City Of New Britain Taxes

Welcome to a comprehensive guide on the City of New Britain's tax system, where we delve into the intricacies of the local taxation landscape. As an essential aspect of municipal governance, understanding the tax structure is crucial for both residents and businesses alike. This article aims to provide an in-depth analysis, shedding light on the various tax components, their implications, and how they contribute to the overall fiscal health of the city.

Unraveling the Tax Landscape of New Britain

The tax system in New Britain, Connecticut, plays a pivotal role in funding essential public services, infrastructure development, and community initiatives. It is a complex yet vital mechanism that ensures the city’s sustainable growth and prosperity. This section provides an overview of the key tax components and their significance.

Property Taxes: The Foundation of Municipal Revenue

Property taxes form the backbone of New Britain’s tax structure. These taxes are levied on both residential and commercial properties, with rates determined by the assessed value of the property and the city’s mill rate. The mill rate, expressed in mills per dollar, is set annually by the city’s governing body, taking into consideration the budget requirements and the need to maintain a balanced tax burden.

The city's assessing department plays a critical role in this process, ensuring fair and accurate property assessments. They utilize various factors such as location, size, condition, and recent sales data to determine the market value of each property. This value is then used as a basis for calculating the tax liability.

| Property Type | Tax Rate (Mills) |

|---|---|

| Residential | 26.82 mills |

| Commercial/Industrial | 33.60 mills |

It's important to note that property tax bills are typically issued twice a year, and timely payments are crucial to avoid penalties and interest charges. New Britain offers convenient payment options, including online payment portals and direct debit facilities, to facilitate taxpayers.

Sales and Use Taxes: Generating Revenue from Economic Activities

New Britain, being a vibrant commercial hub, also relies on sales and use taxes to generate revenue. These taxes are levied on the sale of goods and services within the city limits. The sales tax is applied at the point of purchase, while the use tax is applicable when goods are purchased from outside the city and brought into New Britain for use or consumption.

The current sales and use tax rate in New Britain stands at 6.35%, which includes both the state and local tax components. This rate is subject to change based on legislative decisions and economic factors. Businesses operating within the city are responsible for collecting and remitting these taxes to the state, which in turn distributes a portion to the city based on the sales volume.

The revenue generated from sales and use taxes significantly contributes to the city's infrastructure development, particularly in areas such as transportation, utilities, and public spaces. It also supports economic development initiatives, making New Britain an attractive destination for businesses and investors.

Motor Vehicle Taxes: Registering and Licensing Vehicles

Motor vehicle taxes are an essential component of New Britain’s tax system, particularly for vehicle owners. These taxes are levied annually based on the assessed value of the vehicle and the city’s tax rate. The assessment takes into account factors such as the vehicle’s make, model, age, and condition.

| Vehicle Type | Tax Rate (Mills) |

|---|---|

| Passenger Vehicles | 29.28 mills |

| Commercial Vehicles | 36.60 mills |

Vehicle owners are required to pay these taxes when registering their vehicles with the city. The revenue generated from motor vehicle taxes contributes to various public services, including road maintenance, public transportation, and safety initiatives.

Income Taxes: Contributing to the City’s Fiscal Stability

While New Britain, like many other cities in Connecticut, does not have a local income tax, the state’s income tax system still plays a significant role in the city’s fiscal health. The state income tax revenue is distributed to cities and towns based on various factors, including population, employment levels, and economic activity.

New Britain residents contribute to the state income tax system through their employment or business income. This revenue stream provides a stable and predictable source of funding for the city, supporting essential services and long-term planning.

Tax Incentives and Relief Programs

Recognizing the impact of taxes on individuals and businesses, New Britain offers a range of tax incentives and relief programs to promote economic growth and support its residents.

Business Tax Incentives

The city actively encourages business growth and development by offering tax incentives to new and expanding businesses. These incentives can take the form of tax abatements, tax increment financing (TIF), or other customized arrangements, depending on the nature and scale of the business investment.

For instance, the New Britain Development Corporation (NBDC) collaborates with the city to offer tax incentives to attract businesses to designated redevelopment areas. These incentives aim to stimulate economic activity, create jobs, and enhance the overall business climate.

