Tax Percentage In South Carolina

South Carolina, located in the southeastern region of the United States, has a unique tax system that impacts both residents and businesses operating within its borders. The state's tax structure plays a crucial role in shaping its economic landscape and influencing the financial decisions of its citizens. This comprehensive guide aims to provide an in-depth analysis of the tax percentage in South Carolina, covering its various components, how it affects individuals and businesses, and its broader implications for the state's economy.

Understanding the South Carolina Tax System

The tax system in South Carolina is a combination of various tax types, each serving a specific purpose and contributing to the state’s revenue. These taxes include income tax, sales tax, property tax, and various other fees and assessments. Let’s delve into each of these components to gain a comprehensive understanding.

Income Tax

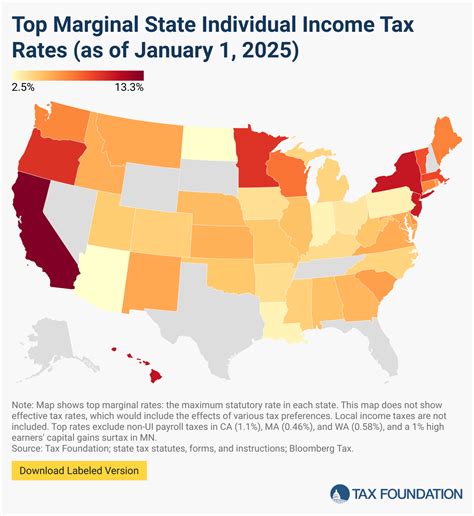

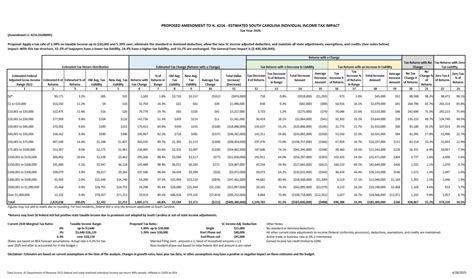

Income tax is a significant source of revenue for the state. South Carolina follows a progressive tax system, which means that the tax rate increases as taxable income rises. This approach ensures that higher-income earners contribute a larger share of their income to the state’s coffers. The state’s income tax rates are as follows:

| Tax Rate | Income Bracket |

|---|---|

| 2% | $0 - $3,350 |

| 3% | $3,351 - $8,400 |

| 4% | $8,401 - $10,250 |

| 5% | $10,251 - $12,250 |

| 6% | $12,251 and above |

It's important to note that these rates apply to South Carolina residents and non-residents alike. However, non-residents may only be taxed on income earned within the state, while residents are taxed on their worldwide income.

Sales and Use Tax

South Carolina imposes a sales and use tax on the sale, lease, or rental of tangible personal property and certain services. The general sales tax rate in the state is 6%, which applies to most goods and some services. However, certain items like groceries, prescription drugs, and non-prepared food are exempt from this tax. Additionally, counties and municipalities have the authority to levy their own local sales taxes, which can vary across the state.

For example, in the city of Charleston, the combined sales tax rate is 8.5%, with an additional 2.5% levied by the city on top of the state's 6% rate. This variation in local sales tax rates can significantly impact the total tax burden for consumers depending on their location.

Property Tax

Property tax is another vital component of South Carolina’s tax system. This tax is primarily levied on real estate, including land and buildings. The tax rate for property varies depending on the location and the type of property. On average, the effective property tax rate in South Carolina is 0.59%, which is below the national average of 1.08%.

The state's property tax system is administered at the county level, meaning tax rates can differ significantly from one county to another. For instance, the property tax rate in Greenville County is 0.82%, while it's 0.64% in Charleston County. These variations can influence property ownership and investment decisions across the state.

Other Taxes and Fees

In addition to the aforementioned taxes, South Carolina levies various other fees and assessments to generate revenue. These include:

- Accommodation tax: A 2% tax is imposed on the rental of hotel rooms, which is often passed on to guests as a separate fee.

- Motor fuel tax: A tax on gasoline and diesel fuel, currently set at 16 cents per gallon, is used to fund transportation infrastructure projects.

- Intangibles tax: This tax applies to certain intangible assets, such as stocks and bonds, and is levied at a rate of 0.5% annually.

- Documentary stamp tax: A tax on legal documents, such as deeds and mortgages, is charged at a rate of $1.20 per $500 of the property's value.

