California Income Tax Refund

In the Golden State, understanding the intricacies of the tax system is crucial, especially when it comes to navigating the process of claiming income tax refunds. California's tax structure is unique, and keeping up with the latest regulations and processes can be challenging for residents and businesses alike. This comprehensive guide aims to demystify the California income tax refund process, providing an expert analysis to help you maximize your refund and navigate potential complexities.

Understanding California’s Income Tax System

California’s tax landscape is shaped by its progressive income tax rates, which are structured to ensure a fair distribution of tax burden. The state’s tax system is designed to collect revenue for essential services, infrastructure development, and social programs, making it a critical component of California’s economic ecosystem.

The state's income tax rates are divided into several brackets, with the tax percentage increasing as income levels rise. This progressive structure ensures that higher-income earners contribute a larger proportion of their income towards state revenues. For instance, in the 2023 tax year, California's income tax rates range from 1% for the lowest income bracket to 12.3% for the highest income bracket. These rates are subject to change annually, influenced by legislative decisions and economic factors.

In addition to the state income tax, Californians also pay federal income tax, which is collected by the Internal Revenue Service (IRS). The federal tax system has its own set of brackets and rates, which are often different from those at the state level. It's essential for taxpayers to understand both systems to ensure they're compliant with all relevant tax laws and to maximize their potential refunds.

Key Differences from Federal Income Tax

While California’s income tax system shares some similarities with the federal system, there are notable differences that taxpayers should be aware of. For example, California allows for the deduction of state income taxes paid on federal returns, which can reduce the overall tax burden for residents. However, this deduction is subject to certain limits and conditions, and it’s important to consult a tax professional to ensure you’re taking full advantage of this opportunity.

Another key difference is that California's tax year aligns with the federal tax year, which runs from January 1st to December 31st. However, the deadlines for filing and paying taxes can vary slightly between the state and federal levels. It's crucial to stay updated on these deadlines to avoid late fees and penalties.

Furthermore, California offers various tax credits and deductions that aren't available at the federal level. These include credits for dependent care, child and dependent tax credits, and the state's Earned Income Tax Credit (EITC), which provides a refund to low- and moderate-income working individuals and families. Understanding these credits and deductions can significantly impact your tax liability and potential refund.

| Tax Credit/Deduction | Description |

|---|---|

| Dependent Care Credit | Offers a credit for childcare expenses, allowing working parents to offset some of the costs of childcare. |

| Child and Dependent Tax Credit | Provides a tax credit for eligible children and dependents, helping to reduce the tax burden for families. |

| California Earned Income Tax Credit (EITC) | Similar to the federal EITC, this credit provides a refund to low- and moderate-income workers, further supporting working individuals and families. |

The California Income Tax Refund Process

Claiming your income tax refund in California involves a systematic process that requires attention to detail and an understanding of the state’s tax regulations. The first step is to ensure that you have all the necessary documentation and information to file your tax return accurately.

This includes gathering your income statements, such as W-2 forms from employers, 1099 forms for any self-employment or freelance work, and any other relevant financial documents. It's essential to keep accurate records of all income sources to ensure a smooth filing process and to support the accuracy of your return.

Filing Your Tax Return

The next step is to file your tax return, either electronically or by mail. California offers an online filing system, TaxCal, which is a secure and convenient way to submit your return. This system guides you through the process, ensuring that you provide all the necessary information and claim all the credits and deductions you’re eligible for.

For those who prefer a more traditional approach, paper returns can be mailed to the Franchise Tax Board (FTB). However, it's important to note that electronic filing is generally faster and reduces the risk of errors. Whichever method you choose, ensure that your return is filed by the deadline to avoid late filing penalties.

| Filing Method | Pros | Cons |

|---|---|---|

| Electronic Filing (TaxCal) |

|

|

| Paper Filing (Mail) |

|

|

When filing, it's crucial to double-check all the information you've provided. Common errors include incorrect personal information, such as name or Social Security Number (SSN), and miscalculations of income or deductions. These errors can delay the processing of your return and impact the accuracy of your refund amount.