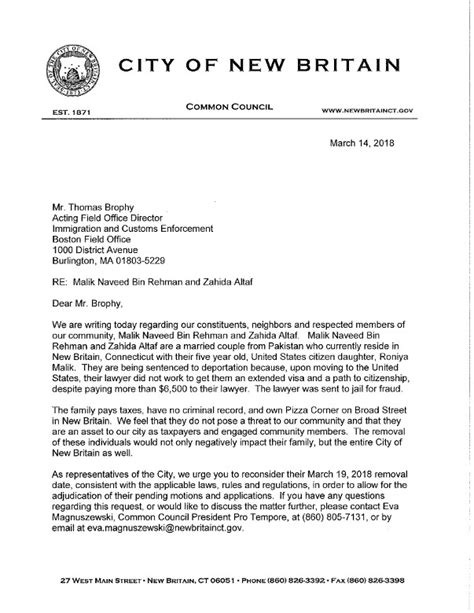

Property Tax Relief Programs

New Britain understands the financial burden that property taxes can impose on certain segments of the population. As such, the city provides various property tax relief programs to support senior citizens, disabled individuals, and low-income households.

The Elderly Tax Relief Program offers a partial or full exemption from property taxes for eligible senior citizens. Similarly, the Disabled Veteran Exemption provides property tax relief to qualifying veterans with disabilities. Additionally, the Homeowner's Property Tax Assistance Program (HPTAP) offers grants to eligible low- and moderate-income homeowners to help cover their property tax expenses.

Community Engagement and Transparency

The City of New Britain recognizes the importance of transparency and community engagement in its tax system. Regular town hall meetings and public forums provide opportunities for residents to voice their concerns, ask questions, and actively participate in shaping the city’s fiscal policies.

Furthermore, the city's official website offers a wealth of information regarding tax policies, payment options, and relevant resources. This ensures that taxpayers have easy access to the information they need to understand their tax obligations and rights.

Future Outlook and Strategic Planning

As New Britain continues to evolve and grow, its tax system plays a crucial role in shaping the city’s future. The city’s strategic planning process involves analyzing tax trends, evaluating the effectiveness of existing tax policies, and exploring potential reforms to ensure a sustainable and equitable tax structure.

The city's leadership actively engages with stakeholders, including business leaders, community organizations, and residents, to gather insights and feedback on tax-related matters. This collaborative approach ensures that the tax system remains responsive to the needs and aspirations of the community.

Looking ahead, New Britain aims to strike a balance between generating sufficient revenue to fund essential services and maintaining a competitive tax environment to attract businesses and residents. This delicate equilibrium is essential for the city's long-term prosperity and quality of life.

Conclusion

In conclusion, the City of New Britain’s tax system is a complex yet crucial mechanism that supports the city’s development, provides essential services, and fosters economic growth. From property taxes to sales taxes and motor vehicle taxes, each component plays a vital role in shaping the city’s fiscal landscape.

By understanding the tax system and actively engaging with the community, New Britain strives to create a fair and transparent taxation environment. This ensures that the city remains a vibrant and prosperous place to live, work, and do business.

What is the average property tax rate in New Britain, CT?

+

The average property tax rate in New Britain is approximately 2.25%, which is relatively higher than the national average. However, it’s important to note that property tax rates can vary significantly based on the assessed value of the property and the specific tax rate applied by the city.

How often are property taxes assessed in New Britain?

+

Property taxes in New Britain are assessed annually. The city’s assessing department conducts regular revaluations to ensure that property assessments remain fair and accurate. This process takes into account various factors such as market conditions, property improvements, and neighborhood changes.

Are there any tax incentives available for businesses in New Britain?

+

Yes, New Britain offers a range of tax incentives to attract and support businesses. These incentives can include tax abatements, tax increment financing (TIF), and other customized arrangements. The New Britain Development Corporation (NBDC) plays a key role in facilitating these incentives, especially for businesses operating in designated redevelopment areas.

How can I pay my property taxes in New Britain?

+

There are several convenient ways to pay your property taxes in New Britain. You can make payments online through the city’s official website, use direct debit facilities, or pay in person at the city’s tax office. The city also accepts payments by mail, ensuring flexibility for taxpayers.

What happens if I fail to pay my property taxes on time?

+

Late payment of property taxes can result in penalties and interest charges. It’s important to stay updated on your tax obligations and payment deadlines to avoid any additional financial burdens. The city provides timely reminders and offers assistance to taxpayers who may be facing financial difficulties.