The Impact of South Carolina’s Tax System

The tax system in South Carolina has a significant impact on the state’s economy and its residents’ financial well-being. Let’s explore some of the key implications:

Economic Growth and Investment

South Carolina’s relatively low tax rates, especially in comparison to other states, have been a key factor in attracting businesses and fostering economic growth. The state’s competitive tax structure has made it an attractive destination for companies looking to expand or relocate. This, in turn, has led to job creation and a thriving business environment.

For instance, the state's 6% sales tax rate is lower than many neighboring states, making it more appealing to consumers and businesses alike. This has contributed to the growth of the retail sector and encouraged investment in the state's infrastructure.

Income Inequality and Tax Burden

While the progressive income tax system aims to ensure that higher-income earners pay a fair share, there are concerns about income inequality and the overall tax burden on individuals. South Carolina’s median household income is $52,978, and the state’s tax system can disproportionately impact those with lower incomes.

For example, a single individual earning $25,000 annually would fall into the 3% tax bracket, paying a total of $750 in income tax. This represents a significant portion of their income, potentially impacting their financial stability.

State Revenue and Budget

The tax system is a critical component of South Carolina’s revenue stream, funding various state programs and services. In the fiscal year 2022-2023, the state’s total revenue was projected to be 11.58 billion</strong>, with <strong>4.57 billion coming from income taxes and $2.93 billion from sales and use taxes.

This revenue is used to fund education, healthcare, infrastructure development, and other essential services. However, the state's reliance on sales tax, which can be volatile, poses a risk to its budget stability during economic downturns.

Impact on Businesses

South Carolina’s tax system has a direct impact on businesses operating within the state. The state’s competitive tax rates can make it more attractive for companies to establish or expand their operations. Additionally, the state offers various tax incentives and credits to encourage business investment and job creation.

For instance, the South Carolina Incentives for Jobs and Economic Growth Act provides tax credits to businesses that create new jobs or invest in certain industries. These incentives can significantly reduce the tax burden for qualifying businesses, making it more feasible to operate in the state.

Future Implications and Considerations

As South Carolina’s economy continues to evolve, the state’s tax system will play a crucial role in shaping its future. Here are some key considerations and potential implications:

Tax Reform and Revenue Stability

South Carolina’s reliance on sales tax as a significant revenue source may need to be reevaluated in the long term. While sales tax is a reliable indicator of economic activity, it can be volatile during economic downturns. Shifting towards a more diverse tax base, such as broadening the income tax base or exploring new tax streams, could provide greater revenue stability.

Income Inequality and Tax Fairness

Addressing income inequality and ensuring a fair tax system will remain a critical issue for South Carolina. The state’s progressive income tax system is a step in the right direction, but further reforms may be necessary to ensure that the tax burden is distributed equitably across all income levels.

Economic Development and Business Incentives

The state’s tax incentives and business-friendly environment have been successful in attracting new businesses. However, keeping up with the evolving needs of businesses and the changing economic landscape will be essential to maintain this competitive advantage. Regular reviews of tax incentives and policies will be crucial to ensure they remain effective and aligned with the state’s economic goals.

Infrastructure and Public Services

The state’s tax revenue is vital for funding essential public services and infrastructure development. As the population grows and the economy evolves, the demand for these services will increase. Balancing the need for adequate funding with the desire to keep tax rates competitive will be a delicate task for policymakers.

FAQ

What is the current sales tax rate in South Carolina?

+The general sales tax rate in South Carolina is 6%. However, counties and municipalities may levy additional local sales taxes, which can vary across the state.

How does South Carolina’s income tax system work?

+South Carolina has a progressive income tax system, with tax rates ranging from 2% to 6% based on income brackets. Residents are taxed on their worldwide income, while non-residents are taxed on income earned within the state.

What are some of the tax incentives available for businesses in South Carolina?

+South Carolina offers various tax incentives, including tax credits for job creation and investment in specific industries. The South Carolina Incentives for Jobs and Economic Growth Act is a notable example of such incentives.

How does South Carolina’s property tax system work?

+Property tax rates in South Carolina vary depending on the location and type of property. On average, the effective property tax rate is 0.59%, but rates can differ significantly from one county to another.

What is the impact of South Carolina’s tax system on its economy and residents?

+South Carolina’s tax system has attracted businesses and fostered economic growth. However, it can also disproportionately impact lower-income individuals and raise concerns about income inequality.