Germany Income Tax

Germany's income tax system is a vital component of the country's fiscal policy, playing a significant role in shaping its economic landscape and social welfare programs. The income tax is progressive, meaning that higher incomes are taxed at a higher rate, fostering a sense of fairness and contributing to the overall economic stability of the nation. This article aims to provide an in-depth analysis of Germany's income tax system, covering its history, structure, and implications for individuals and businesses.

A Historical Perspective on Germany’s Income Tax

The roots of Germany’s modern income tax system can be traced back to the early 20th century. The first comprehensive income tax law, the Einkommensteuergesetz, was introduced in 1919, marking a significant shift in the country’s fiscal policy. This law established the principles of progressive taxation, setting the foundation for the current system.

During the post-war reconstruction period, the income tax system underwent significant reforms. The Wiedereinführungsgesetz of 1949, which reintroduced the income tax after World War II, played a crucial role in rebuilding the country's financial infrastructure. This law not only reinstated the income tax but also made substantial changes to its structure, introducing tax brackets and progressive rates that are still in use today.

Over the years, Germany's income tax system has evolved to adapt to changing economic conditions and social needs. Notable reforms include the introduction of the Einkommensteuerreformgesetz in 2000, which simplified the tax code and introduced new deductions, and the Steueränderungsgesetz of 2010, which further refined the tax system to promote economic growth and social equity.

Understanding the Structure of Germany’s Income Tax

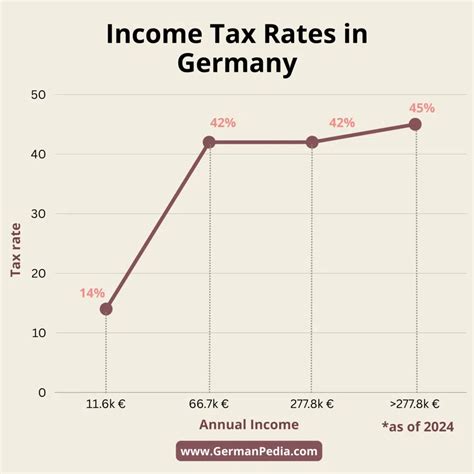

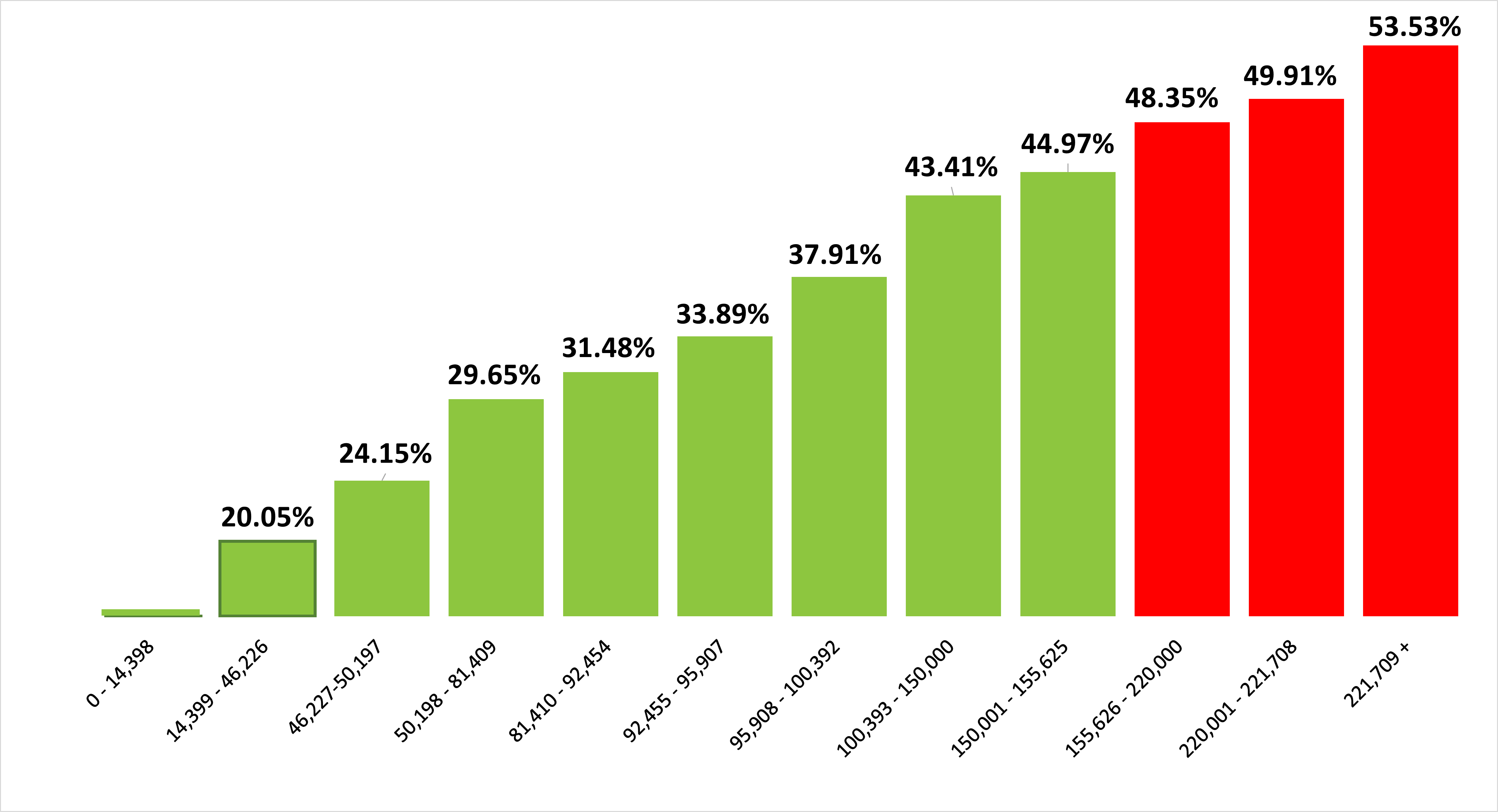

Germany’s income tax system is characterized by its progressive nature, with tax rates increasing as income levels rise. This ensures that those with higher incomes contribute a larger share to the country’s revenue, promoting a more equitable distribution of wealth.

