Maine Sales Tax

Welcome to a comprehensive guide on Maine's sales tax, an essential aspect of the state's economy and a crucial consideration for businesses and consumers alike. Maine's sales tax system is unique, with a combination of state and local taxes, exemptions, and varying rates across the state. This article aims to provide an in-depth analysis of Maine's sales tax, its intricacies, and its impact on the local economy.

Understanding Maine’s Sales Tax Structure

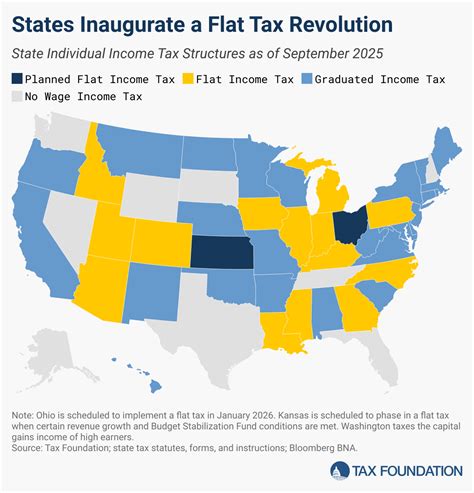

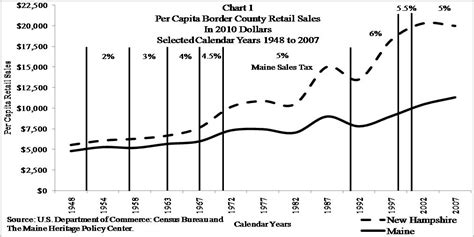

Maine’s sales tax system is a complex web of regulations and rates. At the state level, a uniform sales tax rate is applied across all jurisdictions. This state sales tax rate is currently set at 5.5%, making it one of the lower rates among U.S. states.

However, the real complexity lies in the local sales taxes. In Maine, municipalities have the authority to levy additional sales taxes on top of the state rate. These local sales taxes can vary significantly, ranging from 0% to 5%, creating a diverse landscape of tax rates across the state.

Taxable Items and Exemptions

Maine’s sales tax applies to a broad range of goods and services. From retail sales to restaurant meals, most consumer transactions are subject to the tax. However, there are notable exemptions, such as:

- Groceries and staple foods: A welcome relief for many Maine residents, groceries and staple foods are exempt from sales tax.

- Prescription drugs: An essential exemption, especially for Maine’s aging population.

- Residential rents: A significant exemption that benefits both tenants and landlords.

- Certain services: Maine exempts a range of services, including legal, medical, and professional services, from sales tax.

These exemptions, while providing relief to certain sectors and consumers, also create a unique challenge for businesses operating in Maine, as they must navigate a complex web of taxable and exempt items.

Maine’s Sales Tax Rates by Municipality

One of the most intriguing aspects of Maine’s sales tax is the variation in rates across different municipalities. While the state rate remains constant, local governments have the power to set their own additional rates. This results in a diverse landscape of sales tax rates.

| Municipality | Local Sales Tax Rate |

|---|---|

| Augusta | 1% |

| Bangor | 1.5% |

| Portland | 2% |

| Lewiston | 1% |

| South Portland | 1% |

| Biddeford | 0% |

| Sanford | 1.5% |

| York | 0% |

| Brunswick | 1% |

| Waterville | 1% |

This table provides a snapshot of sales tax rates in some of Maine's major municipalities. It's important to note that smaller towns and rural areas may have different rates, and some may not levy any additional local tax.

The Impact of Maine’s Sales Tax on the Economy

Maine’s sales tax system plays a significant role in shaping the state’s economy. It generates substantial revenue for both the state and local governments, funding essential services and infrastructure projects.

Revenue Generation

In fiscal year 2022, Maine’s sales and use tax revenue reached $988.3 million, a notable increase from previous years. This revenue stream is vital for the state, accounting for a significant portion of its annual budget.

The sales tax is particularly important for funding education, healthcare, and infrastructure development. It also supports social services, ensuring the well-being of Maine's residents.

Consumer Behavior and Economic Growth

The sales tax rate can significantly influence consumer behavior and, consequently, economic growth. A high sales tax rate may discourage consumer spending, especially on discretionary items, which could impact businesses and the overall economy.

