Florida Salary Tax Calculator

Welcome to the comprehensive guide on the Florida Salary Tax Calculator, an essential tool for anyone navigating the complex world of income taxes in the Sunshine State. In this expert-led article, we will delve deep into the workings of this calculator, providing you with the knowledge and insights to understand and manage your Florida salary taxes effectively.

Unveiling the Florida Salary Tax Calculator

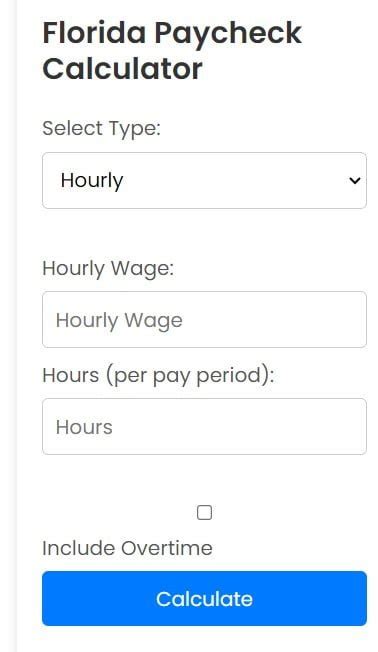

The Florida Salary Tax Calculator is a powerful online tool designed to simplify the process of calculating your state income tax liability. With a user-friendly interface and precise calculations, it empowers individuals and businesses to estimate their tax obligations accurately. Let’s explore its features and benefits in detail.

Key Features of the Calculator

The Florida Salary Tax Calculator offers a range of features tailored to meet the diverse needs of taxpayers:

- Personalized Income Calculation: Users can input their annual gross income, allowing the calculator to generate a precise estimate of their taxable income.

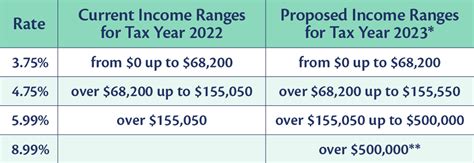

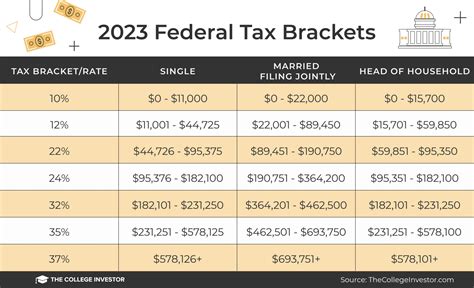

- Tax Bracket Analysis: The calculator provides an overview of the applicable tax brackets based on the user’s income, helping them understand their tax rate and potential deductions.

- Withholding Calculator: This feature assists users in determining the optimal amount of tax to withhold from their paychecks, ensuring they neither overpay nor underpay during the tax year.

- Real-Time Updates: The calculator is regularly updated to reflect the latest tax laws and regulations, ensuring accurate calculations based on the current tax landscape.

- Detailed Reports: Users receive comprehensive reports outlining their tax liability, deductions, and potential refund or balance due. These reports serve as valuable references for financial planning.

Benefits of Using the Calculator

The Florida Salary Tax Calculator offers numerous advantages to taxpayers:

- Time-Saving Efficiency: By automating the tax calculation process, the calculator saves users valuable time, allowing them to focus on other aspects of their financial management.

- Accuracy and Precision: With its advanced algorithms and regular updates, the calculator ensures accurate tax estimates, reducing the risk of errors and potential penalties.

- Financial Planning Assistance: The calculator’s detailed reports provide a clear picture of tax obligations, enabling users to make informed decisions about their financial strategies and savings.

- Compliance with Florida Tax Laws: By adhering to the state’s tax regulations, the calculator ensures users remain compliant with the latest tax requirements, avoiding potential legal issues.

- Easy Accessibility: Available online, the calculator is accessible from any device with an internet connection, providing convenience and flexibility to users on the go.

How the Florida Salary Tax Calculator Works

Understanding the inner workings of the Florida Salary Tax Calculator is crucial for optimizing its use. Let’s break down the step-by-step process:

Step 1: Input Your Income Details

The calculator begins by prompting users to enter their annual gross income. This information forms the basis for all subsequent calculations.

Step 2: Select Tax Year and Status

Users can choose the specific tax year for which they wish to calculate their taxes. Additionally, they can select their filing status, such as single, married filing jointly, or head of household, which impacts the applicable tax rates.

Step 3: Calculate Tax Liability

Based on the provided income and filing status, the calculator applies the relevant tax rates and brackets to determine the user’s taxable income and calculate their tax liability.