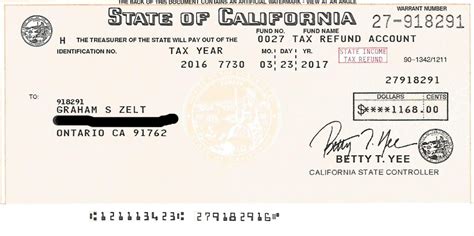

Once your return is filed, the FTB will process it and determine your tax liability. If you've overpaid your taxes, you'll be eligible for a refund. The FTB will then issue your refund, typically within 60 days of filing for electronic returns and within 90 days for paper returns.

Receiving Your Refund

California offers several options for receiving your income tax refund. The most common method is a direct deposit into your bank account, which is typically the fastest way to receive your refund. You’ll need to provide your bank account details, including the routing number and account number, when filing your return.

Alternatively, you can opt for a check refund, which will be mailed to your address on file with the FTB. This method may take longer, and there's a risk of the check being lost or stolen, so it's generally recommended to choose direct deposit if possible.

For those who need their refund quickly, the FTB offers a refund anticipation loan (RAL) option. This is a short-term loan provided by a third-party lender, which is repaid when your actual refund is received. While this option can provide immediate funds, it's important to note that RALs often come with high fees and interest rates, making them a less desirable choice.

| Refund Method | Pros | Cons |

|---|---|---|

| Direct Deposit |

|

|

| Check Refund |

|

|

| Refund Anticipation Loan (RAL) |

|

|

Maximizing Your California Income Tax Refund

While the primary goal of filing your tax return is to ensure compliance with state tax laws, it’s also an opportunity to maximize your refund. There are several strategies and considerations you can implement to increase the amount of your refund.

Explore Tax Credits and Deductions

California offers a range of tax credits and deductions that can significantly reduce your tax liability and increase your refund. These credits and deductions are designed to support specific groups or encourage certain behaviors, such as energy-efficient home improvements or donations to charitable organizations.

Some of the most common tax credits and deductions include the California Earned Income Tax Credit (EITC), which provides a refund to low- and moderate-income workers, and the Child and Dependent Care Credit, which helps offset the costs of childcare. Additionally, California offers a Homeowner's Property Tax Credit to help offset the cost of property taxes for eligible homeowners.

| Tax Credit/Deduction | Description |

|---|---|

| California Earned Income Tax Credit (EITC) | Provides a refund to low- and moderate-income workers, supporting working individuals and families. |

| Child and Dependent Care Credit | Offers a credit for childcare expenses, reducing the tax burden for working parents. |

| Homeowner's Property Tax Credit | Helps offset the cost of property taxes for eligible homeowners, providing financial relief. |

It's crucial to research and understand the eligibility criteria and requirements for these credits and deductions. Many of them have income thresholds, specific documentation requirements, or other conditions that must be met. By carefully reviewing your eligibility and claiming all the credits and deductions you're entitled to, you can maximize your refund and reduce your tax burden.

Consider Tax Planning Strategies

Tax planning is a strategic approach to managing your finances throughout the year to optimize your tax situation. By making informed financial decisions, you can potentially reduce your tax liability and increase your refund. Here are some tax planning strategies to consider:

- Adjust Your Withholding: If you anticipate a large refund, consider adjusting your withholding allowances on your W-4 form. This will increase your take-home pay throughout the year, but it's important to strike a balance to avoid owing taxes at the end of the year.

- Maximize Retirement Contributions: Contributions to retirement accounts, such as 401(k)s or IRAs, are often tax-deductible. By maximizing your contributions, you can reduce your taxable income and potentially increase your refund.

- Utilize Tax-Advantaged Accounts: California offers several tax-advantaged accounts, such as Health Savings Accounts (HSAs) and 529 College Savings Plans. Contributions to these accounts are often tax-deductible, and the earnings grow tax-free.

