San Bernardino County Tax

Welcome to our comprehensive guide on San Bernardino County Tax, where we will delve into the intricacies of tax obligations and strategies within this county. As one of the largest counties in the United States, San Bernardino County boasts a diverse economy and a unique tax landscape. This guide aims to provide you with an in-depth understanding of the tax system, offering practical insights and expert advice to navigate the complexities effectively.

Understanding the San Bernardino County Tax System

San Bernardino County, located in the heart of Southern California, encompasses a wide range of industries, from agriculture and manufacturing to tourism and technology. With such diversity, the tax structure plays a crucial role in shaping the economic landscape. The county’s tax system is primarily governed by state and local laws, with a focus on promoting economic growth and stability.

The county collects various types of taxes, including property taxes, sales and use taxes, business taxes, and special assessments. Each of these tax categories has its own set of rules and regulations, making it essential for individuals and businesses to stay informed and compliant.

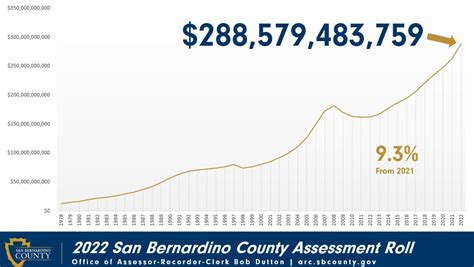

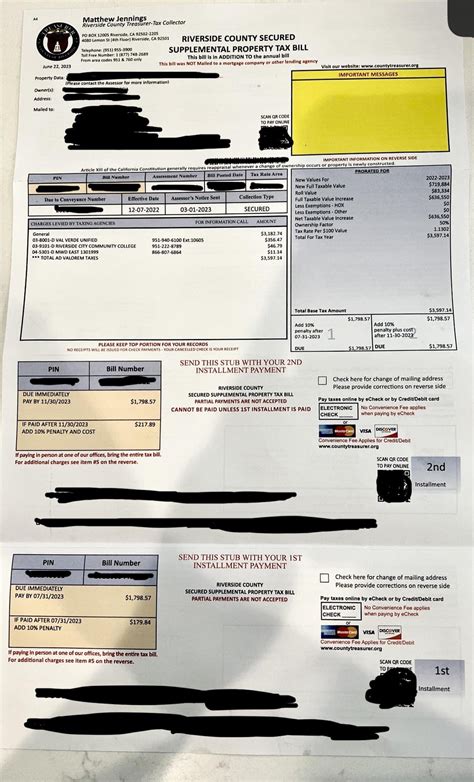

Property Taxes: A Key Component

Property taxes are a significant source of revenue for San Bernardino County. These taxes are based on the assessed value of real property, which includes land, buildings, and improvements. The county’s Assessor’s Office is responsible for determining the assessed value, taking into account factors such as location, market conditions, and property characteristics.

| Property Type | Tax Rate |

|---|---|

| Residential Properties | 1% of Assessed Value |

| Commercial Properties | 1.1% of Assessed Value |

| Agricultural Land | 0.6% of Assessed Value |

It's important to note that property taxes in San Bernardino County are subject to change based on state and local legislation. Additionally, various exemptions and reductions may apply, such as the Homeowners' Exemption, which can reduce the taxable value of a primary residence.

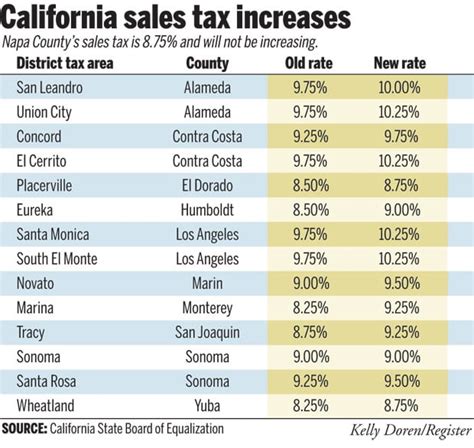

Sales and Use Taxes: A Dynamic Revenue Stream

Sales and use taxes contribute significantly to the county’s revenue stream. The Sales and Use Tax Division oversees the collection and administration of these taxes, ensuring compliance across various sectors.

San Bernardino County imposes a general sales tax rate of 7.25%, which includes both state and county taxes. However, the rate can vary depending on the location within the county, as certain cities and districts have the authority to impose additional taxes. For instance, the city of Ontario has a 1% local sales tax, bringing the total sales tax rate to 8.25% within its boundaries.

Use taxes, on the other hand, are levied on the storage, use, or consumption of tangible personal property in San Bernardino County. These taxes apply when sales tax is not paid at the point of sale, such as in online purchases or out-of-state transactions. The use tax rate mirrors the sales tax rate, ensuring equitable taxation.

