Tax Liability What Is

Tax liability is a fundamental concept in the realm of personal finance and economics, shaping the financial obligations of individuals, businesses, and governments. Understanding tax liability is crucial for navigating the complex world of taxation, ensuring compliance with legal requirements, and making informed financial decisions. In this comprehensive guide, we will delve into the intricacies of tax liability, exploring its definition, various types, factors influencing it, and strategies for effective management.

Understanding Tax Liability

Tax liability refers to the financial obligation or responsibility of an individual or entity to pay taxes to a governing body, typically a government. It represents the total amount of taxes owed based on income, assets, transactions, or specific activities subject to taxation. Tax liability is a critical aspect of any economy, as it forms the foundation for public services, infrastructure development, and the overall functioning of a society.

Types of Tax Liability

Tax liability can be categorized into several types, each with its own unique characteristics and implications:

- Income Tax Liability: This is the most common form of tax liability, where individuals or businesses owe taxes based on their earned income. Income tax is levied on various sources of income, including wages, salaries, investments, business profits, and rental income.

- Payroll Tax Liability: Employers are responsible for withholding payroll taxes from employee wages and remitting them to the government. These taxes include Social Security, Medicare, and federal and state income taxes. Payroll tax liability ensures employees’ contributions to social safety nets and retirement funds.

- Sales and Use Tax Liability: Sales tax is imposed on the sale of goods and services, while use tax is applicable when goods are purchased from out-of-state vendors and used within the state. Tax liability in this category arises when businesses collect and remit these taxes to the appropriate authorities.

- Property Tax Liability: Property owners are subject to property tax liability, which is assessed based on the value of their real estate holdings. Property taxes fund local government services and infrastructure projects.

- Estate and Gift Tax Liability: Estate taxes are levied on the transfer of assets upon an individual’s death, while gift taxes apply to significant gifts made during an individual’s lifetime. These taxes contribute to wealth redistribution and the overall fairness of the tax system.

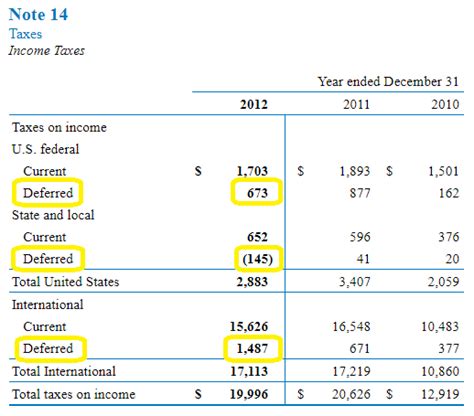

- Corporate Tax Liability: Corporations and businesses are subject to corporate income taxes, which are calculated based on their profits. Corporate tax liability varies across jurisdictions and can significantly impact a company’s financial health and strategic decisions.

Factors Influencing Tax Liability

Tax liability is influenced by a multitude of factors, including:

- Income Level: Higher incomes generally result in higher tax liabilities, as tax rates often increase progressively with income brackets.

- Tax Laws and Regulations: Tax liability is subject to the specific laws and regulations of a jurisdiction, which can vary significantly between countries, states, and municipalities.

- Deductions and Credits: Taxpayers can reduce their tax liability by taking advantage of deductions and tax credits for expenses such as mortgage interest, charitable contributions, and certain business-related costs.

- Filing Status: An individual’s filing status, such as single, married filing jointly, or head of household, can impact their tax liability and eligibility for certain deductions and credits.

- Tax Treaties: International tax treaties between countries can affect tax liability for individuals and businesses operating across borders.

| Tax Category | Real-World Example |

|---|---|

| Income Tax | A salaried employee earning $60,000 annually in the United States may have an income tax liability of approximately $9,000, based on the applicable tax brackets and deductions. |

| Payroll Taxes | An employer with 50 employees, each earning an average of $50,000 per year, may have a significant payroll tax liability, contributing to Social Security and Medicare funds. |

| Sales Tax | A retail business in California with $1 million in annual sales would likely have a sales tax liability of around $70,000, assuming a 7% sales tax rate. |

| Property Tax | A homeowner in New York City with a property valued at $1.5 million could face an annual property tax liability of approximately $18,000. |

Managing Tax Liability

Managing tax liability is a critical aspect of personal and business financial management. Here are some strategies to consider:

- Tax Planning: Engage in proactive tax planning by understanding tax laws, identifying applicable deductions and credits, and optimizing financial strategies to minimize tax liability.