- Strategic Timing of Large Purchases: Consider the timing of large purchases, such as a new car or home improvements. Some expenses may be tax-deductible, and strategic timing can impact your tax liability and potential refund.

It's important to note that tax planning strategies should be tailored to your individual financial situation and goals. Consulting a tax professional can provide personalized advice and ensure that you're making the most of your financial decisions from a tax perspective.

Stay Informed about Tax Changes

The tax landscape is constantly evolving, and staying informed about changes to tax laws and regulations is crucial for maximizing your refund. California’s tax system is subject to legislative changes, and new tax credits, deductions, or incentives may be introduced each year.

Keep an eye on tax-related news and updates, especially as the new tax year approaches. The Franchise Tax Board (FTB) and other official sources provide regular updates on tax law changes, and they often offer guidance and resources to help taxpayers understand and navigate these changes.

Additionally, consider seeking out tax workshops or seminars, which can provide valuable insights into the latest tax strategies and opportunities. These events are often hosted by tax professionals or financial institutions and can be a great way to stay informed and connect with experts in the field.

Common Issues and Troubleshooting

While the income tax refund process in California is designed to be straightforward, there are certain common issues and challenges that taxpayers may encounter. Understanding these potential pitfalls and knowing how to address them can help ensure a smooth refund process.

Dealing with Processing Delays

Processing delays can occur for a variety of reasons, such as errors on your tax return, missing or incomplete information, or high volumes of returns being processed. If you’re expecting a refund and haven’t received it within the typical timeframe, there are steps you can take to investigate the delay.

First, check the status of your refund through the FTB's online refund tracker. This tool provides real-time updates on the status of your refund and can help you determine if there are any issues with your return. If the tracker indicates a delay, you can contact the FTB directly to inquire about the status and potential reasons for the delay.

In some cases, processing delays may be due to identity verification or fraud prevention measures. If the FTB suspects fraudulent activity, they may hold your refund until they can confirm your identity. It's crucial to respond promptly to any requests for additional information or documentation to resolve these issues and get your refund processed.

Addressing Refund Errors

Refund errors can occur when there are discrepancies between the information on your tax return and the FTB’s records. These errors may result in an incorrect refund amount, a delayed refund, or even a request for repayment if you’ve received more than you’re entitled to.

If you suspect an error with your refund, it's important to act promptly. First, carefully review your tax return and the FTB's correspondence to identify the specific issue. Common errors include incorrect income reporting, miscalculated deductions or credits, or missing information.

Once you've identified the error, contact the FTB to discuss the issue and request a correction. They will guide you through the process of amending your return or providing additional documentation to resolve the error. It's crucial to cooperate with the FTB and provide all the necessary information to ensure a swift resolution.

Handling Refund Repayments

In some cases, you may receive a notice from the FTB requesting repayment of a refund that was issued in error. This can be a challenging situation, especially if the repayment amount is significant. However, it’s important to handle these situations promptly and cooperatively to avoid further complications.

If you receive a repayment notice, carefully review the details to understand the reason for the request. Common reasons for repayment include errors on your tax return, changes to your income or deductions, or the discovery of additional income that wasn't reported.

Contact the FTB to discuss the repayment and explore your options. They may offer a repayment plan or other arrangements to make the process more manageable. It's crucial to cooperate with the FTB and provide any additional information they request to resolve the issue.

If you're unable to repay the full amount immediately, it's important to communicate your situation and explore alternative solutions. The FTB may be willing to work with you to find a solution that's feasible for your financial circumstances.

Conclusion

Navigating the California income tax refund process can be complex, but with a thorough understanding of the system and careful planning, you can maximize your refund and ensure a smooth experience. By staying informed, exploring tax credits and deductions, and implementing strategic tax planning, you can make the most of your financial situation and potentially increase your refund.

Remember, the key to a successful refund process is accurate and timely filing, along with staying informed about tax changes and regulations. Whether you’re a resident or a business owner, understanding California’s tax system is an essential part of financial management in the Golden State. By leveraging the resources and expertise available, you can ensure compliance,