Step 4: Explore Deductions and Credits

The calculator offers a comprehensive list of deductions and tax credits specific to Florida residents. Users can explore these options to identify potential savings and reduce their tax burden.

Step 5: Review and Adjust Withholdings

The calculator provides an estimate of the user’s tax liability for the year. Users can then review their withholding status and make adjustments to ensure they are neither over-withholding nor under-withholding taxes.

Step 6: Generate Detailed Report

Upon completing the calculation process, the calculator generates a detailed report outlining the user’s tax liability, deductions, credits, and any potential refund or balance due. This report serves as a valuable reference for financial planning and tax filing.

| Tax Year | Tax Bracket | Tax Rate |

|---|---|---|

| 2023 | Up to $50,000 | 5.5% |

| 2023 | $50,001 - $75,000 | 5.75% |

| 2023 | Over $75,000 | 5.95% |

Real-World Applications of the Calculator

The Florida Salary Tax Calculator finds extensive use in various real-world scenarios, benefiting individuals and businesses alike:

Scenario 1: Personal Income Tax Planning

John, a resident of Miami, Florida, wants to ensure he is maximizing his tax savings. By using the calculator, he discovers potential deductions for his charitable donations and student loan interest. This knowledge allows him to make informed decisions about his financial contributions and reduce his tax liability.

Scenario 2: Small Business Tax Management

Sarah, the owner of a small bakery in Tampa, utilizes the calculator to estimate her business’s tax liability. With the accurate calculations, she can plan her business expenses and savings strategies, ensuring she remains compliant with Florida’s tax regulations.

Scenario 3: Remote Worker Tax Considerations

Emily, a remote worker based in Jacksonville, Florida, needs to calculate her taxes for the state. The calculator helps her determine her tax liability based on her remote work status, ensuring she pays the correct amount despite working outside the traditional office environment.

The Future of Florida Salary Tax Calculations

As technology continues to advance, the future of Florida salary tax calculations looks promising. Here’s a glimpse into what we can expect:

Enhanced User Experience

Developers are continuously improving the user interface and functionality of the calculator, making it more intuitive and user-friendly. This includes implementing interactive features and personalized recommendations to enhance the overall user experience.

Integration with Financial Platforms

The calculator is likely to integrate with popular financial management platforms, allowing users to seamlessly import their income and expense data. This integration will streamline the tax calculation process and provide a more holistic view of an individual’s financial situation.

Advanced Tax Optimization Strategies

With the evolving tax landscape, the calculator will incorporate advanced algorithms and machine learning techniques to offer users dynamic tax optimization strategies. These strategies will adapt to the user’s financial goals and the changing tax environment, ensuring they stay ahead of the curve.

Real-Time Tax Updates

To ensure accuracy, the calculator will leverage real-time data feeds to incorporate the latest tax law changes and updates. This feature will keep users informed about any modifications to tax rates, brackets, or deductions, allowing them to make timely adjustments to their financial plans.

FAQs

What is the Florida Salary Tax Calculator used for?

+The Florida Salary Tax Calculator is a tool used to estimate an individual’s state income tax liability based on their annual gross income and filing status. It helps taxpayers understand their tax obligations, explore potential deductions, and optimize their financial strategies.

Is the calculator accurate for all tax scenarios?

+While the calculator provides accurate estimates for most tax situations, it’s recommended to consult with a tax professional for complex financial scenarios or specific concerns. They can offer personalized advice tailored to your unique circumstances.

Can I use the calculator for previous tax years?

+Yes, the calculator allows users to select the specific tax year for which they wish to calculate their taxes. This feature is particularly useful for reviewing past tax liabilities or comparing different tax years’ calculations.

Are there any limitations to the calculator’s functionality?

+The calculator is designed for estimating state income taxes and may not cover all aspects of federal tax calculations. Additionally, it may not account for highly specialized tax situations or unique deductions specific to certain professions. For such cases, consulting a tax expert is advisable.

How often is the calculator updated with tax law changes?

+The Florida Salary Tax Calculator is regularly updated to reflect the latest tax laws and regulations. However, it’s important to note that significant tax law changes may require a delay in updating the calculator. Users are encouraged to stay informed about any recent tax modifications.

In conclusion, the Florida Salary Tax Calculator is an indispensable tool for anyone residing in or doing business within the state of Florida. By providing accurate and timely tax calculations, it empowers taxpayers to make informed financial decisions and remain compliant with state tax regulations. As the calculator continues to evolve with advancements in technology, users can expect an even more seamless and efficient tax planning experience.