The income tax is levied on various sources of income, including wages, salaries, self-employment earnings, rental income, and capital gains. The tax rates vary depending on the type of income and the individual's tax status. For instance, wages and salaries are taxed at progressive rates, ranging from 14% to 45%, while capital gains are taxed at a flat rate of 25%.

| Income Source | Tax Rate |

|---|---|

| Wages & Salaries | 14% - 45% |

| Self-Employment Income | Varies based on income level |

| Rental Income | Varies based on tax bracket |

| Capital Gains | 25% |

In addition to the progressive tax rates, Germany's income tax system offers a range of deductions and allowances to reduce the tax burden on individuals and businesses. These include deductions for health insurance, pension contributions, and certain expenses related to employment and self-employment.

Tax Brackets and Progressive Rates

Germany’s income tax system is divided into several tax brackets, each with its own tax rate. As income increases, individuals move into higher tax brackets, resulting in a higher overall tax liability. This progressive structure ensures that those with higher incomes contribute a larger share to the country’s revenue.

| Tax Bracket | Tax Rate | Income Range |

|---|---|---|

| Basic Rate | 14% | Up to €9,744 |

| Middle Rate | 24% | €9,744 - €57,919 |

| Upper Rate | 42% | €57,919 - €274,609 |

| Top Rate | 45% | Over €274,609 |

Deductions and Allowances

To alleviate the tax burden, Germany’s income tax system offers a range of deductions and allowances. These include:

- Health Insurance Deduction: Individuals can deduct a portion of their health insurance premiums from their taxable income.

- Pension Contributions: Contributions to certain pension schemes are tax-deductible, encouraging long-term savings.

- Employment Expenses: Certain expenses related to employment, such as travel costs and professional training, can be deducted.

- Self-Employment Deductions: Self-employed individuals can deduct business expenses and certain costs related to their professional activities.

The Impact of Germany’s Income Tax on Individuals and Businesses

Germany’s income tax system has a significant impact on both individuals and businesses, shaping their financial decisions and overall economic behavior.

Individuals

For individuals, the income tax system plays a crucial role in determining their disposable income and overall financial well-being. The progressive tax rates ensure that higher-income earners contribute more, providing resources for social welfare programs and public services. At the same time, deductions and allowances help individuals manage their tax burden and plan their finances more effectively.

Moreover, the income tax system influences individuals' savings and investment decisions. The availability of tax-deductible pension contributions, for instance, encourages long-term savings, contributing to financial security in retirement. Similarly, deductions for health insurance premiums and other expenses can make it more affordable for individuals to access essential services.

Businesses

Businesses in Germany are subject to the income tax on their profits. The tax rates and deductions available to businesses can significantly impact their financial health and investment decisions.

The progressive tax rates for businesses, similar to those for individuals, mean that larger, more profitable companies contribute a larger share to the country's revenue. This helps to balance the economic playing field and ensures that the benefits of economic growth are shared more equitably.

Additionally, businesses can take advantage of various deductions and allowances to reduce their tax liability. These include deductions for research and development expenses, investments in certain assets, and losses incurred in previous years. Such deductions can provide a significant boost to businesses, especially startups and small-to-medium enterprises, helping them grow and contribute to the economy.

The Future of Germany’s Income Tax System

Germany’s income tax system is likely to continue evolving to meet the changing needs of the country’s economy and society. With the ongoing digital transformation and global economic shifts, the tax system will need to adapt to new challenges and opportunities.

One key area of focus is the digital economy. As more economic activities move online, the tax system will need to adapt to ensure that digital businesses, particularly those with a significant online presence, contribute fairly to the country's revenue. This may involve the development of new tax policies and regulations to address the unique challenges of the digital economy.

Furthermore, the income tax system will need to balance the needs of a diverse and changing workforce. With the rise of gig economy workers and the increasing prevalence of remote work, the tax system will need to adapt to ensure that these workers are taxed fairly and have access to the same social benefits as traditional employees.

Finally, the income tax system will continue to play a crucial role in promoting social equity and supporting the country's social welfare programs. The progressive nature of the tax system ensures that higher-income earners contribute more, providing resources for public services and social safety nets. As Germany's population ages and the demand for social services increases, the income tax system will need to adapt to meet these evolving needs.

How often must tax returns be filed in Germany?

+

Tax returns in Germany are typically due by the end of May the following year. However, for certain complex cases or if a tax advisor is engaged, the deadline can be extended to the end of February.

Are there any tax-free thresholds in Germany’s income tax system?

+

Yes, there is a basic tax-free allowance, known as the Steuerfreibetrag, which is €9,744 for single individuals. This means that income up to this amount is not subject to income tax.

What are the main differences between Germany’s income tax system and that of other European countries?

+

Germany’s income tax system is characterized by its progressive nature and comprehensive range of deductions and allowances. While many European countries also have progressive tax systems, the specific rates, brackets, and deductions can vary significantly, reflecting each country’s unique fiscal policies and social priorities.