Maine's relatively low state sales tax rate, combined with the varied local rates, creates an interesting dynamic. While some municipalities benefit from higher tax rates, others may attract more business and consumers with lower rates. This competition can drive economic growth and development in different regions of the state.

Challenges and Considerations

However, the complexity of Maine’s sales tax system also presents challenges. Businesses, especially those with multiple locations or those selling online, must navigate a maze of different tax rates and regulations. This can lead to increased administrative burdens and potential compliance issues.

Furthermore, the variation in tax rates can create a sense of tax inequality, with some areas benefiting from higher revenues while others struggle. This disparity can impact the distribution of resources and the overall economic development of the state.

Strategies for Businesses Operating in Maine

For businesses operating in Maine, understanding and effectively managing sales tax obligations is crucial for success. Here are some strategies to consider:

Stay Informed and Compliant

Keep up-to-date with the latest sales tax regulations and rates. Maine’s Department of Administrative and Financial Services provides comprehensive resources and guidance on sales tax compliance. Ensure that your business is aware of its obligations and complies with all relevant laws.

Implement Efficient Tax Calculation Systems

Given the variation in tax rates across the state, implementing a robust tax calculation system is essential. This system should be able to handle different rates, exemptions, and special cases, ensuring accurate tax calculations for every transaction.

Consider Pricing Strategies

The sales tax rate can significantly impact the final price a consumer pays. Businesses may need to adjust their pricing strategies to remain competitive in different markets. For example, a business in a municipality with a high sales tax rate may need to adjust its pricing to remain affordable for local consumers.

Leverage Exemptions

Understanding the exemptions in Maine’s sales tax system can provide opportunities for cost savings. For example, a business that primarily sells exempt items, like groceries, can significantly reduce its tax burden.

Collaborate with Local Governments

Engaging with local governments and chambers of commerce can provide valuable insights into the local sales tax landscape. This collaboration can help businesses understand the economic climate and make informed decisions about their operations in a particular municipality.

The Future of Maine’s Sales Tax

As Maine’s economy continues to evolve, so too will its sales tax system. The state and local governments face the ongoing challenge of balancing revenue generation with the needs of businesses and consumers.

Potential Changes and Reforms

There have been discussions about potential reforms to Maine’s sales tax system. Some proposals include simplifying the tax structure, harmonizing rates across the state, or expanding the list of taxable items to generate more revenue.

However, any changes to the sales tax system will likely face opposition from various stakeholders. Businesses may resist reforms that increase their tax burden, while consumers may oppose measures that raise the overall cost of living.

Impact of E-commerce and Online Sales

The rise of e-commerce and online sales presents a unique challenge for Maine’s sales tax system. With more transactions occurring online, it becomes increasingly difficult to enforce sales tax collection and compliance. Maine, like many other states, is exploring ways to adapt its tax laws to accommodate this new reality.

One potential solution is the implementation of a "marketplace facilitator law," which would require online marketplaces and platforms to collect and remit sales tax on behalf of their third-party sellers. This approach has already been adopted by several states and could significantly improve sales tax compliance in Maine.

Long-term Economic Impact

In the long run, Maine’s sales tax system will continue to shape the state’s economic landscape. A well-designed and efficient tax system can attract businesses, encourage investment, and promote economic growth. On the other hand, an overly complex or burdensome system can hinder economic development and drive businesses away.

As Maine strives to balance its economic goals with the needs of its residents and businesses, the future of its sales tax system will be a key factor in shaping the state's prosperity.

What is the current state sales tax rate in Maine?

+The current state sales tax rate in Maine is 5.5%.

Are there any municipalities in Maine with no additional local sales tax?

+Yes, some municipalities, like Biddeford and York, have no additional local sales tax on top of the state rate.

How does Maine’s sales tax system impact businesses operating across multiple locations in the state?

+Businesses with multiple locations must navigate different tax rates and regulations, which can increase administrative burdens and potential compliance issues.

What are some strategies for businesses to stay compliant with Maine’s sales tax regulations?

+Businesses should stay informed about the latest regulations, implement efficient tax calculation systems, and consider pricing strategies that account for varying tax rates.

How does Maine plan to address the challenge of collecting sales tax on online transactions?

+Maine may consider implementing a marketplace facilitator law, which would require online marketplaces to collect and remit sales tax on behalf of their third-party sellers.