax professional or refer to IRS guidelines for specific instructions.