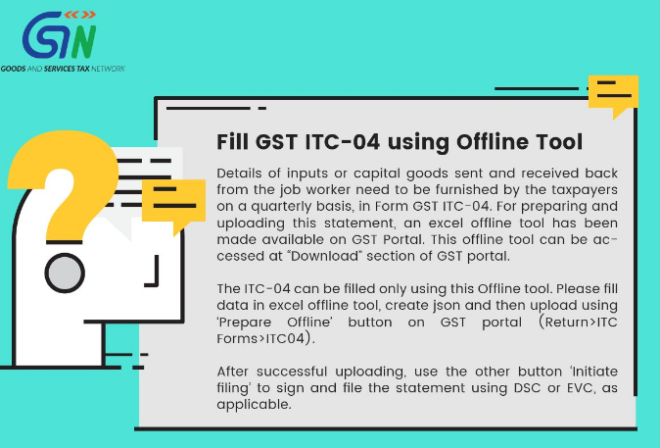

- Record Keeping: Maintain accurate and organized financial records to support tax filings and audits. Proper record-keeping ensures compliance and facilitates efficient tax management.

- Tax Professional Consultation: Consider seeking advice from tax professionals, such as accountants or tax attorneys, who can provide specialized guidance tailored to your specific circumstances.

- Compliance with Tax Laws: Stay informed about tax laws and regulations to ensure compliance. Ignorance of the law is not an acceptable excuse for non-compliance.

- Timely Filing and Payment: Meet tax filing deadlines and make timely payments to avoid penalties and interest charges. Many jurisdictions offer payment plans for taxpayers who cannot pay their tax liability in full.

Tax Liability in Action

Let’s consider a real-world example to illustrate the concept of tax liability:

Imagine a small business owner, Sarah, who operates a successful bakery in a bustling city. Sarah’s bakery has been thriving, with annual revenues exceeding $500,000. As a responsible business owner, Sarah understands the importance of managing her tax liability effectively.

Here’s how Sarah’s tax liability might break down:

- Income Tax Liability: Based on her business profits, Sarah’s income tax liability could be significant. She would need to calculate her taxable income, considering deductions for business expenses, and determine the applicable tax rate.

- Payroll Tax Liability: With several employees on her payroll, Sarah would be responsible for withholding payroll taxes from their wages and remitting these taxes to the government. This includes Social Security, Medicare, and federal and state income taxes.

- Sales Tax Liability: As a retailer, Sarah would collect sales tax from her customers and remit these taxes to the state government. The sales tax liability would depend on the jurisdiction’s tax rate and the volume of sales.

- Property Tax Liability: Sarah’s bakery occupies a commercial space, and she is subject to property taxes based on the assessed value of the property. She would need to pay these taxes to the local government to support community services and infrastructure.

By understanding and managing her tax liability, Sarah can ensure compliance with tax laws, optimize her financial strategies, and contribute to the growth and sustainability of her business.

Conclusion

Tax liability is a complex yet essential aspect of financial management, impacting individuals and businesses alike. By comprehending the different types of tax liability, the factors influencing it, and effective management strategies, taxpayers can navigate the tax landscape with confidence and ensure compliance with legal obligations. Stay informed, seek professional advice when needed, and embrace a proactive approach to tax planning to maximize financial well-being and contribute to the overall economic health of your community.

How can I calculate my tax liability accurately?

+Accurate tax liability calculation involves understanding the applicable tax laws, considering income sources, deductions, and credits, and utilizing tax software or consulting tax professionals for guidance.

Are there any tax relief programs or incentives available?

+Yes, many jurisdictions offer tax relief programs, tax credits, and incentives to support specific industries, promote economic growth, or assist individuals facing financial hardships. Researching these programs can provide opportunities for tax savings.

What happens if I cannot pay my tax liability in full?

+If you cannot pay your tax liability in full, it’s important to contact the tax authority and explore payment plan options. Many jurisdictions offer installment plans or alternative arrangements to help taxpayers manage their financial obligations.