Business Taxes: A Complex Landscape

For businesses operating within San Bernardino County, navigating the business tax landscape can be challenging. The county imposes various taxes and fees on businesses, including:

- Business License Tax: Required for most businesses, this tax is based on the type of business and its gross receipts. The tax rate varies depending on the business category and can range from 0.1% to 0.4%.

- Transitory Occupancy Tax (TOT): Applicable to hotels, motels, and other lodging establishments, this tax is charged to guests and collected by the business. The TOT rate is typically set by the city or district where the lodging facility is located.

- County Tax Registration Fee: All businesses operating within the county are required to register and pay an annual fee. This fee varies based on the business type and can range from $35 to $80.

It's crucial for businesses to stay updated on their tax obligations and seek professional guidance to ensure compliance and optimize their tax strategies.

Maximizing Tax Strategies: A Guide for Individuals and Businesses

In the complex world of San Bernardino County taxes, adopting effective strategies can make a significant difference in your financial well-being. Whether you’re an individual homeowner or a business owner, here are some key strategies to consider:

Tax Planning for Individuals

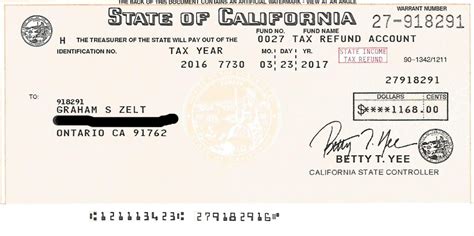

For homeowners, understanding property tax exemptions and reductions is essential. The Homeowners’ Exemption, as mentioned earlier, can provide significant savings on your annual property tax bill. Additionally, the Senior Citizens’ Exemption and the Disabled Veterans’ Exemption offer further relief for eligible individuals.

Furthermore, staying informed about changes in tax laws and assessment practices can help you anticipate and plan for potential tax increases. Regularly reviewing your property assessment and appealing if necessary is another strategic move to ensure fairness.

Tax Optimization for Businesses

Businesses operating in San Bernardino County have a unique set of tax considerations. Here are some strategies to optimize your tax position:

- Business License Tax Optimization: Analyze your business's gross receipts and structure your operations to fall within the lowest tax bracket. Consider the impact of different business types and their corresponding tax rates.

- Sales Tax Compliance: Ensure your business is registered for sales tax and collects the correct tax rate. Regularly review sales tax rates and any changes to avoid penalties. Consider using sales tax automation tools to streamline compliance.

- Tax Incentives and Credits: Explore the various tax incentives and credits available at the state and local levels. These can include research and development tax credits, job creation credits, and tax abatements for certain industries. Consult with tax professionals to identify applicable incentives.

- Business Expense Management: Properly track and categorize business expenses to maximize deductions. This includes rent, utilities, marketing costs, and employee expenses. Stay updated on tax law changes to ensure you're taking advantage of all allowable deductions.

The Future of San Bernardino County Taxes: Trends and Insights

As we look ahead, several trends and insights shape the future of San Bernardino County’s tax landscape. Here’s a glimpse into what experts predict:

Potential Tax Reforms

San Bernardino County, like many other jurisdictions, is considering tax reforms to address budget constraints and promote economic growth. One potential reform is the split-roll property tax system, which would treat commercial and residential properties differently for tax purposes. This could lead to higher taxes for commercial properties and provide some relief for homeowners.

Technology’s Impact

The rise of e-commerce and digital transactions has already had a significant impact on sales tax collection. San Bernardino County, along with other counties, is adapting to this trend by investing in technology to improve compliance and streamline tax administration. This includes implementing sales tax software and online registration systems for businesses.

Economic Development Initiatives

The county’s focus on economic development is expected to continue, with an emphasis on attracting and retaining businesses. This may lead to the introduction of targeted tax incentives and credits to encourage investment and job creation. Keep an eye out for new programs and initiatives aimed at supporting business growth.

Conclusion: Empowering Tax Compliance and Success

Understanding and navigating the tax landscape of San Bernardino County is crucial for individuals and businesses alike. By staying informed, adopting strategic tax planning, and leveraging available resources, you can optimize your tax position and contribute to the county’s economic prosperity. Remember, tax compliance is not just a legal obligation but also an opportunity to support the community and its growth.

FAQ

What is the deadline for paying property taxes in San Bernardino County?

+

The deadline for paying property taxes in San Bernardino County is typically February 1st of each year. However, if the due date falls on a weekend or holiday, the deadline is extended to the next business day.

How can I appeal my property assessment if I believe it is inaccurate?

+

To appeal your property assessment, you need to file an application with the Assessment Appeals Board within a specified timeframe. The process involves submitting evidence to support your claim and attending a hearing. It’s advisable to consult a tax professional for guidance.

Are there any sales tax holidays in San Bernardino County?

+

Yes, San Bernardino County, along with other California counties, participates in certain sales tax holidays. These are designated periods when specific items, such as clothing or school supplies, are exempt from sales tax. Stay updated on the dates and eligible items through the county’s official website or local news sources.