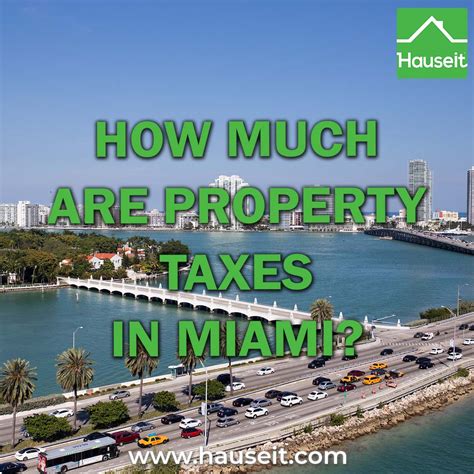

Miami Property Tax

In the vibrant city of Miami, Florida, property ownership comes with an important financial obligation: property taxes. Understanding the ins and outs of Miami's property tax system is crucial for both residents and investors alike. This comprehensive guide will delve into the intricacies of Miami property taxes, providing you with valuable insights to navigate this essential aspect of property ownership.

Understanding Miami’s Property Tax Landscape

Miami, known for its sunny beaches and dynamic culture, is a popular destination for real estate investors and homeowners. However, the allure of the Magic City extends beyond its scenic beauty; it also boasts a robust economy and a diverse range of neighborhoods, each with its own unique charm. As a result, property taxes in Miami can vary significantly depending on the location, type of property, and its assessed value.

Miami's property tax system is governed by the Florida Department of Revenue, which oversees the assessment and collection of taxes on real estate. The city's tax rates are influenced by various factors, including local government budgets, school district funding, and special assessments for community projects. Understanding these influences is key to grasping the nuances of Miami's property tax landscape.

How Property Taxes are Calculated in Miami

The calculation of property taxes in Miami involves a series of steps, each contributing to the final tax bill. Here’s a breakdown of the process:

- Property Assessment: The first step is the assessment of your property’s value by the Miami-Dade County Property Appraiser’s Office. This value, known as the “assessed value,” is based on factors such as the property’s location, size, improvements, and market conditions. It’s important to note that the assessed value may not always align with the property’s fair market value.

- Taxable Value Determination: After the assessment, the property’s taxable value is calculated. In Florida, properties are eligible for various exemptions, such as the Homestead Exemption for primary residences. These exemptions reduce the taxable value of the property, resulting in lower tax bills. The taxable value is then multiplied by the appropriate tax rate to determine the tax liability.

- Tax Rate Application: Miami’s tax rates are expressed as millage rates, which represent the amount of tax per $1,000 of taxable property value. These rates are set annually by local government entities, including the county, city, and school board. The cumulative millage rate determines the overall tax rate for your property.

| Tax Entity | Millage Rate |

|---|---|

| Miami-Dade County | 9.7717 |

| Miami City | 2.3295 |

| Miami-Dade School Board | 7.5469 |

Factors Influencing Property Tax Bills

Several factors come into play when determining your property tax bill in Miami. Here are some key considerations:

- Property Type: Different types of properties, such as residential, commercial, or agricultural, may have varying tax rates and assessment methodologies.

- Location: Property taxes can differ significantly across Miami’s diverse neighborhoods. Factors like proximity to the beach, downtown areas, or sought-after school districts can influence tax rates.

- Property Value: As property values rise, so does the assessed value, which directly impacts your tax bill. Regularly monitoring property values in your area can help you anticipate potential changes in your tax liability.

- Exemptions and Discounts: Miami offers a range of exemptions and discounts to eligible property owners. These can include the Homestead Exemption, Senior Exemption, and Disability Exemption. Understanding your eligibility and applying for these benefits can reduce your tax burden.

Managing Your Property Tax Obligations

Navigating Miami’s property tax system can be complex, but with the right strategies, you can effectively manage your tax obligations. Here are some tips to consider:

Stay Informed and Engage with Local Government

Staying informed about local government decisions and budget allocations is essential. Attend community meetings, engage with your local representatives, and keep an eye on news sources to understand how tax rates and assessments may change. By staying involved, you can anticipate and plan for potential tax increases or new assessments.

Understand Your Property’s Value and Assessments

Regularly review your property’s assessed value and compare it with recent sales in your neighborhood. If you believe your property’s value has been over-assessed, you have the right to appeal. The Miami-Dade County Property Appraiser’s Office provides resources and guidance on the appeal process. Staying proactive can help ensure your tax bill aligns with your property’s true value.

Explore Exemption Opportunities

Take the time to understand the various exemptions and discounts available in Miami. The Homestead Exemption, for example, can provide significant savings for primary residence owners. Additionally, Miami offers special assessments for elderly or disabled homeowners. Research and apply for these exemptions to reduce your tax burden and make property ownership more affordable.

Consider Tax Strategies for Investment Properties

If you own investment properties in Miami, explore tax strategies to optimize your returns. Consult with tax professionals who specialize in real estate to understand how depreciation, cost segregation, and other strategies can minimize your tax liability. Effective tax planning can enhance the profitability of your investment properties.

Utilize Online Tools and Resources

Miami-Dade County provides online tools and resources to help property owners navigate the tax system. These include property tax estimators, assessment records, and payment options. Utilize these resources to calculate your tax liability, track payments, and stay informed about any changes or updates.

The Future of Miami’s Property Tax Landscape

As Miami continues to evolve and grow, its property tax landscape is likely to experience changes and adjustments. The city’s dynamic real estate market, coupled with ongoing infrastructure developments and community initiatives, will influence tax rates and assessments. Staying abreast of these developments is crucial for both long-term residents and investors.

One notable trend is the increasing focus on sustainability and green initiatives. Miami, known for its environmental awareness, is likely to see more tax incentives and assessments tied to sustainable practices. Property owners who embrace eco-friendly measures may benefit from reduced tax burdens and enhanced property values.

Additionally, as Miami's population continues to diversify, the city's tax base will expand, potentially leading to more stable and predictable tax rates. This stability can provide a sense of security for property owners, making long-term planning more feasible.

Conclusion

Understanding and effectively managing Miami’s property tax system is a critical aspect of responsible property ownership. By staying informed, engaging with local government, and exploring the various exemptions and strategies available, you can navigate the complexities of property taxes with confidence. Whether you’re a resident or an investor, this comprehensive guide provides the foundation you need to make informed decisions and ensure your property tax obligations are well-managed.

What is the average property tax rate in Miami?

+The average effective property tax rate in Miami is approximately 0.98%, which is below the national average. However, it’s important to note that rates can vary significantly based on the property’s location and value.

When are property taxes due in Miami?

+Property taxes in Miami are due in two installments. The first installment is typically due in November, and the second installment is due in March of the following year.

Can I appeal my property’s assessed value in Miami?

+Yes, if you believe your property’s assessed value is inaccurate, you have the right to appeal. The Miami-Dade County Property Appraiser’s Office provides guidelines and resources for the appeal process.

Are there any tax incentives for eco-friendly properties in Miami?

+Yes, Miami offers various tax incentives for properties that incorporate sustainable practices. These incentives can include reduced assessments for energy-efficient improvements and tax credits for solar installations.

How can I estimate my property tax bill in Miami?

+Miami-Dade County provides an online property tax estimator tool. By entering your property’s details, you can get an estimate of your tax liability based on the current tax rates and your property’s assessed value.